The short term may seem very difficult, but there is a simple way out.

After a weak year, Bitcoin (BTC +2.65%), Ethereum (ETH +2.48%)And Solana (GROUND +3.10%) have entered a downtrend over the past few months. Many investors are convinced that a bear market is on its way or already underway. Sentiment among crypto natives is extremely low and many are bracing for things to get even worse.

This is not the first time investors have been openly concerned about crypto. But, especially if you’re feeling scared right now, it’s worth knowing how these periods tend to play out, so let’s take a look at what’s happened historically after great uncertainty.

Image source: Getty Images.

The picture of today’s feelings is ugly, but familiar

You’ve probably seen these fear and greed indices on many investment websites, which display “fear” on one side and “greed” on the other, in a crude attempt to map the prevailing sentiment in the market.

Today, most of these results unambiguously show that the crypto market is in a state of “extreme fear” – the same seen during turbulent and turbulent times like the COVID-19 crash, and during the industry’s sharp decline after the FTX bankruptcy a few years ago, not to mention the October 10 crypto flash crash.

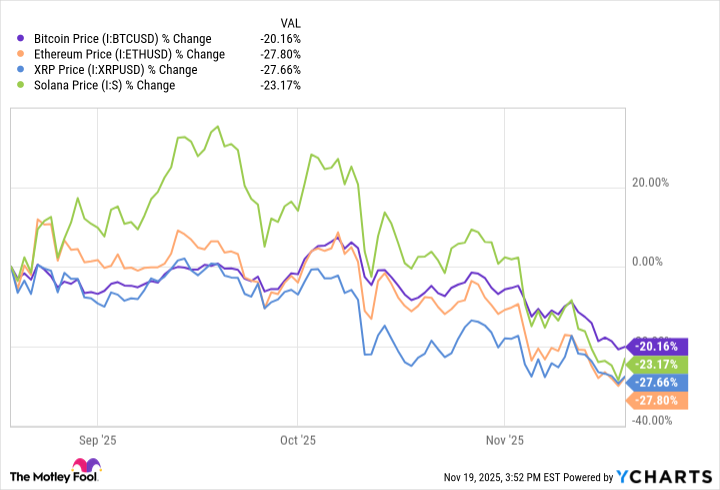

Recent price developments obviously align with this mood; take a look at this table:

Bitcoin price data by YCharts

Looking at these declines alone, it’s no surprise that investors are saying “it’s over” and deciding to move on to greener pastures to seek new investments.

However, in the context of these assets’ historical performance, this decline looks more like a violent but ultimately ordinary upheaval. Since 2017, Bitcoin has suffered more than 10 declines of at least 25%, including six above 50% and three approaching 75%. Each of these periods eventually gave way to new highs.

Today’s change

(2.65%) $2323.33

Current price

$89904.00

Key Data Points

Market capitalization

$1,789 billion

Daily scope

$86216.00 -$89822.00

52 week range

$74604.47 -$126079.89

Volume

63B

Average flight

0

Gross margin

0.00%

Dividend yield

N / A

At the same time, extremely scary conditions often occur just before strong rebounds over several months, including as recently as April of this year. And if we step back and look at how these assets have performed over the past three years, it’s hard to believe that previous periods of extreme fear portend any sort of prolonged downturn:

However, it is also true that the feeling takes time to recover after being bruised so badly. Expect any recovery to take at least 30 days before you gain significant traction.

What History Suggests Will Happen Next

Crypto market cycles tend to feature a euphoric rise in price, followed by a strong reset, and then a prolonged period of uncertainty. Assuming adoption and other fundamentals continue to improve in the meantime, this will eventually give way to another breakthrough. The current mix of steep declines and extreme fear, punctuated by a flash crash, fits perfectly into the “hard reset” phase.

Today’s change

(2.48%) $73.07

Current price

$3015.59

Key Data Points

Market capitalization

365 billion dollars

Daily scope

$2877.16 -$3027.11

52 week range

$1398.62 -$4946.05

Volume

22B

Average flight

0

Gross margin

0.00%

Dividend yield

N / A

If history repeats itself, the next stage will be the dubious slump, where investors stop paying attention to the market out of boredom or discouragement. But even today, important trends for the growth of the crypto sector remain at work.

For example, despite the drop in price level, the value of all real-world token assets (RWA) across all blockchains increased by 2.3% in the last 30 days alone, reaching $35.7 billion. This paves the way for a future in which the market will take notice of the networks used to manage and transmit these assets and increase the prices of their native tokens accordingly.

In the short to medium term, the real risk is that something breaks in the economy or the traditional financial system, causing investors to withdraw their capital safely and out of riskier sectors like crypto. Keep in mind that the current liquidation is occurring alongside an increasingly wobbly and top-heavy stock market, widespread concerns about stretched AI stock valuations, considerable economic uncertainty resulting from tariffs and other trade policies, and renewed concerns about interest rates, all of which are draining demand for volatile assets. If these factors play to the downside, it could turn what is currently a sharp correction into a full-blown bear market or perhaps even a crypto winter.

Today’s change

(3.10%) $4.24

Current price

$141.29

Key Data Points

Market capitalization

$79 billion

Daily scope

$134.47 -$140.88

52 week range

$96.70 -$293.31

Volume

5.2B

Average flight

0

Gross margin

0.00%

Dividend yield

N / A

But, even if there is a bear market, so far in its history the crypto market has rewarded those brave enough to buy the dip, or even the Dollar-Cost Average (DCA), in high-conviction assets when sentiment is sustainably pessimistic. Bitcoin, Solana, and Ethereum aren’t going anywhere anytime soon, even if their prices fall much further. So, especially if you were bullish on these coins earlier this year, it still makes sense to continue buying them as prices drop to ensure you make the most of the opportunity.