08/19 update below. This message was initially published on August 18

Bitcoin – Next to other major cryptocurrencies Ethereum and XRP – fell suddenly, which raises fears of a crypto market after having completed up to a top of $ 4.2 billions of dollars this month (just like Tala billionaire Elon Musk breaks his silence on crypto).

Register now for Cryptocurrency– a free newsletter for the cryptocurical

The price of Bitcoin went from a summit of $ 124,000 per Bitcoin last week, lowering about 10% to $ 114,000, while the XRP of Ethereum and Ripple experienced similar declines despite American president Donald Trump, dropping a cryptographic bomb of $ 12.2 billion surprise.

The decline of Bitcoin and Crypto, coming just as JPMorgan makes a federal reserve flip that changes the situation, follows the giants of Wall Street emitting a warning according to which the StableCoin Genius Act bill recently adopted could trigger a deluge of 6.6 billions of dollars of account withdrawals.

Register now for free Cryptocurrency–A five-minute daily newsletter for merchants, investors and cryptocurrency will update you and keep you in advance on Bitcoin and the Bull Run Crypto-Marché

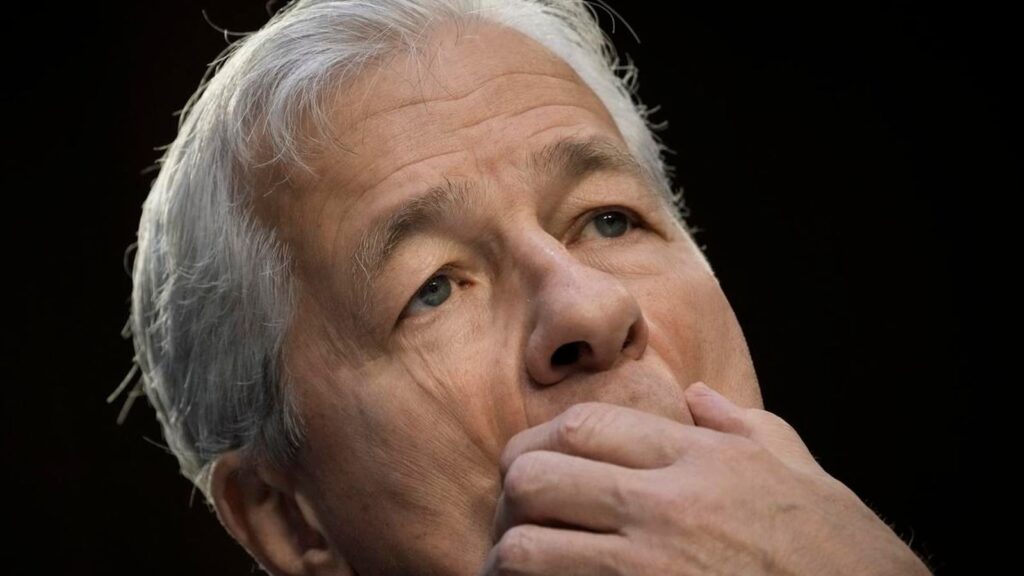

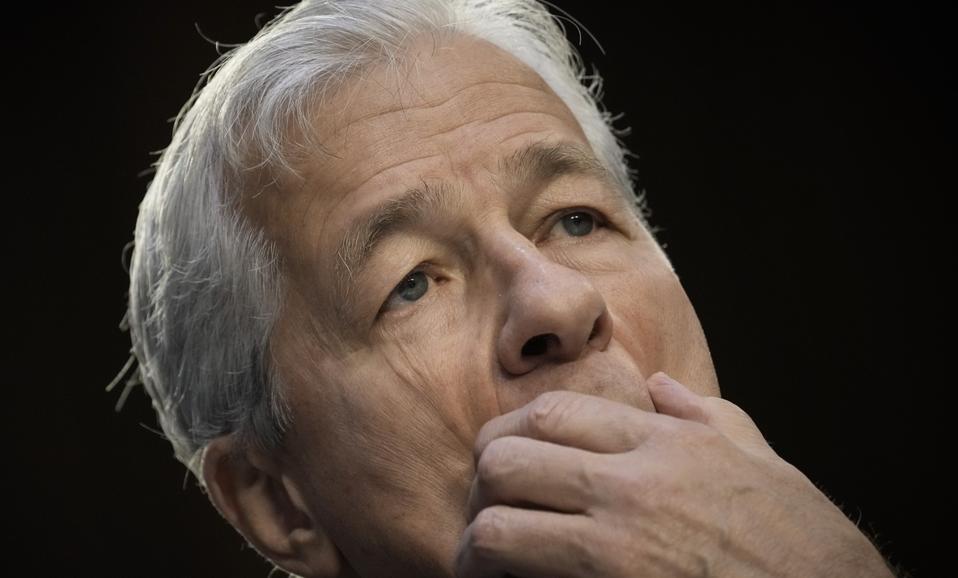

The CEO of JPMorgan Chase, Jamie Dimon, is one of the most frank Bitcoin criticisms, but has adopted the underlying technology that feeds stablins in Pie.

Getty images

American banking groups that count Wall Street’s giants such as JPMorgan and Bank of America as members have urged the congress to fill a flaw in the recently adopted stablecoin draft bill which allows issuers of cryptocurrencies of enormous accounts that underpin the banking system.

08/19 Update: The price of the price of bitcoin and cryptography has tilted wildly while fears swirl a widespread cryptography market could be to collect a rate.

The price of Bitcoin dropped around $ 113,000 before rebounding at around $ 115,000, leading to the wider cryptography market which has experienced $ 250 billion in the endless value since last week.

“The cryptocurrencies have negotiated strongly,” said David Morrison, senior market analyst at Trade Nation, in the comments sent by e-mail.

“Bitcoin continued to move away from Thursday’s highest, just below $ 124,500. Ethereum suffered heavier sales pressure, lowering more than 5%. These losses highlight continuous volatility in the cryptographic sector. The greater question is whether it is simply a series of benefits after the highest sale in the first two weeks of August.

The index of fear and greedily watched crypto has balance Reading from 68 last week at only 56 years old, its lowest reading since the price of Bitcoin fell at less than $ 112,000 in early August and putting it on the verge of “fear” territory.

This week, the three -day Jackson Hole’s economic policy symposium begins in Wyoming, with the Friday speech of the president of the Federal Reserve Jerome Powell at the top of the agenda while merchants are preparing for what should be a drop in FED interest rates in September.

“The markets are suffocating their concentration on the upcoming comments of the Fed chair to the Jackson Hole symposium,” said Joel Kruger, a market strategist at Lmax Group, in the comments sent by e-mail. “The Fed reserve deadlines and geopolitical developments shape flows through actions, FX and Crypto.”

Last week, Treasury Secretary Scott Bessent said The federal reserve could reduce interest rates by 50 base points in SeptemberReflecting a drop in surprise interest rate of 2024 which fueled a boom in the price of bitcoin in the November elections.

“If Powell reports a slower path to ensure Jackson Hole, the markets could reproduce aggressively, tighten financial conditions and put pressure on the prices of short-term crypto,” said Carolane de Palmas, market analyst at Activtrades, in the comments sent by email.

“While bitcoin is often considered” digital gold “, its short -term performance is always very sensitive to liquidity cycles. Traders must recognize that Fed policy directly shapes the liquidity of the dollar, and by extension, influences flows in and out of bitcoin. If the Fed seems more cautious on the rate cans, we could see a reduced momentum in the crypto space through the fall. But there is a second layer here – Beyond in the crypto space through the fall. But there is a second timing here – Beyond in the crypto space of autumn. But there is a second layer here – Beyond in the crypto space. The hole problems are there that Powell sets the tone for political leadership, and any index that the rate cuts are still firmly on the table in the table in the cryptography rally.

In April, a report from the Treasury Department estimated that the states could trigger up to 6.6 billions of dollars of deposit outlets, depending on whether they can offer interest or yield, the StableCoin market should reach $ 2 billion by 2028, compared to $ 280 billion today.

“The congress must protect the credit flow to American companies and families and the most important financial market stability by closing payment of the implementation of interests”, the report, published on the website of the Bank Policy Institute, and sent to the legislators, Lu.

“Banks feed the economy by transforming deposits into loans. Encourageing a passage from bankruptcy and funds from the monetary market to Stablecoins would eventually increase loan costs and the reduction of loans to business and households. ”

The plea for legislators was also signed by the American Bankers Association, the Consumer Bankers Association, Independent Community Bankers of America and the Financial Services Forum.

Stablecoin’s adoption wars warm up following the adoption of the engineering law which established road rules for dollars based on crypto.

The USDT of Tether remains the dominant stablecoin but faces a raz of competition from the competition from all angles, including the giants of Wall Street themselves, technological companies such as Facebook Meta, as well as financial technological companies like Paypal and Stripe.

Earlier this year, David Sacks, a technological investor and the cryptographic Tsar by US President Donald Trump, said on the Everything in the podcast He welcomes with three other investors that he hopes that the rules will eventually swing in favor of stable issuers, allowing them to directly offer interest to stablecoin holders.

Trump’s sons, Eric and Don Jr, said publicly that their World Liberty Financial Crypto project is a direct challenge for Wall Street after their claims to be “deactivated” in the aftermath of Trump’s electoral loss in 2020. “Honestly, I would like to see some of the big banks disappear because, honestly, they deserve it,” said Eric Trump in May.

Register now for Cryptocurrency– a free newsletter for the cryptocurical

The price of bitcoin fell from its heights of all time, which makes it fear that the market can go towards a correction or even a prices accident in its own right.

Digital forbes active ingredients

The latest slowdown in the price of bitcoin and the crypto market, coming as merchants were celebrating a new record of all time, have raised fears that the market could see new decreases in the coming weeks.

“The cryptography market continued its decline on Monday after a break during the weekend,” said Alex Kuptsikevich, chief analyst of the FXPRO market, in the comments sent by e-mail.

“Total capitalization rose to 3.88 dollars billions, reaching its lowest level in more than two weeks. As expected, altcoins drop the most difficult, Ethereum and XRP losing approximately 5% in the last 24 hours, twice as much as Bitcoin. Bitcoin fell to $ 115,000, the lowest level of the last 11 days. In high increase the chances of a deeper correction and a failure of less than $ 112,000 – the recent stockings area – will confirm the correction, opening the drop in decline to $ 105,000 to $ 107,000. »»