Main to remember

- Choreo LLC reports its very first Bitcoin ETF Holdings worth around 6.5 million dollars.

- The most important position of the company is in Ishares Bitcoin Trust ETF, with important allowances at GBTC, FBTC and BTC.

Share this article

Choreo, an independent wealth management company with more than 27 billion dollars in assets under management, officially entered the rush to Bitcoin ETF, revealing about $ 6.5 million invested in several funds.

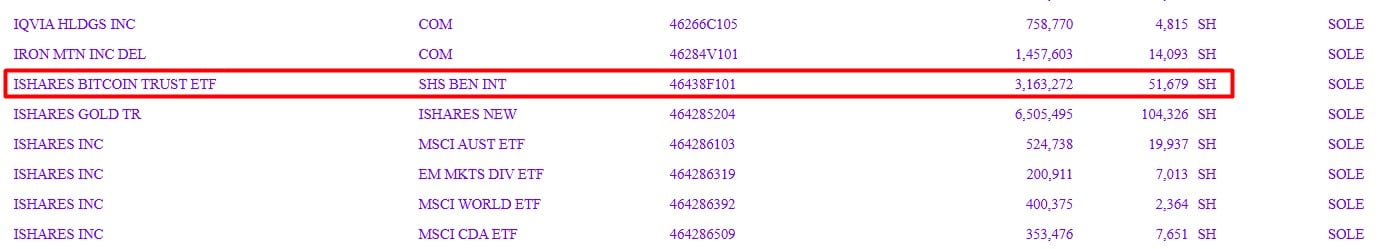

According to a Wednesday filed with the SEC, Choreo’s largest participation was in the FNB Ishares Bitcoin Trust in BlackRock (IBIT), with 51,679 shares worth more than $ 3 million on June 30.

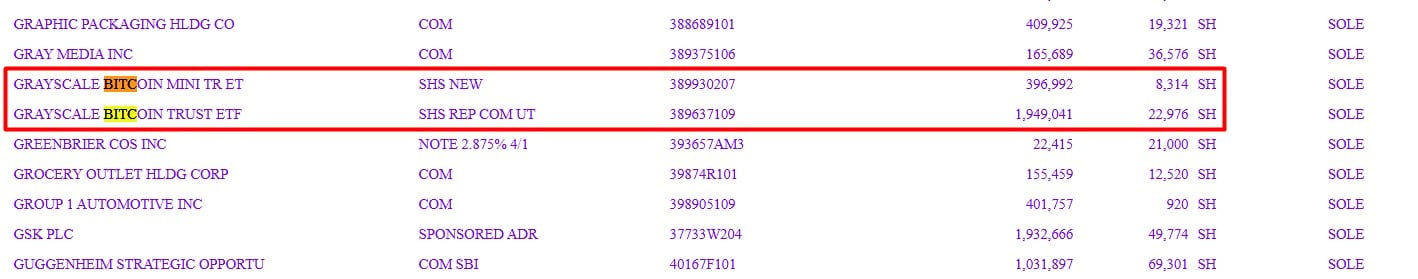

The firm also owned 22,976 shares of the Grayscale Bitcoin Trust ETF (GBTC), worth around 1.9 million dollars and 8,314 shares of ETF Bitcoin Mini Trust (BTC) of Grayscale, valued at nearly $ 397,000.

To complete its exposure to Bitcoin, Choreo had 13,607 actions of the ETF Bitcoin by Fidelity Wise Origin (FBTC), worth around 1.3 million dollars, during the second quarter of this year.

The new disclosure places Choreo among a growing list of heritage managers and institutional investors adding Bitcoin FNB to their wallets.

Not only are fund managers and pension funds, but university allocations are also sowing FNB Bitcoin.

The Harvard management company revealed last week that it bought approximately 1.9 million shares from the BlackRock FNB Ishares Bitcoin, worth more than $ 116 million on June 30. The position was the fifth largest in its endowment of $ 53 billion, after Microsoft, Amazon, Holdings and Meta.

Share this article