- The Federal Reserve has launched enforcement action against bank customers who are pro-cryptocurrency.

- Tyler Winklevoss sees the move as an extension of the Biden-Harris administration’s “Operation Choke Point 2.0.”

The cryptocurrency market has sounded the alarm over the new “Choke Point 2.0” operation. The warning comes after the Federal Reserve filed a lawsuit against crypto-friendly bank Customer Bancorp.

Commenting on the update, Gemini co-founder Tyler Winklevoss, said that “Operation Choke Point 2.0” was underway and called Kamala Harris’ crypto “reset” a “scam.”

“Today, the Fed confirmed that Operation Choke Point 2.0 is still in full swing, provided valuable insight into its operation, and verified that Harris’ crypto “reset” was a scam.”

For the uninitiated, Operation Choke Point 2.0 refers to perceived actions by US regulators to restrict crypto companies’ access to banking services.

SAB 121, which banned major banks from engaging in the cryptocurrency custody business, was also part of Operation Choke Point 2.o

Bank customers under surveillance

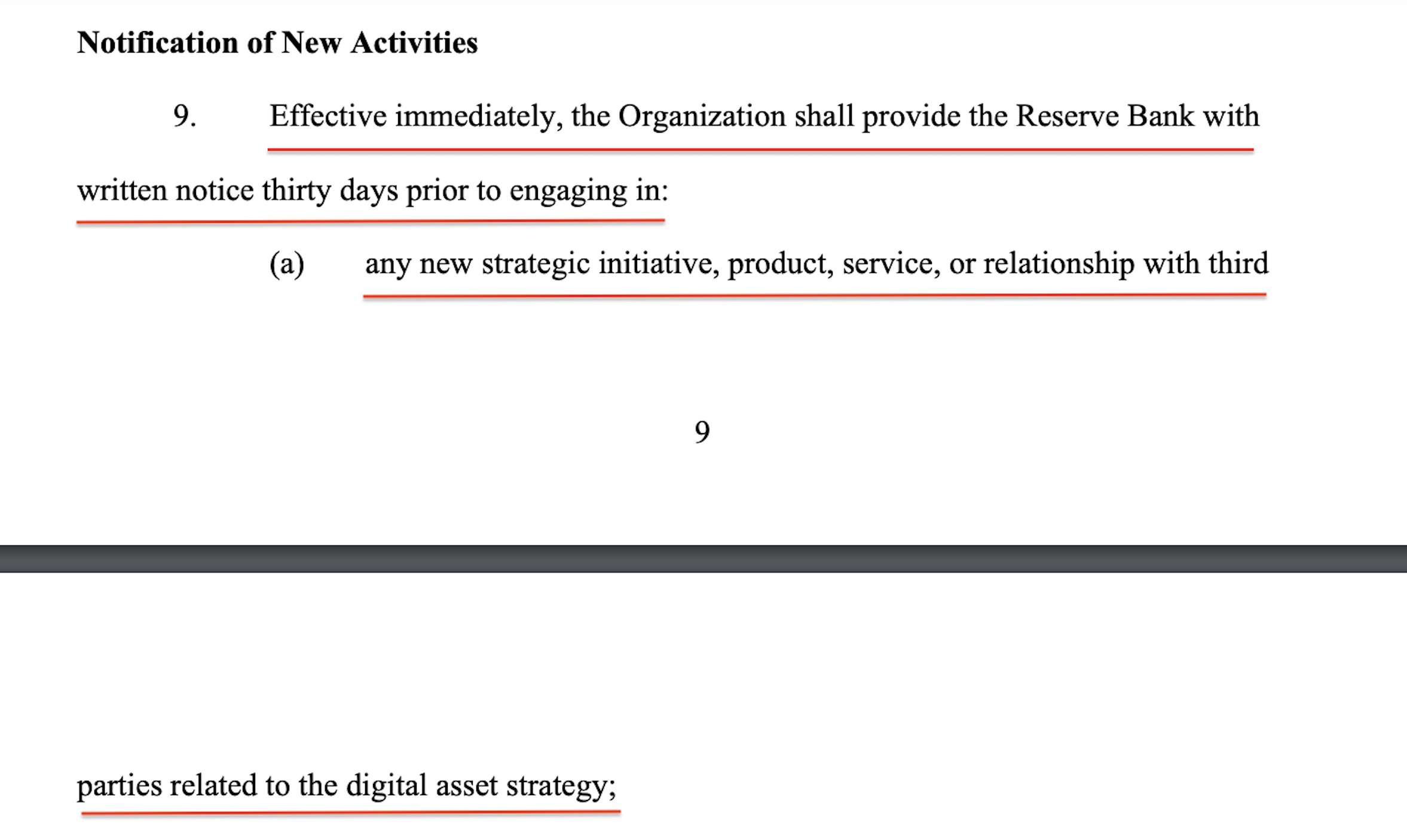

In the application action Published on August 8, the Federal Reserve required Customers Bank to give it 30 days’ notice before onboarding a crypto firm.

Source: Federal Reserve

In the order, the Federal Reserve alleged “significant deficiencies” in Customer Bank’s anti-money laundering (AML) compliance, particularly in its digital asset strategy.

According to Tyler Winklevoss, this order meant that the Fed was the sole gatekeeper between banking services and crypto companies.

He added that it would kill the American crypto industry if it continues for the next four years.

“Operation Chokepoint 2.0 is still alive. The Biden-Harris administration’s reign of terror continues. If this continues unabated for another 4 years, the crypto industry in America will be dead.”

A recent meeting between cryptocurrency industry executives and White House advisers also revealed a lack of commitment to policy change. That could fuel fears.

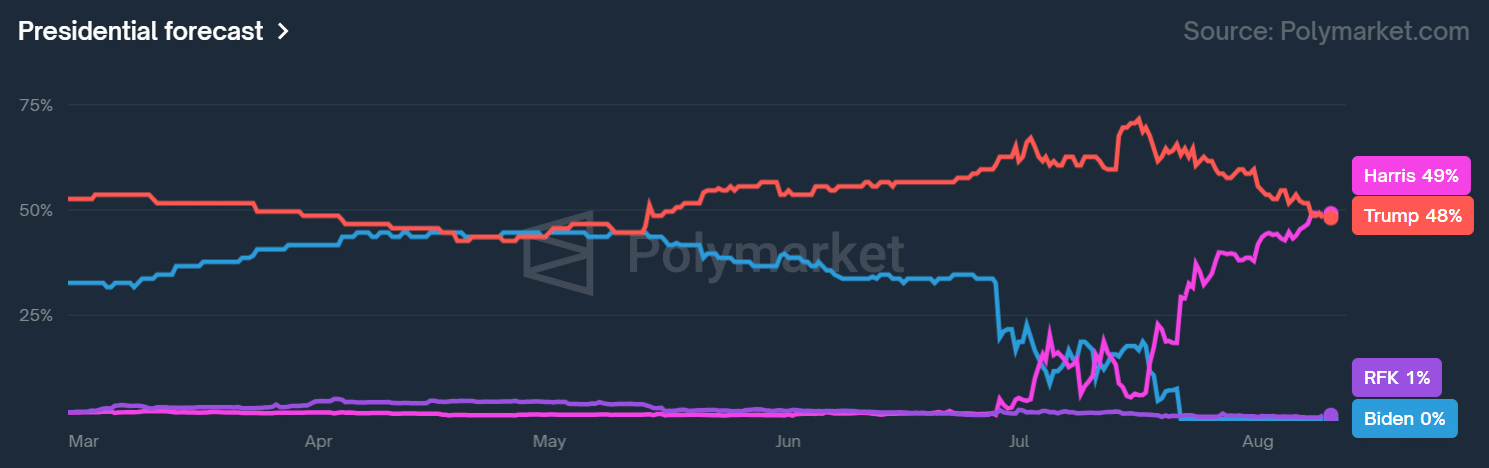

Meanwhile, the odds of pro-crypto candidate Trump winning the US election have fallen to 48% on prediction site Polymarket.

Earlier in the week, Trump and Harris were tied in terms of their chances of winning. At the time of writing, Harris was leading with 49%, while Trump’s chances of winning were 48%.

Source: Polymarket

The data actually showed that Harris’ potential victory could not be ignored.

If she wins, the Democrats’ perceived coercive action could be extended to the new administration, as Winklevoss pointed out,

“The Fed is on its best behavior right now because the election is coming up. If Harris wins in November, she will have no gloves left.”