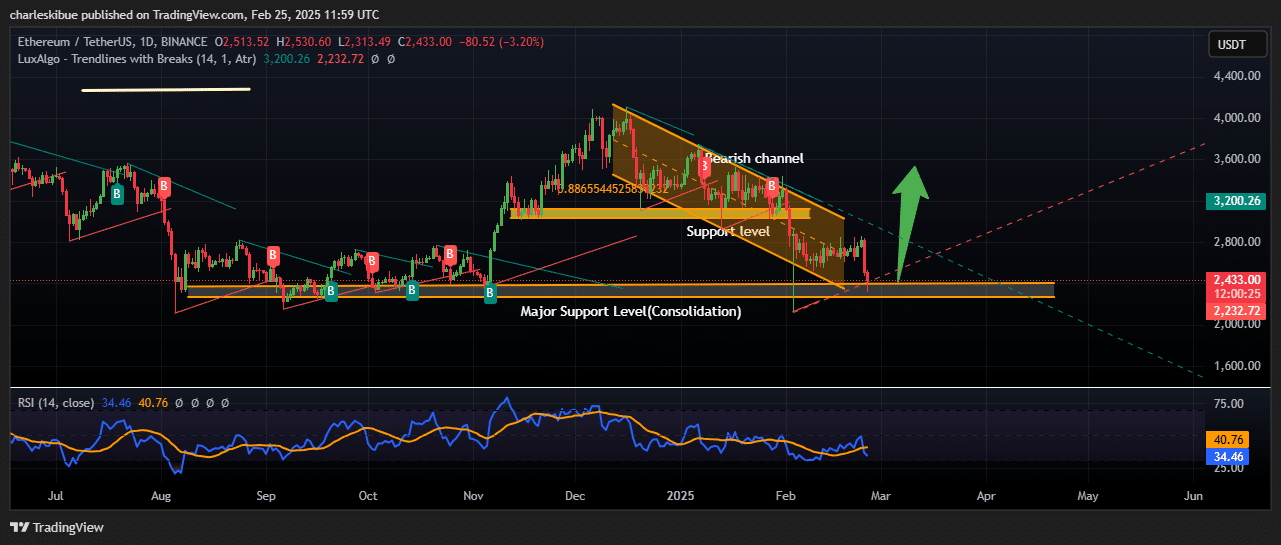

Ethereum (ETH / USDT) currently oscillates in a major support area nearly $ 2,232 – $ 2,433, an area that has strongly supported prices and potential rebounds. The market indicates a lower bias, as shown by the rupture of a descending channel (or “downward channel”) and a failure to maintain the momentum above the levels of resistance.

Despite these lowering signals, the support of this region remains critical and the reaction of the prices here will probably shape the trajectory of Ethereum in the coming days and weeks. A key point of interest is the relative force index (RSI), now nearly 34.47, approaching the territory of occurrence.

The area from $ 2,232 to $ 2,433 is a central point. If buyers manage to defend this region, Ethereum can try a rebound, with the first main objective of increase around $ 2,800, where recent prices action has undergone sales pressure.

Ethusdt Source analysis: tradingView

Beyond that, $ 3,200 is a stronger level of resistance, reflecting previous peaks and a significant pivot area. A decisive decision above $ 3,200 could report a more pronounced bullish overthrow, potentially arousing new purchasing interests and triggering a new leg.

Conversely, ventilation less than $ 2,232 would weaken the market structure and could invite additional drawbacks to $ 2,000 or even more, as stop orders are triggered and the sale of accelerating. In such a scenario, traders could seek to reduce support areas around $ 1,800 to $ 2,000 for potential accumulation, but the feeling would probably remain cautious until the market shows signs of stabilization.

A short -term lower structure (rupture of downhill canal) compared to a long -term consolidation support area could trigger a rebound if it is successfully defended. RSI reading also highlights the possibility of a short -term rebound, but the purchase of follow -up will be crucial to confirm any significant reversal.

The best presale of presale does not go beyond $ 10.5 million – the next crypto to explode?

Even if the Ethereum price dives, investors flock to buy the best (better) presale, which has already raised more than $ 10.5 million in funding.

The best portfolio is a large digital asset management platform supporting more than 60 blockchains that allow users to manage several web3 portfolios safely.

🚀 Weekly tokens 🚀

Here are three trendy tokens that make waves right now:

Do you hold one of them? Let us know. 👇👀 pic.twitter.com/7xiqbsotra

– Best portfolio (@Bestwallethq) February 21, 2025

A remarkable feature is its next section of tokens, which signals the hottest presses on the customer market. He established a good assessment, recommending the first coins like Catslap (SLAP) and Pepe Unchained (PEPU), which both provided enormous yields to first investors.

Its latest recommendation is BTC Bull Token (BTCBull), a new piece of memes which gives bitcoin to token holders via Airdrops based on milestones when the Bitcoin price reaches new peaks of all time.

Crypto Analyst and Youtuber Crypto Gains, which has more than 141K subscribers, predicts that the best could increase 10x after its launch.