Cryptographic space is known for explosive rallies. In October 2024, total market capitalization increased from around 2.7 billions to 3.8 billions of dollars in just two months. Something similar has happened at the beginning of 2024 when the total market capitalization of cryptography increased from $ 1.7 billion in February to 2.85 billions of dollars in mid-March.

Today, history seems different. Since June 2025, the market has increased from 3.5 billions of dollars to 3.94 billions of dollars. The market is still in Taurus phase (as experts suggest), but gatherings continue to calculate. One of the reasons can be hidden inside Defi, where borrowing dominates growth. Read the rest to find out more.

Borrow the growth and domination of stables

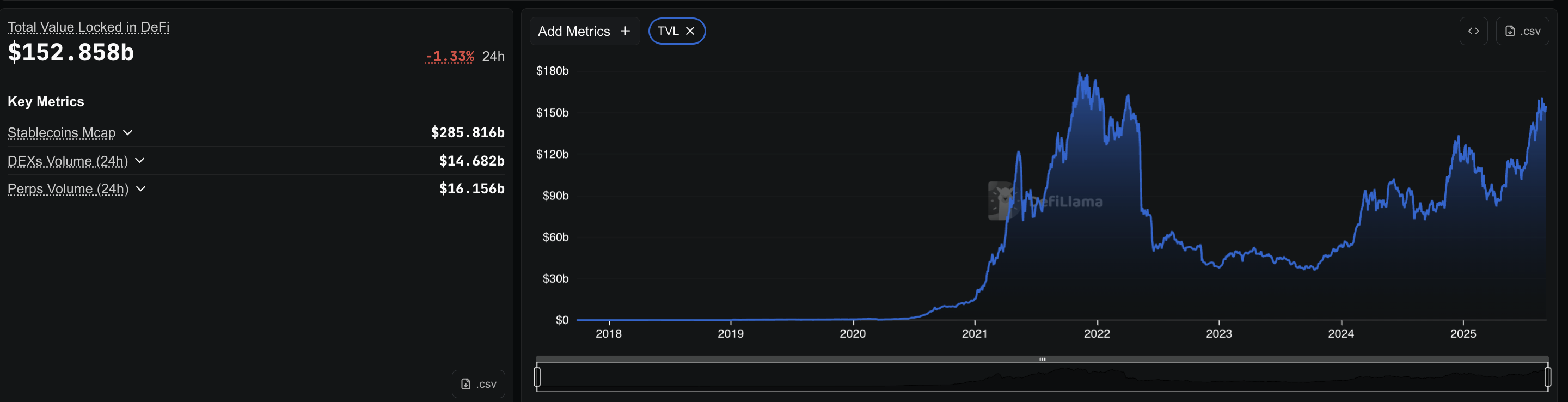

At the time of the press, DEFI Total Value Locked (TVL) amounted to around $ 152 billion, with nearly $ 49 billion borrowed from protocols. Using a 40%user assumption, loan pools would need around $ 123 billion in deposits to support $ 49 billion borrowed. It would be around 81% of the total TVL of $ 153 billion – but it is an estimate.

TVL includes many other assets (puncture, LPS and bridge sales), so treat the figure of 80% as an approximate sign of the big loan, not a specific part.

Sponsored

Sponsored

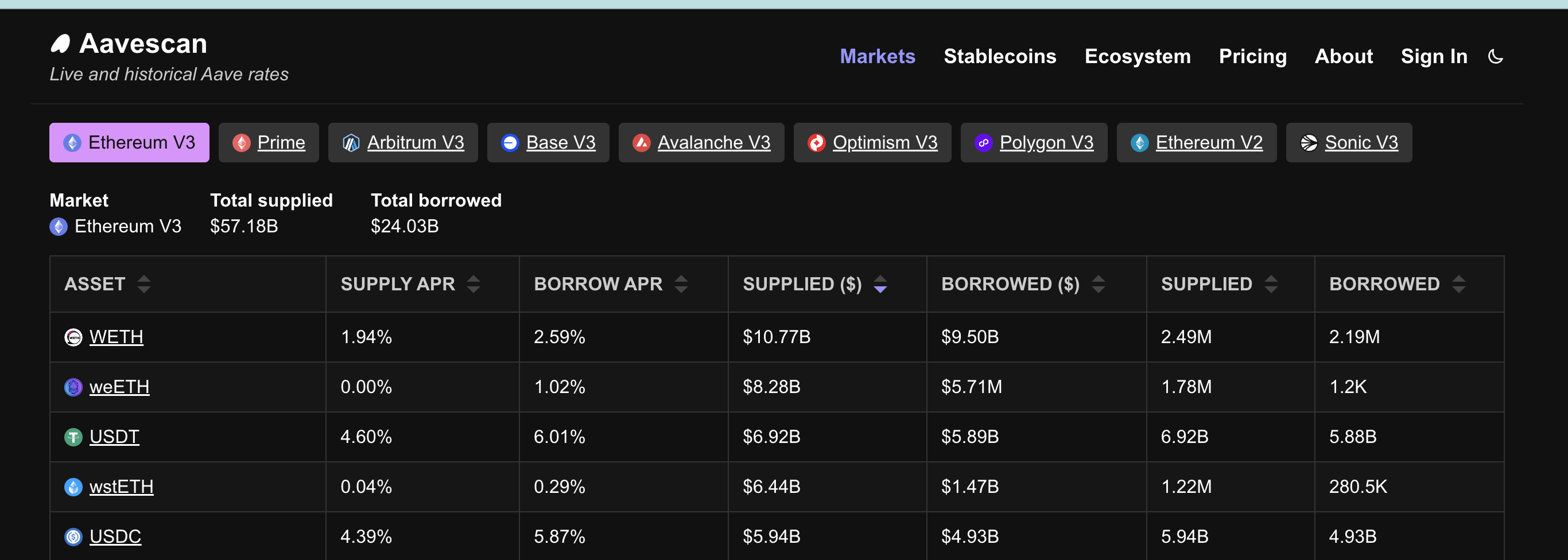

The rate of use means that the amount of money provided in a loan pool is actually borrowed. For example, if Aave has deposited $ 57 billion and 24 billion dollars borrowed, the use rate is around 40%.

Aave leads the sector with about 24 billion dollars in current debt on Ethereum alone, which means that total money has already borrowed from its pools.

Compound adds around $ 986 million. The stablecoins dominate this loan. On Aave, $ 5.94 billion in USDT and $ 4.99 billion in USDC are borrowed. The compound shows a similar model, with nearly $ 500 million in USDC and $ 190 million in USDT.

Do you want more symbolic information like this? Register for the publisher Daily Crypto newsletter Harsh Notariya here.

This dependence on stablescoins is important. The traders do not borrow eth eth or volatile parts to hold.

They borrow dollars. And like any ready, the dollars borrowed are not maintained inactive. Just as people contract loans to buy houses or cars, traders borrow floors to move them elsewhere – most often towards trading. But what kind of trading!

Stablescoins flow to exchanges: spot vs derivatives

Sponsored

Sponsored

The Stablecoin reserves show where the money is going. Spot exchanges currently hold about $ 4.5 billion in stablescoins, compared to $ 1.2 billion a year ago. On the other hand, derivative exchanges increased from 26.2 billion to $ 54.1 billion during the same period.

Derived exchanges – the derived sections of major exchanges – hold around 54.1 billion dollars in stablescoins.

This tweet shows how great exchanges have a massive liquidity of Stablecoin, even more on the side derived from things.

The split is clear. Most of the borrowed stablecoins are not used for the purchase of Bitcoin or Ethereum one by one. They are sent to derived platforms, where each dollar borrowed acts as a margin and can be multiplied 10 times, 25 times or even 50 times. This change shows that merchants prefer leverage to purchases of simple points.

The volume of trading on the scholarships confirms that:

Sponsored

Sponsored

Lever builds fragile positions

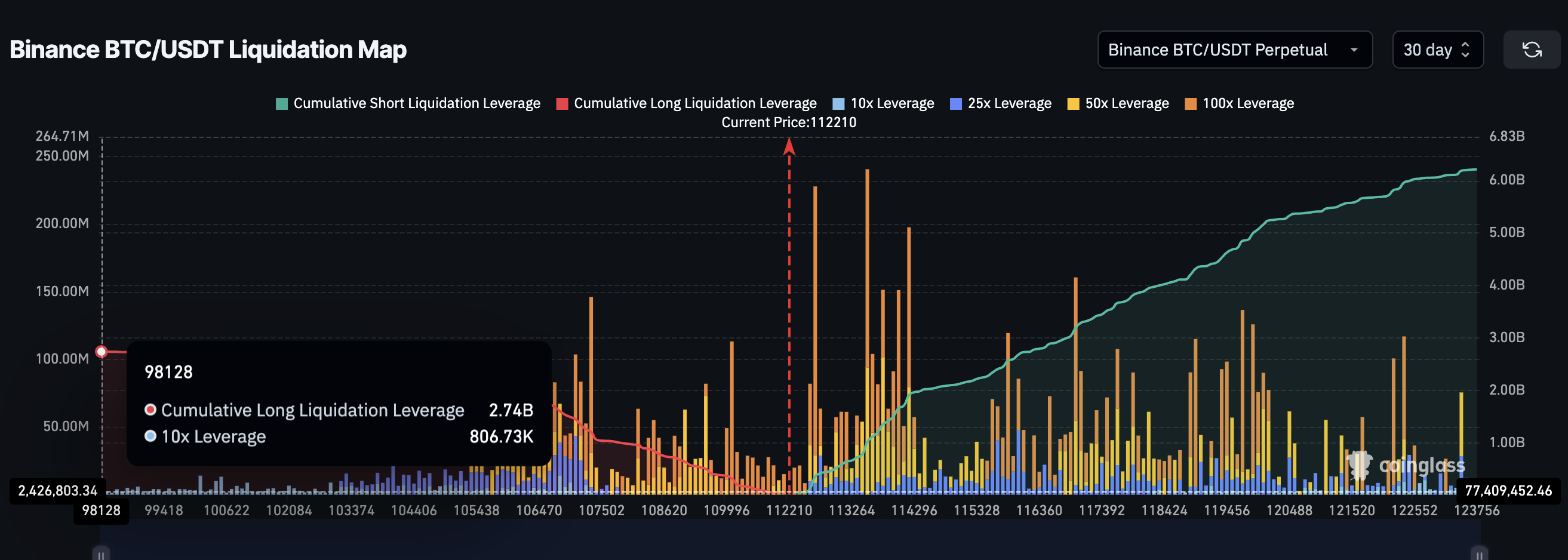

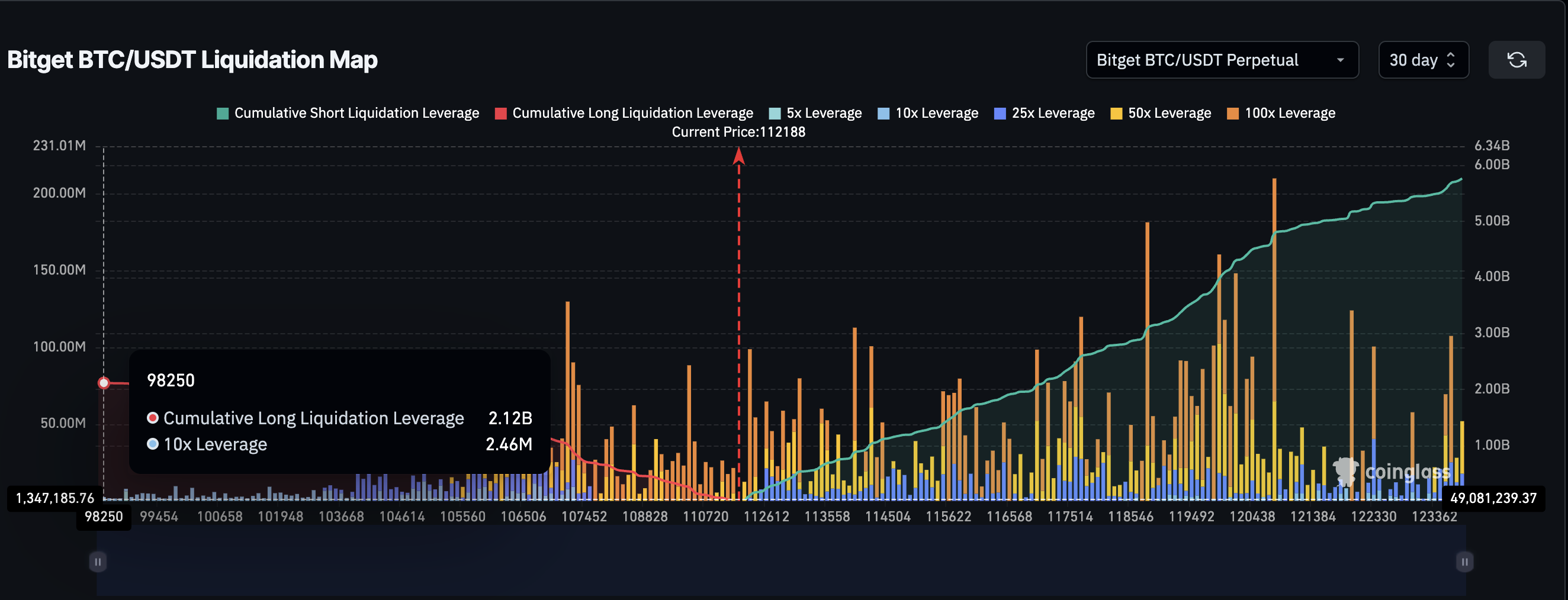

Liquidation cards reveal how fragile leverage trading can make cryptographic gatherings. On Binance, Bitcoin / USDT Perpetuals – A type of expiration without expiration – show about 6.22 billion dollars in short positions and $ 2.74 billion in long positions. On Bitget, Bitcoin pairs add an additional $ 5.71 billion in shorts and $ 2.09 billion long. Together, these two scholarships and a trading pair total nearly $ 17 billion in open positions.

Currently, short positions are heavier because the market moves to the side. But dynamic flips during rallies. The traders take care of long positions, in the hope of mounting the movement above.

When these long bets come together at similar price levels, even a small decline of 2 to 3% can eliminate them. This triggers a chain of forced liquidation, transforming what should be strong crypto rallies into lively inversions.

You might ask yourself why the same thing does not happen in the opposite direction – why short liquidations do not eat rally in the same way. The difference lies in how traders use short positions.

Many short positions are not clear bets, but part of other strategies. Traders cultivate funding bonuses or perform neutral Delta configurations where short films hide other positions. When these shorts disappear, the pressure can cause clear spikes, but they rarely support. Unlike long compressions, which eliminate market buyers, short compressions tend to go out quickly instead of building lasting rallies.

Sponsored

Sponsored

This exposure scale would not be possible without leverage. Remember that total stablecoin reserves on derived scholarships are close to $ 54 billion. If all the exchanges were individual without leverage, these two pairs that we have just mentioned earlier could not explain almost a third of this. This shows how the dominant lever effect has become.

The size of this market is clearer when you look at volumes. In August 2025, Binance’s long -term trading volume reached an annual summit of 2.62 billions of dollars. This monthly total, the most important this year, underlines how future and perpetuates now eclipse the punctual activity and feed the extent of these lever -effect positions.

Borrowing costs push merchants towards the lever effect

Sponsored

Sponsored

The last part is the cost. Borrowing of stablecoins is interested. On Aave, borrowed APR for USDT is around 6%.

A merchant who borrows $ 1,000 pays approximately $ 1.15 per week. With a 10x lever effect, a hair price decision of only 0.011% covers the cost of interest.

The obstacle is so low that traders often move to a higher lever effect. Tiny movements cover the costs and larger movements provide greater benefits. But the more the positions remain open, the higher the costs of costs.

This creates pressure to leave quickly, adding to the cycle of the rallies which rise and fade without follow -up. And there is also the risk of liquidation. For example, a lever effect 10x would liquidate more or less the trader for a fall of 10%, which is not uncommon in the crypto. Consequently, while the long liquidations of defi-menées can block rallies, the possibility of such liquidations remains high, due to the volatile nature of the crypto.

Crypto gatherings do not disappear. The market is always optimistic. But the structure and dependence of DEFI on the bond of loans can explain why the rallies are shorter and lower. The borrowed stablecoins feed the lever effect, not the cash demand, which makes the market more fragile each time it tries to climb.