Join our Telegram Channel to stay up to date on the coverage of information on the breakup

The Ethereum price has jumped 3% in the past 24 hours to negotiate $ 4,436 to 3 h 33 hne after Bitmin bought $ 200 million from ETH and, as Securities and Exchange Commission (SEC) of the United States, has delayed a decision to harm the ETF ETF of Blackrock.

Bitmin by Tom Lee has expanded his ETH holdings for the second time this week. Lookonchain data show that the company has acquired 46,255 ETH additional ethn of approximately $ 200.43 million.

Bitmin (@Bitmnr) bought 46,255 others $ ETh(200.43 million dollars) 5 hours ago and currently holds 2,126,018 $ ETh($ 9.27b). pic.twitter.com/mchckyx8s5

– Lookonchain (@lookonchain) September 11, 2025

Bitmin had already bought 202,500 Ether on Monday, which sent its 2 million ETH for the first time.

With the latest purchase, Bitmine now has an impressive 2.1 million ETH which is currently worth around $ 9.27 billion.

The firm has the largest ETH assets of any public enterprise, and it has now expanded the gap of the second largest ETH portfolio company, Sharplink Gaming, which has more than 837,000 ETH in its treasury, according to ETH reserve strategic data.

Dry delays the decision on the stimulum of Blackrock

In another development, the American sec has once again delayed Decisions on a handful of Crypto ETF applications.

He said he needed more time to examine the applications to allow ETHEREUM ETHERE -published by Blackrock, Fidelity and Franklin Templeton.

The agency has now established a new deadline of November 13 for the implementation amendment of Ethereum de Franklin and November 14 for its ETF Solana and XRP.

Meanwhile, a proposal to allow stimulation in Ishares Ethereum Trust of BlackRock is now scheduled for October 30.

While the president of the SEC, Paul Atkins, remained vocal in his support for digital assets, the agency continues to delay decisions on many ETFs.

However, during the OECD round table in Paris, he said: “We must admit that Crypto’s time has come”, signaling an upward position.

According to a Bloomberg table, more than 90 ETF Crypto await the approval of the dry.

In case you have missed it, there are more than 90 ETF Crypto ETF while waiting for approval of the dry (see graphic below via @Jseyff ))

At this rate, we will have one for every top 30 to 40 #crypto In 12 months, even with delays. Entrances may surprise some, but others still bounce on LT graphics. pic.twitter.com/q6hsl8xnyt

– James McKay (@mckayresearch) September 10, 2025

Meanwhile, the FNB Spot ETH have recorded two consecutive days of positive net inputs, according to data from Rinsing.

Ethereum price climbs on the Haussier canal

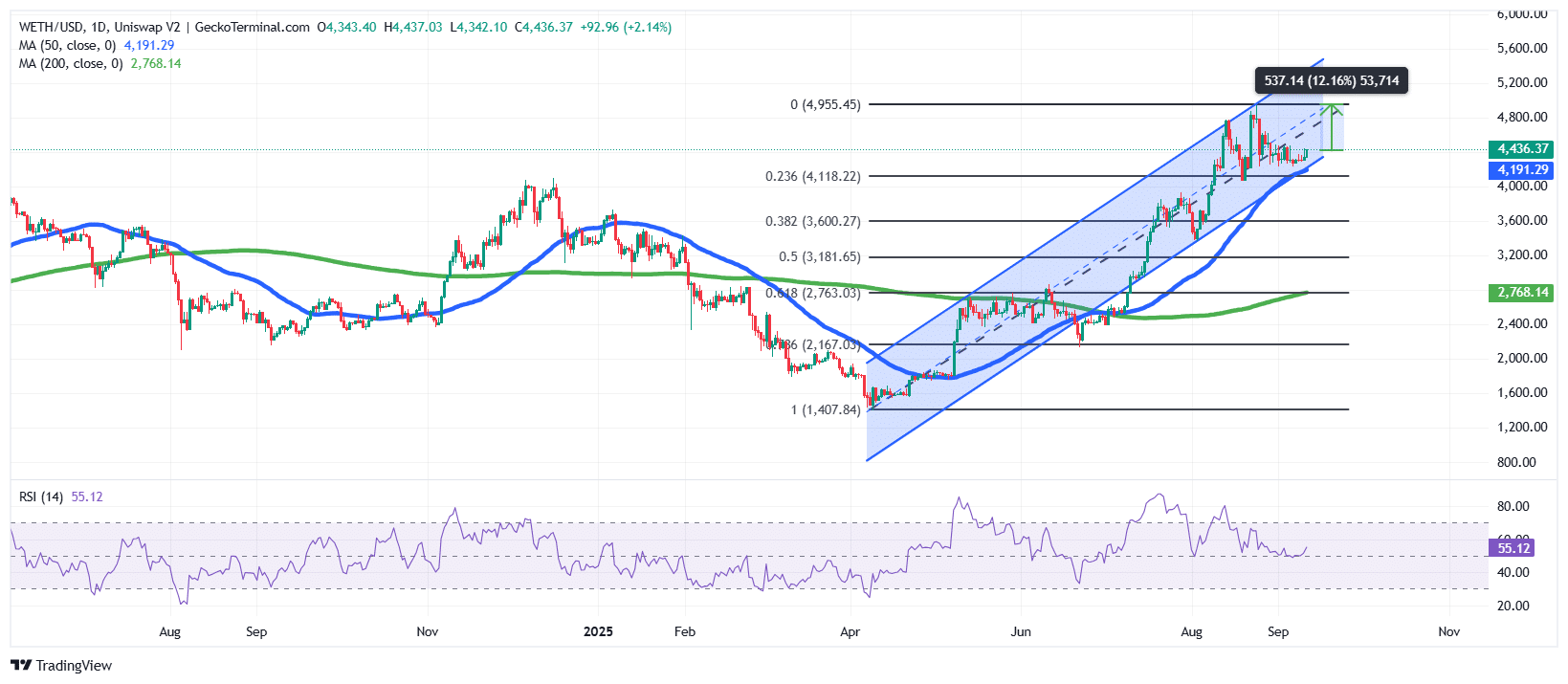

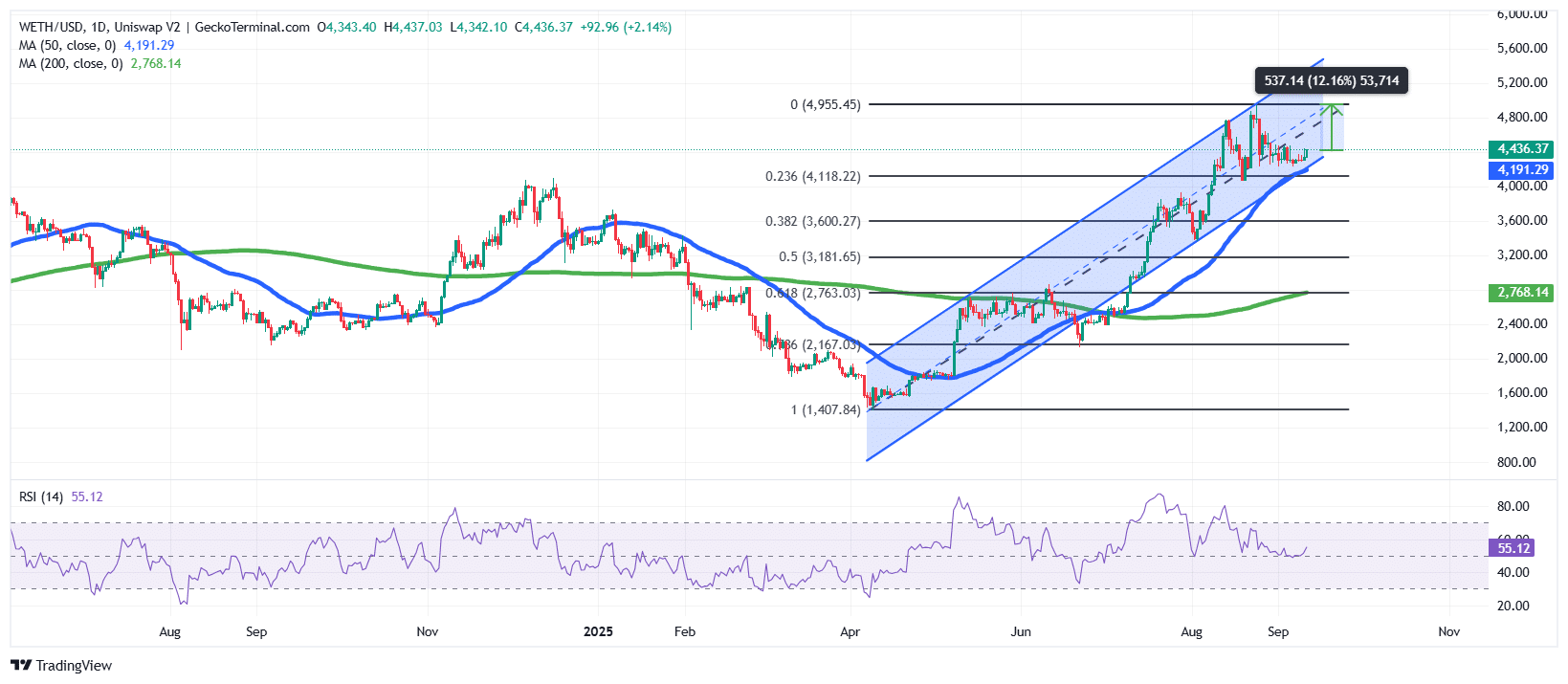

The price of the ETH moves to a clear -up channel model since April 2025, signaling a strong bullish momentum.

After climbing down almost $ 1,400, the Ethereum price is now negotiated about $ 4,436, the channel offering constant support and resistance levels.

The recent withdrawal from the upper border nearly $ 4,950 did not break the upward structure, because the price of Ethereum quickly found the support and remains in the channel.

Fibonacci’s retracement levels reinforce this trend, with the retrace of 0.236 $ 4,118 key acting as an important level which has now been transformed into support.

Meanwhile, the 50 -day simple mobile average (SMA) ($ 4191) acted as a dynamic support, while the SMA of 200 days to $ 2,768 remains well below the price of the ETH, highlighting a strong separation and a trend force.

ETH indicators indicate more space for growth

The relative resistance index (RSI) is 55.12, a neutral reading to Bullins which shows that the momentum is healthy without being excessive. This suggests that Ethereum has room for more moving up before a major correction becomes likely.

The ETH is positioned to retest the limit of the upper canal nearly $ 4,950. If this resistance breaks, the next target is around $ 5,200, offering approximately 17% increase in current levels.

Lower, if the momentum is weakening and the price of Ethereum loses the SMAS of 50 days, the Fibonacci support of $ 4,118 and the line of the average channel could be the following support levels.

Depending on his analysis on Bollinger strips, Ali Martinez believes that the price of ETH can see a greater movement.

Expect a big step for Ethereum $ ETh As soon as the Bollinger groups tighten! pic.twitter.com/5kgyzuf3vb

– Ali (@ali_charts) September 10, 2025

Another analyst on X, “Altgem Hunter”, believes that the action of Ethereum prices is similar to that of Bitcoin in 2021, and could prepare for a massive rally.

$ ETh Repeats the action of the price of Bitcoin from 2021.

If history is repeated …

A massive pump arrives! pic.twitter.com/vszolim2w2

– Altgem Hunter ⚡🥷 (@altgemhunter) September 10, 2025

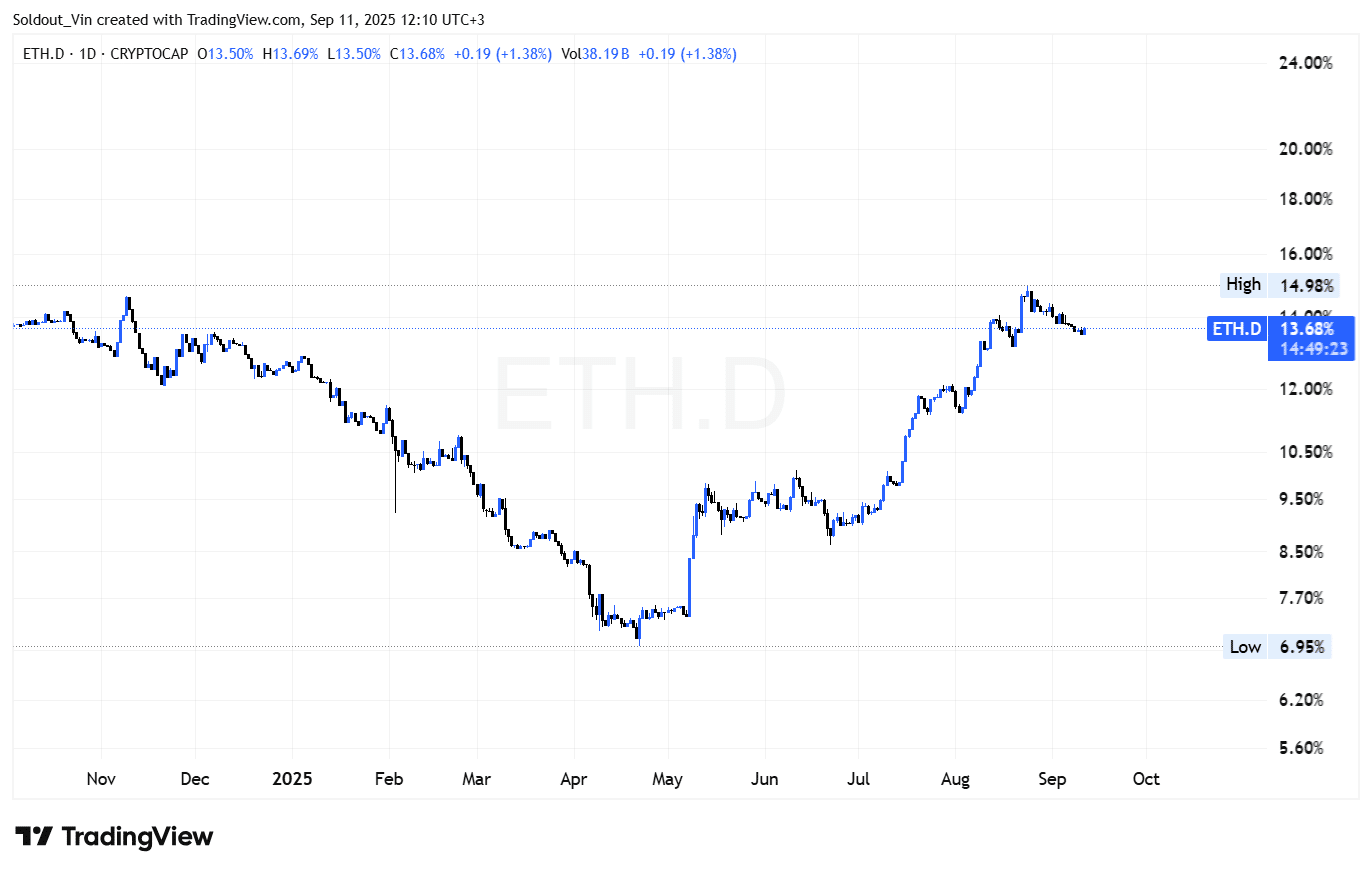

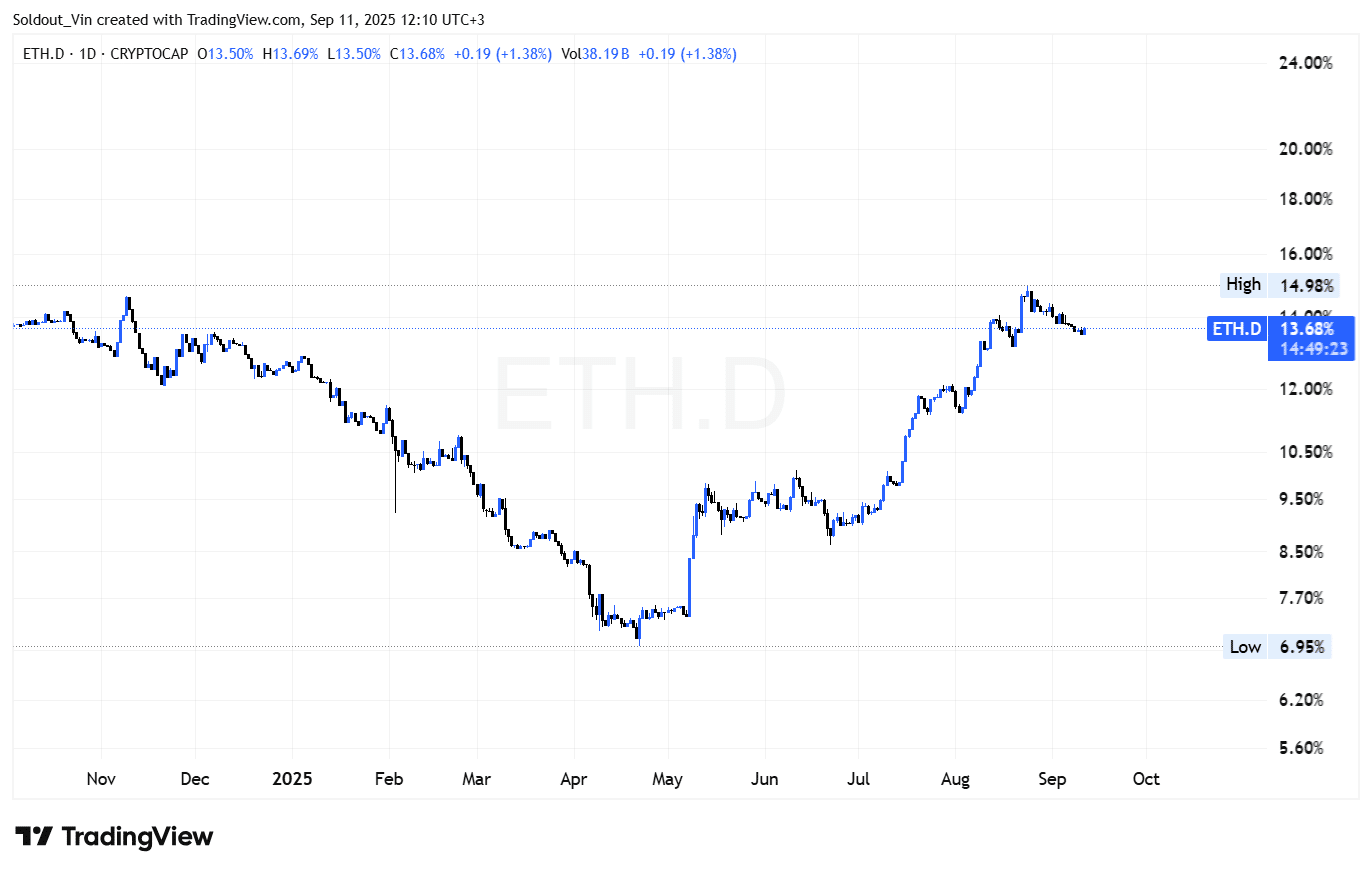

Ethereum Dominance (ETH.D) strongly rebounded from its lower April 6.95%to a September peak of 14.98%, but now dates back to around 13.68%. ETH always surprises most other cryptos.

The positive feeling of the Ethereum Prize is supported by the CMC Altcoin season indexThis shows that the Altcoin season is approaching with the index now at a summit for the year.

Related news:

Best wallet – diversify your crypto wallet

- Easy to use cryptographic wallet, easy to use

- Get early access to ICO to toys to come

- Multi-chaînes, multi-walk, non-guardians

- Now on the App Store, Google Play

- Pape to win the native token $ the best

- 250,000+ monthly active users

Join our Telegram Channel to stay up to date on the coverage of information on the breakup