The measures used to measure the results can be misleading when evaluating blockchain performance. As more emerging blockchain networks, the public needs clear and efficiency -oriented measures, rather than exaggerated allegations, to differentiate them.

In a conversation with Beincrypto, the co-founder of Taraxa, Steven Pu, explained that it was increasingly difficult to compare with precision the performances of the blockchain, because many reported measures are based on too optimistic assumptions rather than results based on evidence. To fight against this wave of false statements, PA offers a new metric, which he calls TPS / $.

Why does industry lack reliable benchmarks?

The need for clear differentiation increases with the growing number of Blockchain 1 layers of layer 1. As various developers promote the speed and efficiency of their blockchains, based on measures that distinguish their performance becomes essential.

However, the industry still lacks reliable references for real efficiency, based rather on sporadic sentimental waves of popularity focused on media. According to PU, the deceptive performance figures currently saturate the market, obscuring real capacities.

“It is easy for opportunists to take advantage by increasing too simplified and exaggerated stories to take advantage of themselves. Each conceivable technical and metric concept has been used at one time or another for the counting of many projects that do not really deserve them: TPS, latency of finality, modularity, compatibility of network nodes, execution speed, parallelity, strip-use, EVM compatibility, network, EVM-incompatibility Beincrypto.

Could focus on how certain projects use TPS measures, using them as marketing tactics to make the performances of the blockchain more attractive than it could be in real conditions.

Examine the deceptive nature of TP

Transactions per second, more commonly known as TPS, are a metric that refers to the average or sustained number of transactions that a blockchain network can treat and finalize in normal operating conditions.

However, he has often linked projects badly, offering a biased vision of overall performance.

“Decentralized networks are complex systems that must be taken into account as a whole, and in the context of their use cases. But the market has this horrible habit of simplifying and selling a specific metric or a specific aspect of a project, while ignoring the whole. Perhaps a highly centralized and high network has its uses in the right scenarios with specific models of trust, but the market really has no appetite for such nuanced descriptions, ”

PU indicates that blockchain projects with extreme claims on unique measures such as PDV may have compromised decentralization, security and precision.

“Take TPS, for example. This metric masks many other aspects of the network, for example, how was TPS made? What was sacrificed in the process? If I have 1 knot, running a Jit VM, call this a network, which made you a few hundred thousand TPS. Unrealistic hypotheses such as non-conflicts, and you assume that you can parallelize all transactions, then you can get “TP” in billions.

The co-founder of Taraxa revealed the extent of these inflated measures in a recent report.

The significant gap between theoretical and the real world

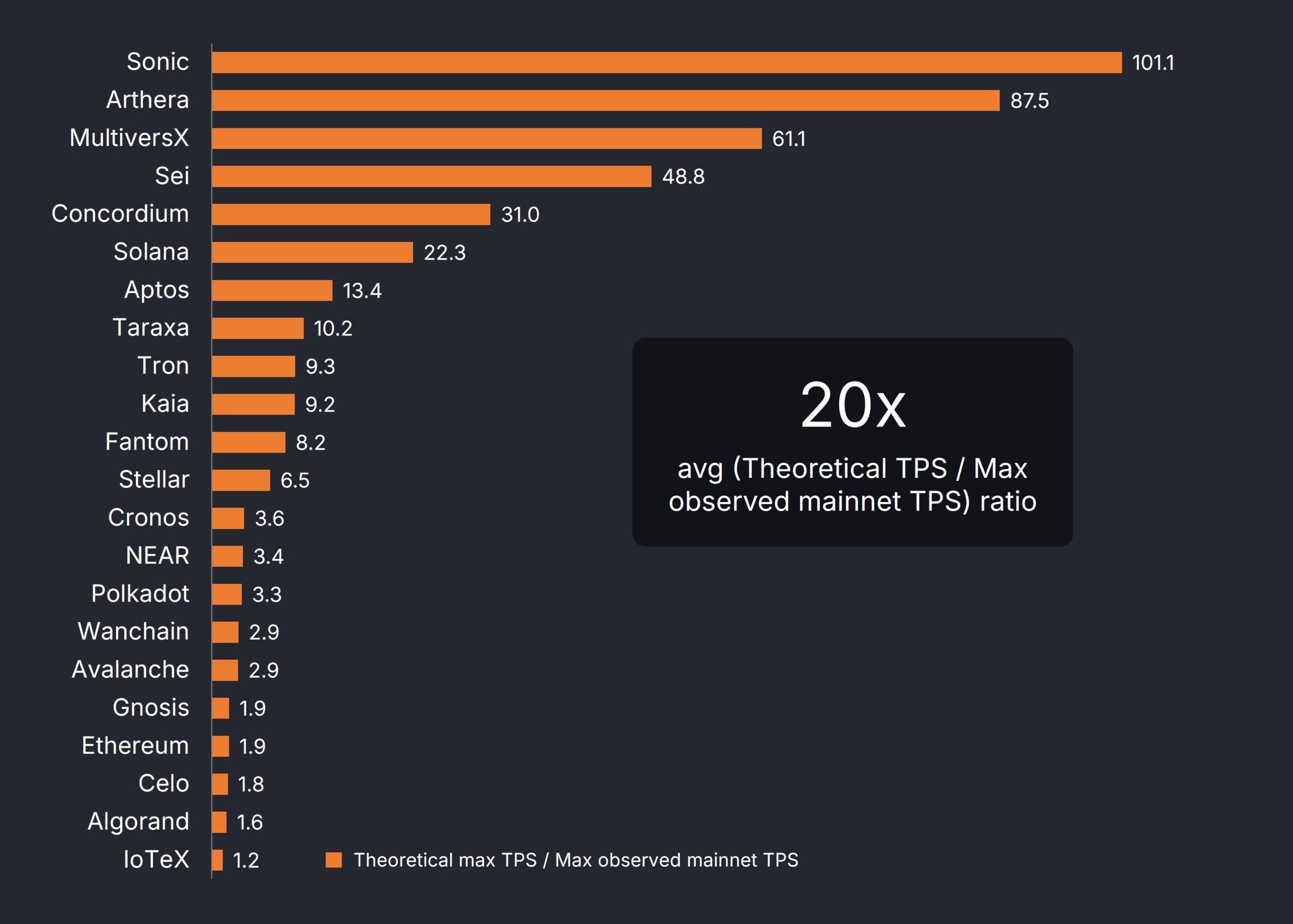

Pu sought to prove its point by determining the difference between the maximum historical TPS made on the reunification of a blockchain and the theoretical TPS maximum.

On the 22 networks without permission and with single leaves observed, PU noted that in average, there was a gap of 20 times between theory and reality. In other words, the theoretical metric was 20 times higher than the maximum of Mainnets observed.

“Metric overestimations (as in the case of TPS) are a response to the very speculative and narrative cryptography market. Everyone wants to position their project and their technologies in the best possible light, so that they find theoretical estimates, or carry out tests with very unrealistic hypotheses, to arrive at inflected metrics.

Seeking to counter these exaggerated measures, PU has developed its own performance measure.

Presentation of TPS / $: a more balanced metric?

PU and his team developed the following: TPS realized on the Mainnet / monthly cost of a single validator’s node, or TPS / $ to be short, to meet the need for better performance measures.

This metric assesses performance based on verifiable TPs obtained on the maint of live labor from a network while considering material efficiency.

The significant difference of 20 times between theoretical flow and the real flow has convinced the PU of excluding measures based solely on hypotheses or laboratory conditions. He also aimed to illustrate how certain blockchain projects inflate performance measures based on expensive infrastructure.

“The release allegations of the published network are often inflated by extremely expensive equipment. consensus by evaluating them, ”said PU.

The PU team has located the material requirements of a minimum validator of each network to determine the cost by validator’s node. They then estimated their monthly cost, paying particular attention to their relative dimensioning when used to calculate the TPS ratios by dollar.

“Thus, the metric TPS / $ tries to correct two of the most blatant disinformation categories, forcing the performance of the TPS to be on the Mainnet and by revealing the inherent compromises of extremely expensive equipment,” added.

PU underlined taking into account two simple and identifiable characteristics: if a network is without permission and unique.

Networks authorized in relation to networks without authorization: who promotes decentralization?

The security degree of a blockchain can be revealed according to its operation under an authorized network or without authorization.

Authorized blockchains refer to closed networks when access and participation are limited to a predefined user group, forcing the authorization of a central authority or a trusted group. In blockchains without authorization, everyone is authorized to participate.

According to PU, the old model is in contradiction with the philosophy of decentralization.

“An authorized network, where belonging to the validation of the network is controlled by a single entity, or if there is only one entity (each layer-2), is another excellent metric. This tells you if the network is actually decentralized.

Attention to these measures will be vital over time, as networks with centralized authorities tend to be more vulnerable to certain weaknesses.

“In the long term, what we really need is a battery of standardized attack vectors for the L1 infrastructure which can help reveal the weaknesses and compromises for any architectural design. Organically emerging in a standard on an industry scale, ”added.

Meanwhile, understanding a network uses state modules compared to the maintenance of a single fragile state reveals how unified its data management is.

State spot vs only one state: Understanding the data unit

In blockchain’s performance, latency refers to the time between the submission of a network transaction, confirming it and including it in a blockchain block. It measures how long it takes for a transaction to be processed and becomes a permanent part of the big distributed book.

Identify whether a network employs a state of land or a leaf state by a single element can reveal a lot about its latency effectiveness.

Late networks divide the blockchain data into several independent parts called fragments. Each fragment works somewhat independently and does not have direct access and in real time in the complete state of the entire network.

On the other hand, a non -state -ramp -rated non -state network has a single shared state throughout the network. All nodes can access and process the same full set of data in this case.

PU noted that state voltage networks aim to increase storage and transaction capacity. However, they are often faced with longer latencies due to the need to deal with transactions on several independent fragments.

He added that many projects adopting a break -up approach swells the flow by simply reproducing their network rather than creating a truly integrated and scalable architecture.

“A state with state late that does not share the state, simply makes unconnected copies of a network. If I take a L1 network and I simply make 1000 copies of independent current IT, it is clearly dishonest to claim that I can add all the speed through copies together and represent them as a single network. Make independent copies, ”said Pu.

Based on his research on the effectiveness of blockchain measures, PU emphasized the need for fundamental changes in the way the projects are assessed, financed and finally succeeding.

What fundamental changes do blockchain do they need?

PU ideas have a notable alternative in a layer 1 blockchain space where misleading performance metrics are more and more rival for attention. Reliable and effective benchmarks are essential to counter these false representations.

“You only know what you can measure, and right now in crypto, numbers are more like hype narratives than objective measures. Having standardized and transparent measures allows simple comparisons through product options so that developers and users understand what they use and that we still have a lot of means in crypto, “concluded an PU.

The adoption of standardized and transparent references will promote enlightened decision-making and stimulate real progress beyond simple promotional complaints as the industry matures.

Non-liability clause

Following the directives of the Trust project, this operating article presents opinions and prospects of experts or individuals in the industry. Beincrypto is dedicated to transparent relationships, but the opinions expressed in this article do not necessarily reflect those of Beincrypto or its staff. Readers must check the information independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.