Join our Telegram Channel to stay up to date on the coverage of information on the breakup

Ethereum’s institutional adoption accelerates at a pace that now eclipses bitcoin, with open -ended Eths’ interests exceeding $ 10 billion and ETH Spot by seeing entries ten times higher than their BTC competitors.

According to the CME group, the total open notional interests (OO) in the term contracts on ETH recently exceeded $ 10 billion. The notional OI represents the total value of the dollar of active or open contracts at any time.

“We certainly note a resurgence and an enthusiasm renewed in future ether – in particular with regard to institutional participation,” said CME Group cryptocurrency, Giovanni Vicioso.

The number of large -open interest supports strikes a new record

The CME offers standard size contracts of 50 ETH as well as micro-dimensioned contracts of 0.1 ETH. Earlier this month, the number of major holders of open interests, who have at least 25 ETH contracts at a given time, have reached a record of 101.

According to Vicioso, “signals a strengthening of the institutional and professional ecosystem around ether”.

Other measures have also been skyrocketing at the registration levels, including the number of open micro -ETH contracts, which exceeded 500,000. ETH notional options open interests also recently exploded more than a billion dollars.

Meanwhile, the number of contracts for ETH OI options reached more than 4,800 at the start of the year.

“With regard to wider trends around overvoltage, the increase in network activity, the accumulation of ether business cash and the positive regulatory developments have still contributed to a large gathering on ether and ether derivatives,” said Vicioso.

Ethereum ethereum leaves fNB bitcoin that hang out in the dust

In addition to the weighing future of the ON, the arrows on the measures on the chain and the accumulation of the current company, the FNB spots and the FNBs were also on a sequence of inputs of several days which allowed them to surpass their Bitcoin counterparts from 10 to 1.

Since August 21, ETH products have experienced an impressive $ 1.83 billion in entries. It is ten times more than the $ 171 million that the Bitcoin ETF recorded during the same period, according to to Coringlass data.

Yesterday, we published our note on the upper carriers of ETHEREUM ETF. The advisers dominate known holders and have moved away from the hedge funds. pic.twitter.com/qvp6zgn3vi

– James Seyffart (@jseyff) August 27, 2025

This outperformance was also observed during the last negotiation session. Yesterday, the nine Funds of Ethereum posted $ 310.3 million in entries, while the eleven -seat FNB bitcoin FNB only experienced $ 81.1 million during the day.

ETH also crowded More than 7% last week, while the BTC price has slipped in the last seven days.

The activity of the network increases that the cryptographic industry gains regulatory clarity

Supporting the Fig Figure Figure is an increase in chain activity for Ethereum.

According to data From ycharts, the number of ETH transactions per day is around 1.6 million. Although it is about a decrease of 2% compared to transactions of 1.633 million habit yesterday, it is an increase of more than 43% compared to the measurement of metrics a year ago at the same time.

At the time, daily transactions amounted to around 1.114 million.

Earlier this month, the number of daily transactions on the Ethereum network reached a new record of around 1.875 million.

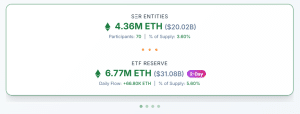

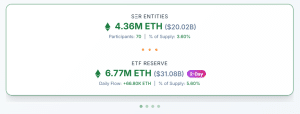

Several institutions have also started to quickly accumulate Ethereum as part of a cash strategy. As of August 28, 70 companies added Altcoin to their balance sheets data of StrategiceThreve.

The largest ETH treasury company is Bitmin Immersion Technologies, which holds 1.7 million Ethics worth around 7.87 billion dollars. Sharplink Gaming, the company whose co -founder of Ethereum, Joe Lubin, is a shareholder, holds 797.7K of ETH worth around $ 3.66 billion.

Statistics of the ETH Treasury (Source: Strategicethreve)

Collectively, all cash companies hold 4.36 million ETH tokens, which is equivalent to 3.6% of its supply.

It is as analysts, including the CEO of Vaneck, Jan Van Eck, predict that Ethereum is about to benefit from the recently adopted engineering law, a key bill that establishes the requirements for stabing issuers in the United States to follow.

This act is one of the first bills to provide the cryptographic industry with a long -awaited regulatory clarity.

Vaneck’s CEO provides that the bill will launch a race for Stablecoin, where banks and institutions will rush to adopt technology.

Ethereum, which is currently the favorite channel for stablecoin issuers with a share of more than 50% of the Stablecoin walkshould maintain its first engine advantage.

Related items:

Best wallet – diversify your crypto wallet

- Easy to use cryptographic wallet, easy to use

- Get early access to ICO to toys to come

- Multi-chaînes, multi-walk, non-guardians

- Now on the App Store, Google Play

- Pape to win the native token $ the best

- 250,000+ monthly active users

Join our Telegram Channel to stay up to date on the coverage of information on the breakup