The cryptography market is under pressure from pressure while bitcoin and main altcoins are found at key demand levels, testing the conviction of the bulls. After months of volatility and net rallies, traders are now found in a critical phase where consolidation and uncertainty dominate the story. While short -term feeling is focused, information on the chain highlights the wider forces shaping this cycle.

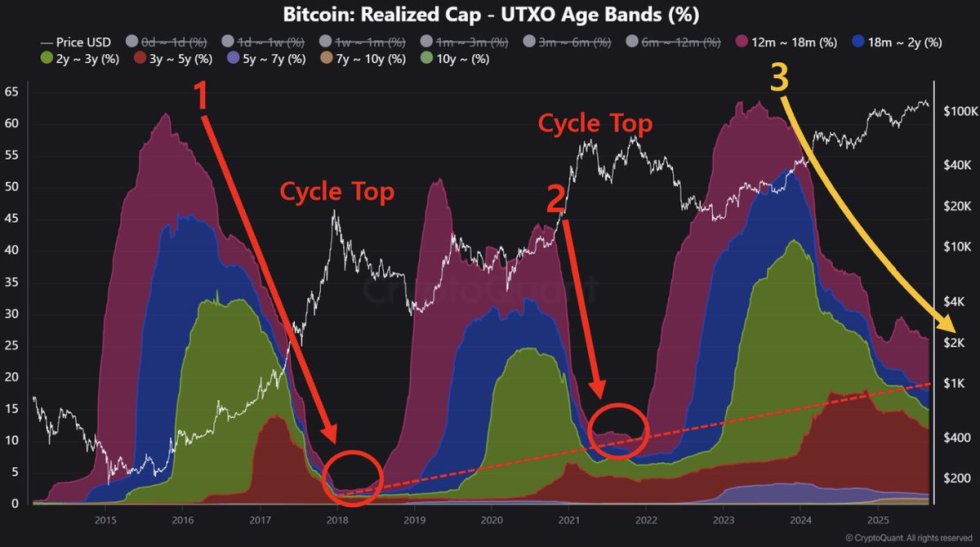

According to cryptocurrency analyst Dan, the percentage of Bitcoin owned for more than a year – measured by market capitalization carried out – provides a reliable framework to understand the long -term market phases. In the anterior phases of past cycles (cycles 1 and 2), this metric has shown rapid growth, because accumulation has resulted in sharp overvoltages, leading to cycle peaks.

On the other hand, the current cycle (3) depicts a different image. The slope of the upward trend has started to flatten, reflecting a slower rate of growth and indicating that the cycle extends longer than in previous years. This prolonged pace has raised questions about structural changes behind the current market.

Why is the cycle of the cryptography market slowing down? Analysts highlight new dynamics – from the rise of ETF to increasing institutional participation – while potential engines reshaping the course of this cycle.

Why the cycle of the cryptography market slows down

According to cryptocurrency analyst Dan, the slowdown in the current crypto cycle is closely linked to structural changes on the market. One of the main reasons is the introduction of ETF Spot, which have changed the way capital turns into Bitcoin. The involvement of large institutions and even certain nations has further modified the pace, extending the duration of the cycle compared to the previous ones. These developments have created a more mature but slower market environment.

Another factor is the way in which the capital rotation affects momentum. In this cycle, whenever the funds start to flow strongly in altcoins, the ascending momentum of Bitcoin tends to stall. This model has been repeated several times, stressing how diversification between assets has a damping effect on the speed of bitcoin rallies. Unlike the period 2023-2024, when Bitcoin’s domination was clear, today’s market shows a migration of progressive but regular capital to altcoins.

For the future, the Macro backdrop also plays a key role. A drop in rate scheduled for September, associated with the potential approval of ETF Spot for Altcoins in October, opens the way to a renewal of optimism in the fall and winter 2025. From the cycle point of view, current consolidation and any other correction could present attractive entry opportunities for the positioning of investors for the next step.

Bulls have trouble holding $ 110,000 as volatility increases

Bitcoin is negotiated nearly $ 110,000 after having strongly withdrawn its August summit around $ 123,200, the daily graphic showing a decisive change in the momentum. The price action has dug a series of lower ups and lower lows, highlighting the sales pressure that has weighed on the market since mid-August.

The graph underlines that BTC is now seated just above the mobile average at 100 days at $ 111,700, the 50-day mobile average at $ 116,500 acting as a ceiling in recent sessions. As long as Bitcoin remains below this area, recovery attempts are likely to be capped by resistance.

The level of $ 110,000 turns out to be an essential area of support. Ventilation confirmed here could expose the BTC to new losses to $ 106,000 to $ 108,000, while the 200 -day mobile average almost $ 101,100 remains a final defense line for the wider trend.

The recovery of $ 115,000 would be the first significant step towards the retirement of control. It is only then that Bitcoin could make another attempt to challenge the range from $ 120,000 to $ 123,000. For the moment, however, the market remains under pressure and if the BTC can contain $ 110,000 will probably define short -term prospects.

Dall-e star image, tradingview graphic

Editorial process Because the bitcoinist is centered on the supply of in -depth, precise and impartial content. We confirm strict supply standards, and each page undergoes a diligent review by our team of high -level technology experts and experienced editors. This process guarantees the integrity, relevance and value of our content for our readers.