Join our Telegram Channel to stay up to date on the coverage of information on the breakup

The Ethereum price fell 1.6% in the last 24 hours to negotiate $ 4,439.05 to 5 h 20 hne on a 37% increase in daily negotiation volume at $ 31.7 billion.

ETH’s ignition occurs even after a Bitcoin OG whale with more than $ 5 billion in BTC has converted more than $ 400 million Bitcoin into Ethereum in recent days. The whale sold 4,000 BTC, followed by 1,000 other BTC, then used the funds to buy more than 96,000 ETH in a single batch.

This raised the Ethereum assets of the whale to more than 800,000 ETH, worth more than $ 4 billion, most of it, reporting a long-term commitment.

I am 100% aligned with almost everything that Tom @Fundstrat said here.

Yes, Wall Street will be at stake because they are currently paying their infrastructure and Ethereum will replace a large part of the many batteries with which they operate (for example, JPMorgam probably operates on several batteries with tjectures …

– Joseph Lubin (@ethereumjoseph) August 30, 2025

This high -challenged BTC in Eth rotation is involved while Ethereum’s demand among institutional investors increases, helping outreformance recently outperforming the BTC. Asset managers like Blackrock and Vaneck, with new ETH ETF approvals, have reported billions of dollars in Ethereum for customer wallets.

Large technology and game companies, as well as cash companies such as Sharplink Gaming, now hold billions of ethics in their balance sheets when they create businesses of ETH ETH ETH.

Blackrock has just deposited for a $ ETh ETF of jaliago.

This will attract a new wave of institutional investors.

What comes then could be absolutely massive. pic.twitter.com/6vj8pii3gv

– Crypto Rover (@rovercrc) July 18, 2025

On the front of prediction, the co-founder Ethereum Joseph Lubin and Tom Lee of Fundstratic both envisage the value of Ethereum multiplying 100x in the years to come, largely thanks to institutional adoption.

Lubin believes that Wall Street moves the commercial infrastructure to the Ethereum blockchain and that larger banks participate, the ETH will cement its role as the main digital asset for institutional treasury bills in the world.

Joseph Lubin and Tom Lee opened the trail for the companies of the ETH Treasury. He cannot be overestimated how optimistic it is for $ ETh.

I’m just starting. Unforgivatedly higher.

Follow the cash industry industry and pic.twitter.com/ismfimlffl

– 🅿🅴🅿🅴🐸🦧🅺🅾🅽🅶 (🪈, 🪈) (@Thepepeekong) August 8, 2025

Ethereum price, portfolio growth and appearance activity

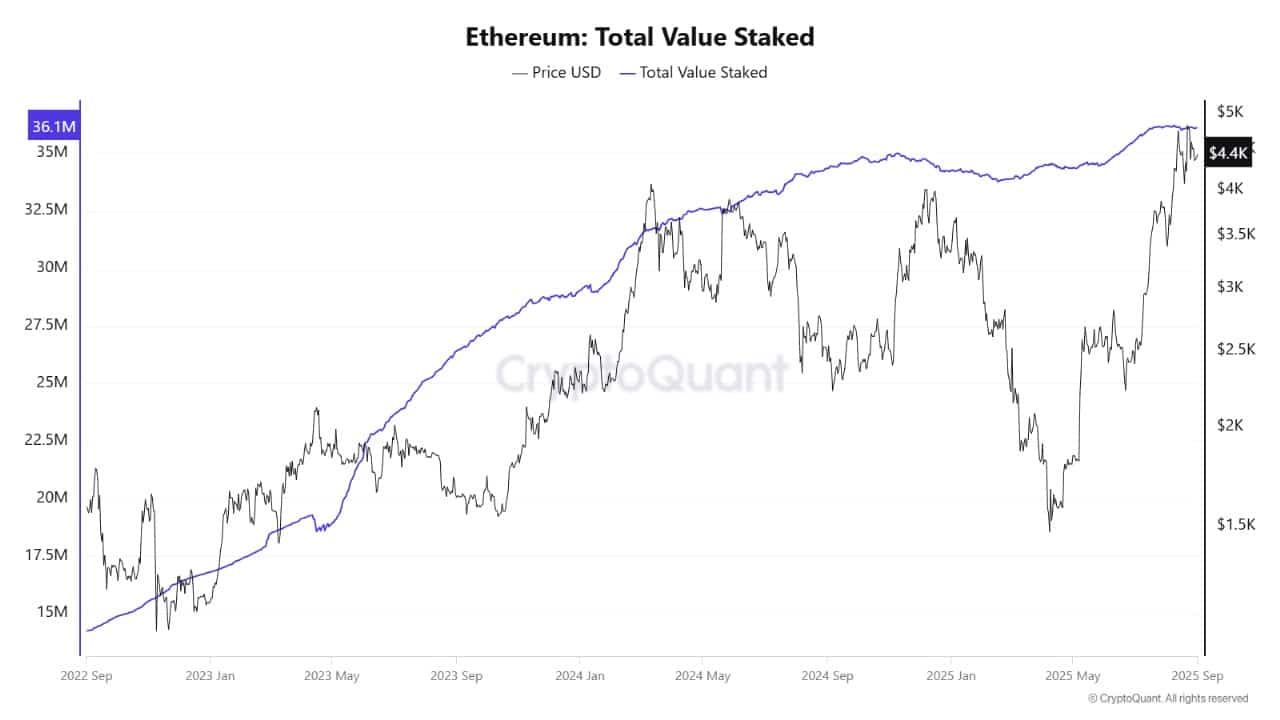

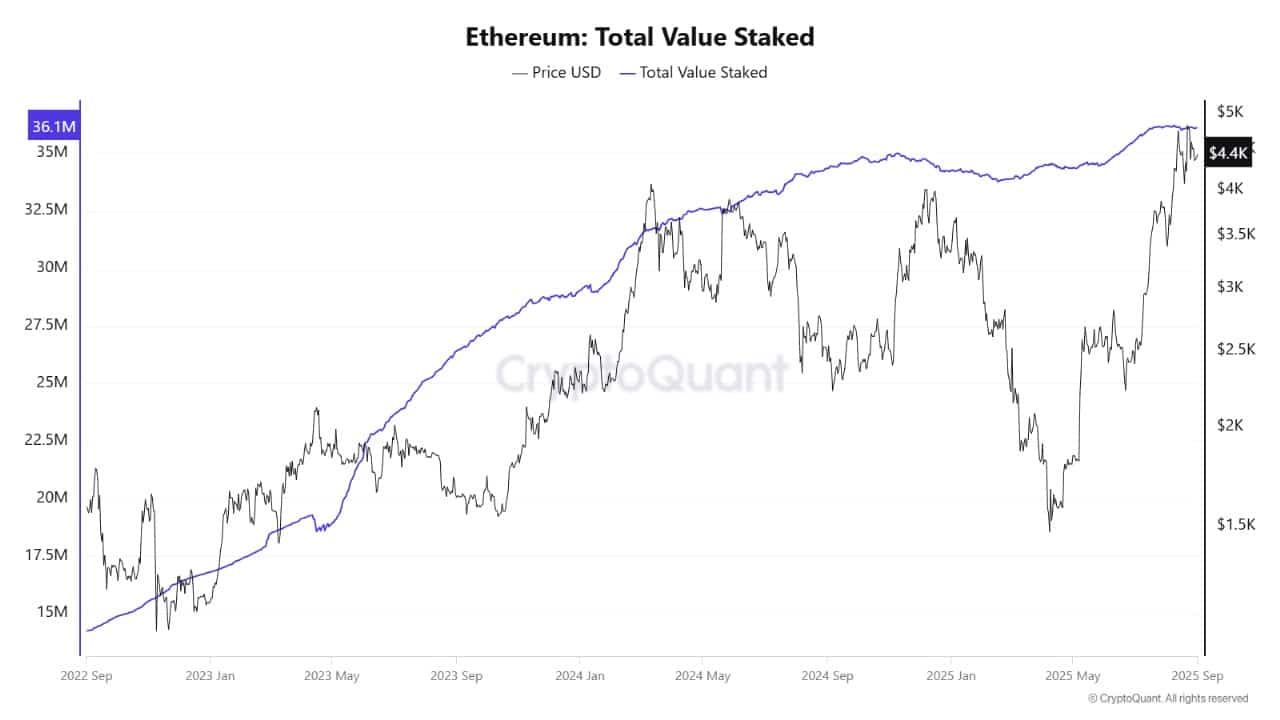

Chain metrics show solid signs supporting the latest ETH price trend. The big holders are increasingly mark their parts, reducing the liquid ETH on the exchanges and the tightening of the supply. Almost 5% of the total traffic in Ethereum has passed through cash and funds since the start of the year.

Ethereum Total value Marked analysis Source: cryptocurrency

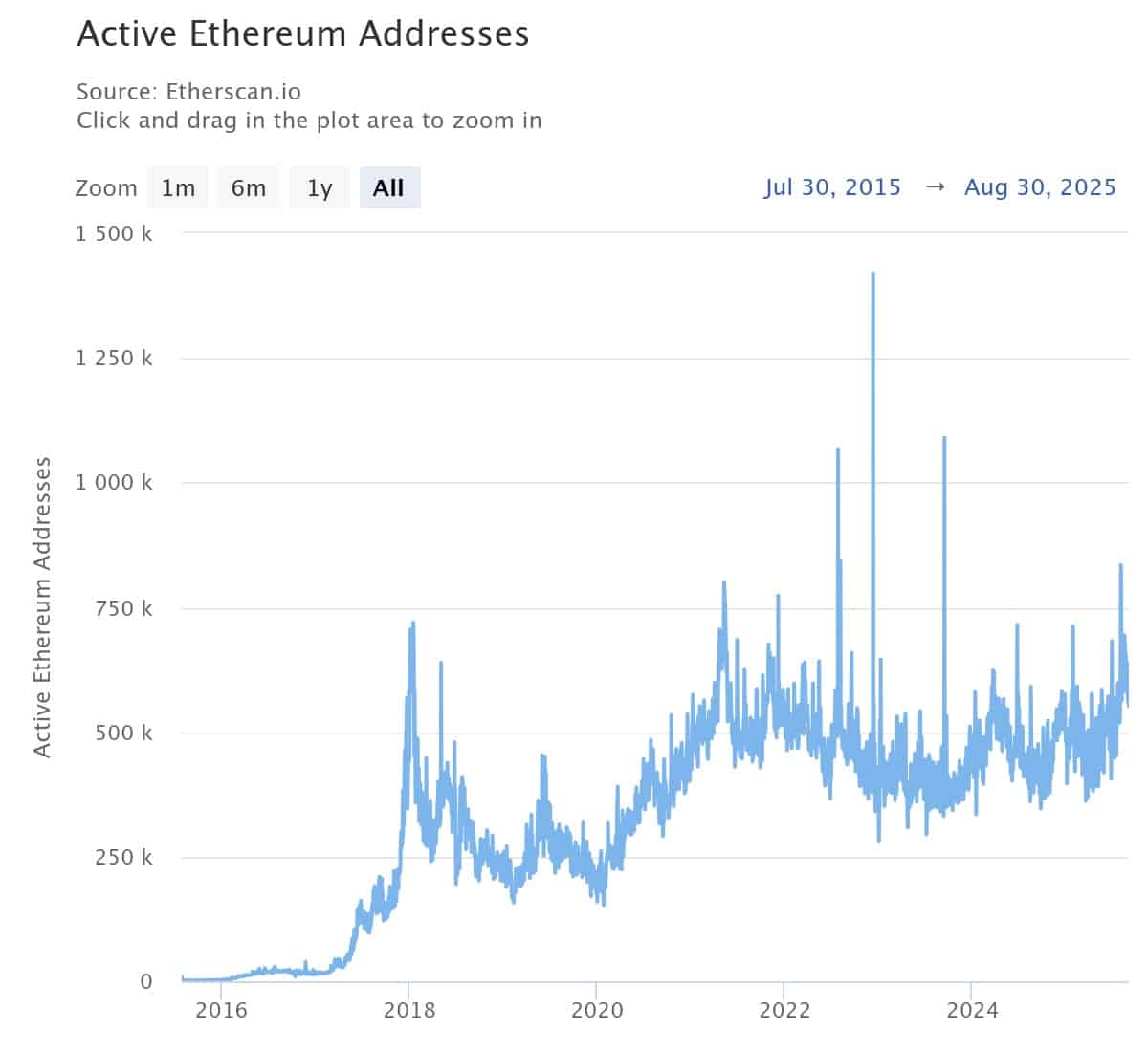

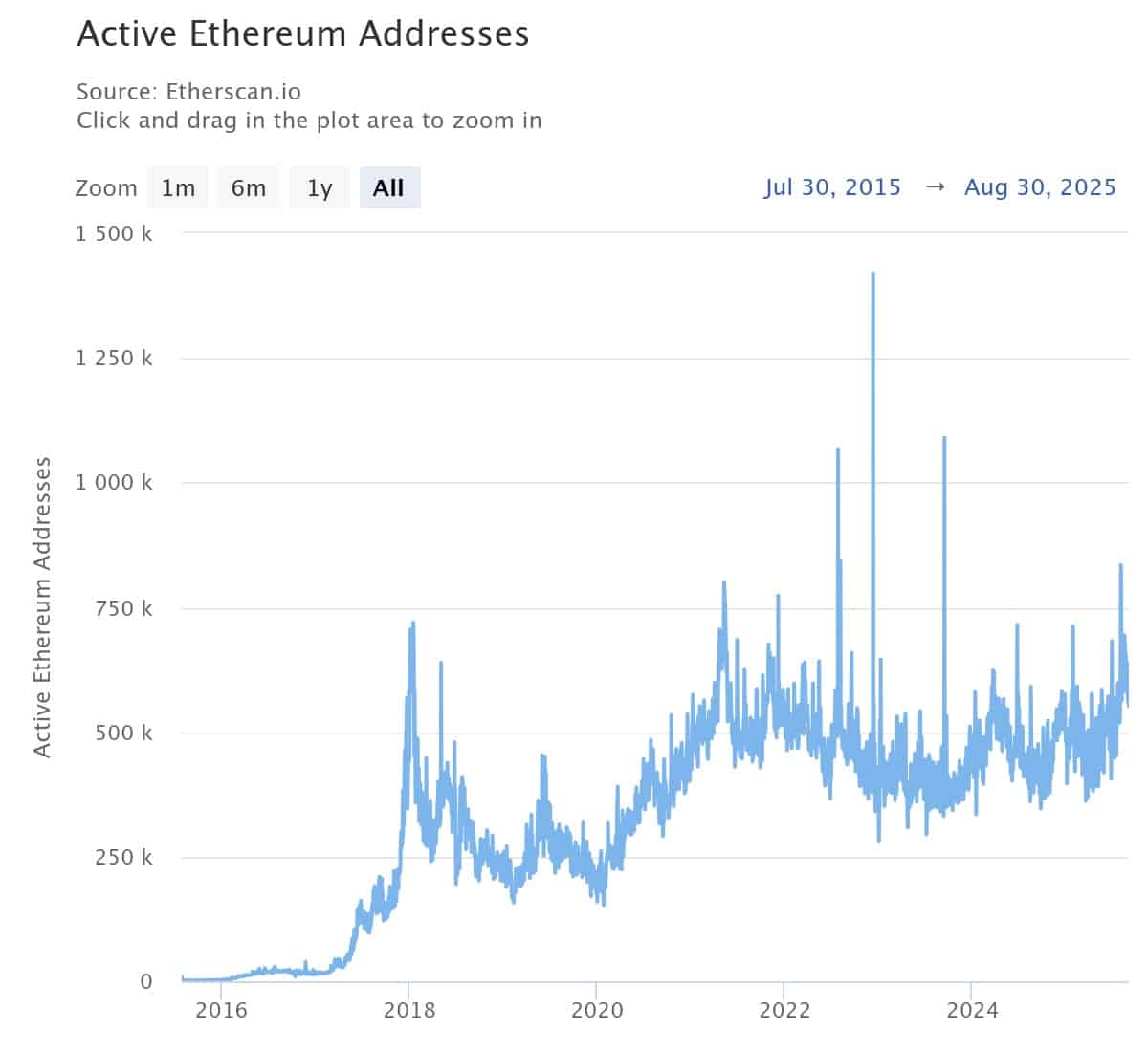

This means that less ETH are available for sale, feeding stability and pushing prices upwards. Participation in the network is high, as reflected in solid transaction volumes and Active addresses. The development continues to increase, which uses individual and institutional investors looking for long -term return and growth.

Analysts also note a growing diversification of the wallet, showing that not only whales, but many new participants join the Ethereum ecosystem. These trends combine to maintain the price of dynamic ethn, even if the wider market faces turbulence.

Ethereum price: set to test new heights?

Looking at the weekly ETH / USD graphic, the Ethereum price is up and recently closed $ 4,438. The room rebounded hard from previous stockings in 2025, which made higher highs at each movement.

The ETH is currently negotiating above key support levels: the simple mobile average from 50 weeks to $ 2,901 and the 200 weeks at $ 2,446, highlighting a long-term long-term trend.

The immediate support area is between $ 4,323 and $ 4,375, while the resistance is visible near the range from $ 4,482 to $ 4,592. The critical level of $ 5,000 is the next psychological barrier and could soon come into play if the bullish momentum continues.

Ethusd analysis 1 week. Source: tradingView

Eln indicators support the positive view. The relative resistance index (RSI) increased to 67.2, a strong purchase sign but not yet excessive conditions. The MacD remains in bullish territory, although traders ensure any turn in these indicators which could report a break or a correction.

The volume points on the eruptions crossing the resistance confirm the real request. If the ETH remains above its support levels, analysts see a strong chance of testing $ 4,850 to $ 5,000 in the coming weeks. Ahead, a drop of less than $ 4,323 could trigger a sale that could test the lower averages close to $ 2,900.

The Ethereum price is gaining in force purchases of major whales, institutional entries and upward predictions of industry leaders. With the 100x prediction of Joseph Lubin resonant at Wall Street, the ETH Prize could soon test new heights.

Related items:

Best wallet – diversify your crypto wallet

- Easy to use cryptographic wallet, easy to use

- Get early access to ICO to toys to come

- Multi-chaînes, multi-walk, non-guardians

- Now on the App Store, Google Play

- Pape to win the native token $ the best

- 250,000+ monthly active users

Join our Telegram Channel to stay up to date on the coverage of information on the breakup