Despite a 14.8% drop in market capitalization, the BNB channel concluded the first quarter of 2025 with significant growth and technical achievements.

According to Messari’s full quarter’s full report, the network generated turnover of $ 70.8 million, which represents an increase of 58.1% of a quarter quarter (QOQ).

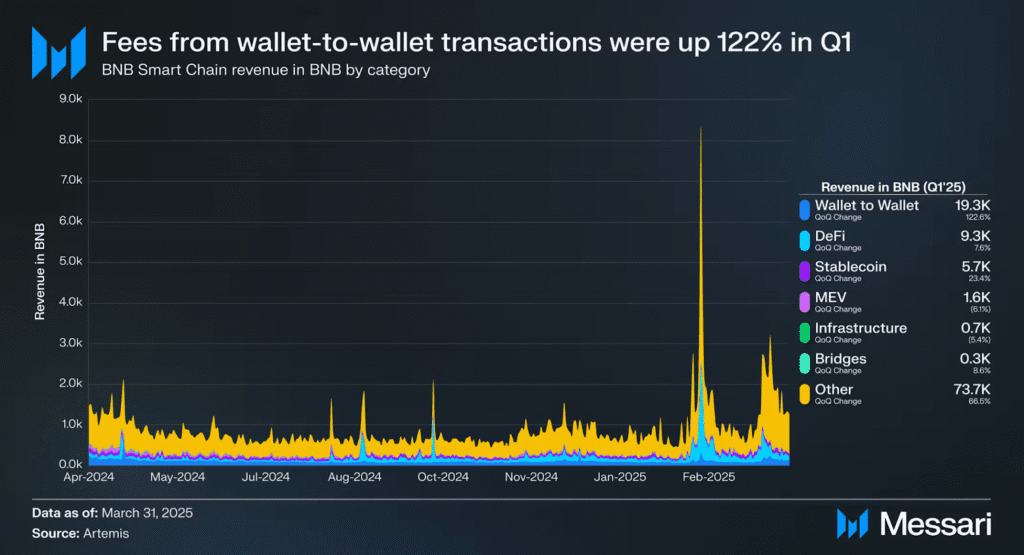

This increase was largely fueled by an astonishing increase of 122.6% of the portfolio transaction fees as a spokesperson, which exceeded DEFI as the main contributor in income.

The beginning of February marked a pivotal moment for the network, because the popularity of the TST Mamecoin helped stimulate user engagement, pushing unique users on the chain at a summit of 517 million people on February 11.

This increase in activity has greatly contributed to the income of the BNB chain, which increased in terms of Fiat and BNB, from 69,500 BNB to the fourth quarter of 2024 to 109,800 BNB in T1 2025.

Despite the depreciation of BNB prices, the chain maintained its position as fourth cryptocurrency by market capitalization, following only Bitcoin, Ethereum and XRP.

This performance exceeded Ethereum, who saw an astonishing drop of 45.2%, and Solana, which decreased by 29.6%.

The deflationary mechanics of the BNB ecosystem remained intact, the 30th quarter quarter incinerating 1.6 million BNB ($ 1.2 billion), contributing to an annualized deflation rate of 4.6%.

DEFI, DEX and Stablecoins anchor a flourishing ecosystem

BNB Smart Chain’s chain activity has experienced strong growth, average daily transactions increasing by 20.9% to 4.9 million and average active active addresses increasing by 26.4% to 1.2 million.

Stablecoin transfers and portfolio transactions in the spare carrier were recorded for the majority of this activity, collectively including 74.4% of all transactions.

The use of stablescose alone increased by 28% to 1.2 million daily transactions, and portfolio transfers jumped from 50.9% to 835,000 per day.

The DEFI commitment held firm despite a broader uncertainty of the market. Although the total locked value (TVL) in USD terms fell 1.2% to $ 5.3 billion, TVL called BNB increased by 14.7%.

This increase helped the BNB smart chain to claim fourth place in the total TVL ranking, exceeding a rival chain.

The volume of decentralized exchanges (DEX) experienced remarkable growth, increasing by 79.3% QOQ to an average of $ 2.3 billion in daily volume.

Pancakeswap remained the dominant force, controlling 91.8% of all DEX activities, supported by an increase of 95.2% of the negotiation volume.

Other DEFI applications, such as Venus Finance and Kernel, have also played key roles. Venus led by TVL despite a small drop in asset loans, while the nucleus experienced a spectacular increase of 655.6% TV of 81.9 million dollars to more than half a billion, caused by the use of incentives.

Stablecoins also fueled ecosystems income, generating 5,745.1 BNB in the first quarter, up 23.4% QOQ, although their share of total turnover decreased to 5.2%.

DEFIT revenues increased from 7.6% of the QOQ to 9,274.9 BNB, but fell in the second location of the distribution of income as portfolio fees in flagship holder jumped. The revenues of the MEV and the infrastructure both decreased slightly, the bridge costs seeing a modest increase by 8.6% to 275.1 BNB.

Upgrades lead to long -term scalability

According to this operational growth, a series of substantial upgrades of infrastructure and protocols.

The Pascal Hard Fork, launched during the first quarter, introduced several compatible and compatible features Ethereum such as the Smart EIP-7702 contracts, BLS12-381 cryptography for an efficient aggregation of signature, the abstraction of gas and the batch transaction support.

The gas limits have also increased from 120 million to 140 million gas units, allowing the network to support a more complex transaction activity. Pascal is only the first of the three major improvements planned for 2025.

As for the BNB price, BNB is currently consolidated above the support level of $ 595 and is negotiated nearly $ 602, near the mobile average at 100 hours.

After having formed a base at $ 592, the price rebounded and exceeded the levels of $ 600 and $ 605, reaching a summit of $ 611 before retreating to retain the level of $ 600.

The presence of a key rising channel and a regular RSI greater than 50 suggests an upward momentum, with resistance at $ 606 and $ 610.

A successful breakthrough greater than $ 610 could lead to new gains around $ 620, with potential upwards up to $ 635 and $ 650.

However, if BNB fails to overcome the resistance of $ 610, it can face a renewed sale pressure.

The initial support is at $ 600, followed by higher levels at $ 598 and $ 592. A drop below $ 592 could trigger a greater drop, potentially pushing the price to $ 585, or even $ 580.

Overall, the short -term BNB management depends on the possibility of maintaining support greater than $ 598 and piercing the resistance of $ 610.

The post -BNB chain shows strong growth in the first quarter despite a drop in market capitalization by 15% – Messari appeared first on Cryptonews.