- Ethereum’s domination increases while other altcoins continue to fight.

- ETH still experiences high pressure downwards and risks a drop of less than $ 2,000.

Since reached a local summit of $ 3.7,000 in early January, Ethereum (ETH) has decreased considerably. After trying to escape this downward trend a month ago, ETH faced resistance at $ 2.8,000, which led to a decline.

Despite these difficulties on its price graphics, the crypto-chain observed that the domination of the ETH continued to go up.

The growth of Ethereum domination continues

According to cryptocurrency, Ethereum captured a significant share of the data based on data from January to May 2025.

This increase in the domination of the ETH is mainly driven by a significant drop in the volume of other altcoins.

Source: cryptocurrency

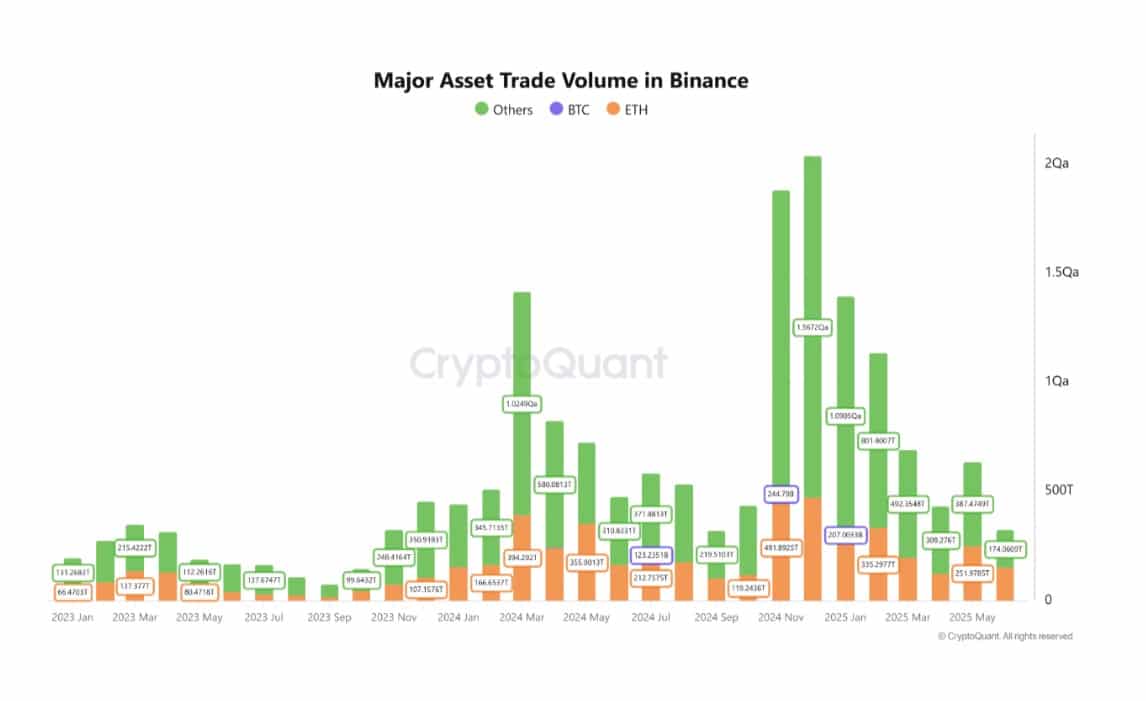

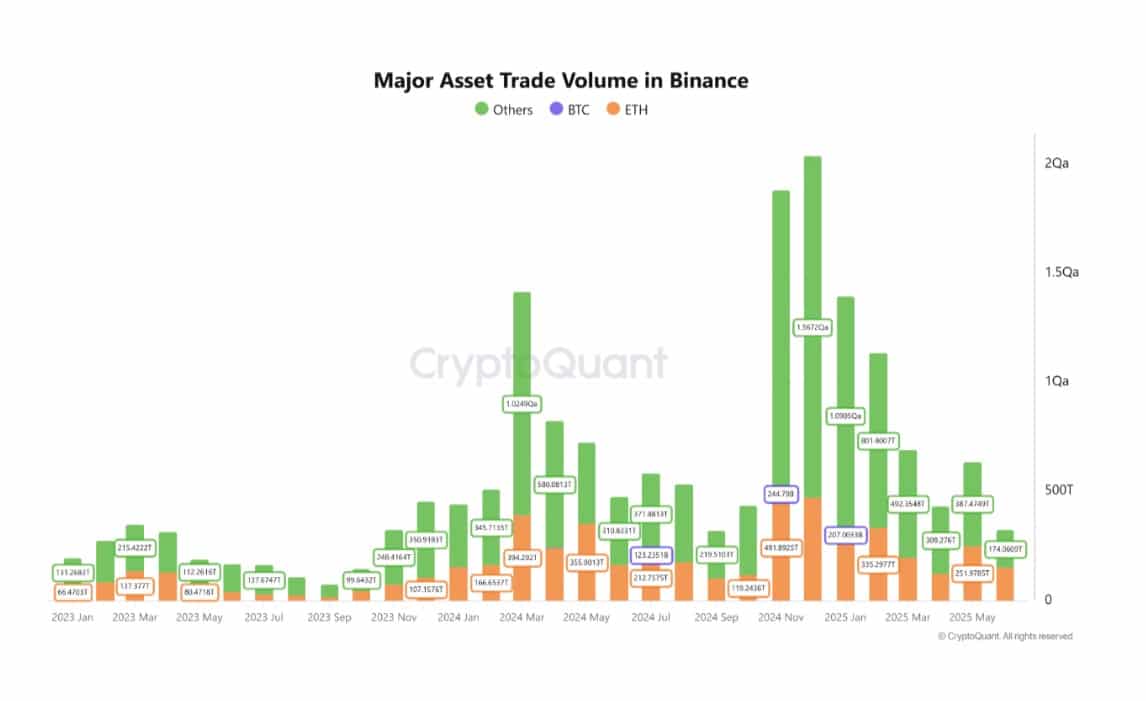

Unlike market expectations, Ethereum trading has not led to the recent increase. From 2024 to 2025, the ETH trading volume remained relatively stable, varying between 300 billions and 490 billions.

On the other hand, the Altcoin negotiation volume culminated at 1.5672 quadrillion in November 2024, but featured 387.47 billions in May 2025. The share of Altcoin transactions increased from more than 1 quadrillion to less than $ 400 billion, reflecting a significant decrease.

This trend suggests that investors draw liquidity from more risky projects. Part of this capital seems to have been redirected to Ethereum, considered a relatively safer alternative.

Source: Coringlass

Consequently, the domination of Ethereum is not mainly the result of its growth but rather of the retirement of its competitors. Although the ETH has not increased significantly, it remains very favorable compared to other smaller parts.

When we look at the Altcoin season index, it shows that the overall Altcoin market has decreased. This metric went from 88 to 12 between December 2024 and June 2025, signaling a weakened Altcoin market.

An impact on the ETH price movement?

Although Ethereum’s domination has increased significantly, its growth has been problematic. Since then, demand and chain activity have all had trouble following the market.

Source: Santiment

At the time of the press, the NVT report of Ethereum increased to 1041, indicating a significant overvaluation of the network.

This means that chain activity is low compared to the price, which suggests that current ETH prices may not be supported by organic demand.

Historically, these disconnects – where value exceeds the real use of the network – the summits of the signal market and are followed by corrections.

If this trend continues, ETH could trace itself to better align with real demand, pointing to a speculative market environment.

Despite the growing domination of the Ethereum market, long -term holders are still in red.

In addition, the difference in long / short MVRV has remained negative and has been in the past four months, signaling persistent non-activability for long-term ETH investors.

Source: Santiment

A negative value suggests here that short -term holders have a higher unrealized profit than LTH. For example, those who acquired ETH between December 2024 and February 2025 are mainly at a loss.

This implies that despite an increasing influence, the ETH does not record significant upward movements while other altcoins continue to drop. Under the conditions of the market in force, the ETH seems to be overvalued and must trace to meet real demand.

If a retrace emerges, we could see ETH fall below $ 2,000. However, if speculators continue to hold the market, Ethereum will continue to cover and try to recover $ 2.5,000.