The meeting of the Federal Open Market Committee (FOMC) is set for Tuesday and Wednesday, and investors are at the forefront. The markets are careful about all signals on interest rates, especially after the president of the federal reserve, Jerome Powell, suggested a waiting approach. The American economy is already faced with uncertainty due to new politicians, in particular aggressive prices, and the impact begins to show.

Actions vacillate, the feeling of investors is fragile and the cryptography market feels heat. In just 24 hours, the global cryptography market dropped by 3.1%, Bitcoin and Ethereum slipping both.

Are we directed towards trouble? Let’s take a closer look at what’s going on.

Bitcoin and Ethereum Face losses

Bitcoin recorded a sharp decrease of one day of 2.09% yesterday, closing at $ 82,577. In the past 24 hours, it decreased by 1.9% additional. However, for the moment, it is slightly negotiated at $ 82,888, up 0.37% compared to the closing price of yesterday.

Ethereum also experienced a significant drop, from $ 1,935 to $ 1,886 yesterday, a drop of 2.52%. In the past 24 hours, it has lost an additional 2.4%, although it was slightly recovered at $ 1,888.

Analysts believe that this drop in feeling is largely motivated by concerns about policies and economic regulations.

Will the Fed maintain stable interest rates?

At the start of the FOMC meeting, most experts predict that the Fed will not make any change in interest rates. Currently, the rate of federal funds remains between 4.25% and 4.5%, without immediate adjustment expected.

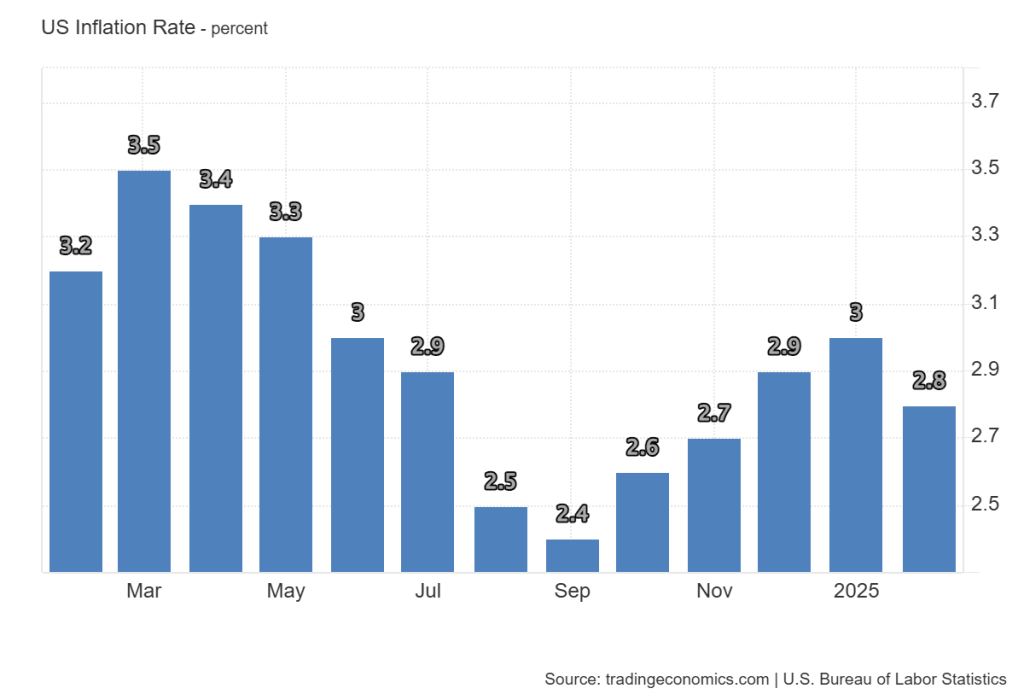

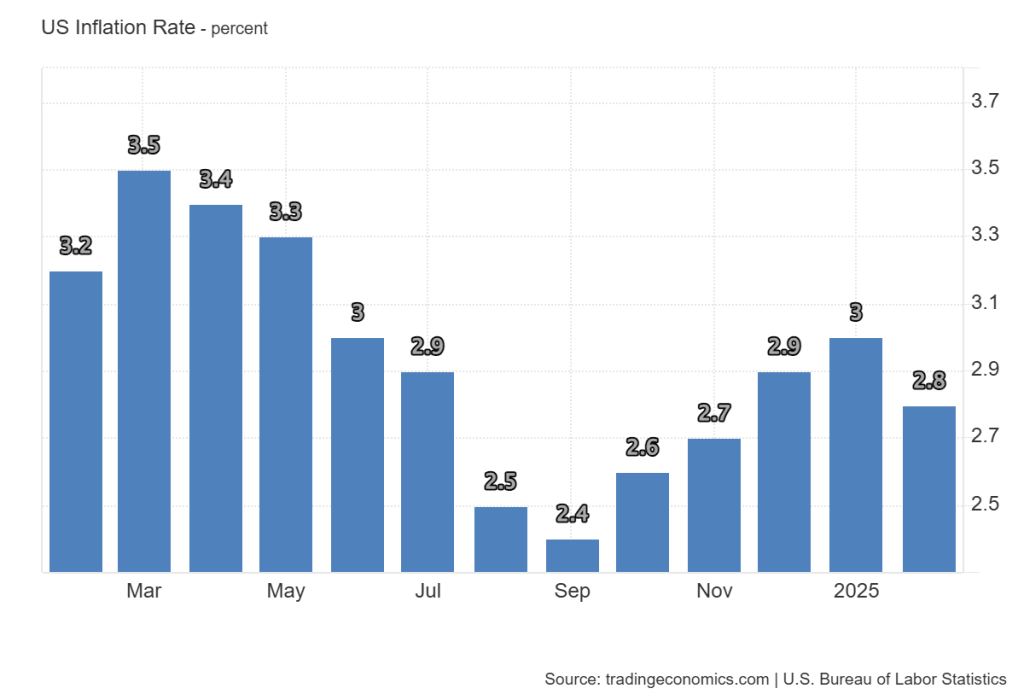

At the same time, inflation in the United States has gradually decreased. In February, it went from 3% to 2.8% and forecasts suggest that it could drop to 2.5% in March.

Trump’s pricing policy creates more uncertainty

President Donald Trump

Donald Trump Donald Trump is a former politician, businessman and American media personality, who was the 45th President of the United States between 2017 and 2021. Trump obtained a baccalaureate in economics in the University of Pennsylvania in 1968. Trump Hillary Clinton as losing republican popular vote. As president, Trump ordered the ban on traveling to citizens in several Muslim majority countries, has diverted military funding towards the construction of a wall on the American-Mexican border and has implemented a policy of separation of families. Trump has remained an eminent figure of the Republican Party and is considered a probable candidate for the 2024 presidential election President Import prices recently imposed on China, Mexico and Canada. His administration also announced his intention to expand these prices.

Donald Trump Donald Trump is a former politician, businessman and American media personality, who was the 45th President of the United States between 2017 and 2021. Trump obtained a baccalaureate in economics in the University of Pennsylvania in 1968. Trump Hillary Clinton as losing republican popular vote. As president, Trump ordered the ban on traveling to citizens in several Muslim majority countries, has diverted military funding towards the construction of a wall on the American-Mexican border and has implemented a policy of separation of families. Trump has remained an eminent figure of the Republican Party and is considered a probable candidate for the 2024 presidential election President Import prices recently imposed on China, Mexico and Canada. His administration also announced his intention to expand these prices.

Many believe that the Fed will avoid making major decisions about interest rates until the economic impact of these trade policies becomes clearer. However, some experts warn that prices could increase inflation, which could complicate the future approach of the Fed.

- Read also:

- Key economic events in the United States this week: how markets and crypto can react

- ,,

US markets show signs of weakness

The stock markets were also affected by uncertainty. The term contracts linked to Dow Jones, S&P 500 and Nasdaq Composite have all decreased, reflecting the prudent feeling of investors.

The cryptocurrency market has followed suit, with almost every ten best digital assets with losses in the past 24 hours:

- Bitcoin is down 1.9%

- Ethereum fell 2.4%

- XRP fell 1.9%

- Solana decreased by 4.6%

- Cardano is down 3%

Despite 253 million dollars in term crypto liquidation during the last day, the lever effect remains high, which suggests that traders are still taking risks. The funding rates have stabilized at neutral levels, indicating a mixed feeling on the market.

For the moment, crypto traders are looking for a clear signal to determine the next market movement. A change in Fed policy or a major institutional investment could provide this catalyst. Until then, volatility should continue.

Never miss a beat in the world of cryptography!

Stay in advance with the news, expert analysis and real -time updates on the latest Bitcoin, Altcoins, DEFI, NFTS, etc. trends