ETHER (ETH), the cryptofuelle which feeds the applications distributed on the Ethereum platform, will be issued at a constant annual linear rate via the block extraction process. This rate is 0.3 times the total quantity of ETH which will be bought in pre-sales.

Although the best metaphor for ETH is “fuel for the execution of the contract for the processing of the contract”, for the purposes of this article, we will treat ETH only as a currency.

There are two common definitions of “inflation”. The first concerns prices and the second concerns the total amount of money in a system – the base or the monetary offer. Likewise for the term “deflation”. In this article, we will distinguish between “price inflation”, the increase in the general level of goods and services in an economy and “monetary inflation”, the growth in money supply in an economy due to a kind of emission mechanism. Often, but not always, monetary inflation is a cause of price inflation.

Although ETH emission is fixed each year, the growth rate of the monetary base (monetary inflation) is not constant. This monetary inflation rate decreases each year by making the ETH a disinflationary currency (in terms of monetary basis). Disinflation is a particular case of inflation in which the amount of inflation shrinks over time.

It is expected that the quantity of ETH which will be lost each year caused by transmissions to addresses which are no longer accessible are estimated at the order of 1% of the monetary base. The ETH can be lost due to the loss of private keys, the death of the owner without transmission of private keys or deliberate destruction by sending an address that has never been generated by an associated private key.

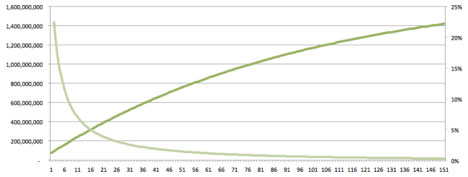

If we assume that Ethereum sells 40,000 ETH BTC in pre-sales, and if we assume that the average price is 1500 ETH / BTC, 60,000,000 ETH will be created in the Genesis block assigned to buyers. Each year, perpetuity, 18,000,000 ETH will be issued by the mining process. Given the creation of new ETH and the loss of existing Ethics, the first year, this represents a monetary inflation rate of 22.4%. During the second year, the rate fell to 18.1%. At the tenth year, the rate is 7.0%. During the year 38, it reached 1.9%. And in the 64th year, the level of 1.0% is reached.

Figure 1. Quantity of ethn existing (dark green curve) on the left axis. Monetary basic inflation rate (clear green curve) on the right axis. Years on the horizontal axis. (Adapted from Arun Mittal with thank you.)

By about the year 2140, BTC’s publication ceases and as a BTC will probably be lost each year, the Bitcoin monetary base should start to shrink at that time.

About at the same time, the expected rate of annual loss and destruction of ETH will balance the emission rate. Under this dynamic, a quasi-stable state is reached and the quantity of existing ethn is no longer developing. If ETH demand increases at this stage due to an expanding economy, prices will be in a deflationary diet. This is not an existential problem for the system because the ETH is theoretically infinitely divisible. As long as the price deflation rate is not too fast, the pricing mechanisms will adjust and the system will work smoothly. The main traditional objection to deflationary savings, wage grip, should not be a problem because all payment systems will be fluid. Another frequent objection, borrowers forced to reimburse loans with a currency that increases in purchasing power over time, will not be a problem either if this diet is persistent, because the loan conditions will be defined to take this into account.

Note that even if monetary inflation remains higher than zero for many years, the price levels (followed as price inflation and deflation) depend on supply and demand, therefore are linked, but not completely controlled by the emission rate (offer). Over time, the growth of the Ethereum economy is expected to considerably exceed the growth of ETH’s supply, which could lead to an increase in the value of ETH with regard to inherited currencies and the BTC.

One of the Bitcoin value proposals was the total fixed algorithmically emission of the currency which compared that only 21,000,000 BTC be created. At a time of impression of inherited money inherited in an exponentially condemned attempt to correct the fact that there are too many debts in the global economic system (with more debts), the prospect of a universally accepted cryptocurrency which can possibly serve as a relatively stable reserve is attractive. Ethereum recognizes this and seeks to imitate this proposal for a fundamental value.

Ethereum also acknowledges that a system intended to serve as a consensus-based application platform distributed for global economic and social systems must strongly emphasize the inclusiveness. One of the many ways that we intend to promote inclusiveness is to maintain a emission system that has a certain unsubscribe. New participants in the system will be able to buy new ETH or mines for new ETH, whether they live in 2015 or 2115. We believe that we have achieved a good balance between the two objectives of promoting inclusion and maintaining a stable value store. And the constant program, especially in the first years, will probably make the use of ETH to create companies in the Ethereum economy more lucrative than hoarding with speculation.