Bitcoin has rebounded in recent weeks, with regard to the serious collapse of the US dollar.

Donald Trump at the front Cryptoasset & Blockchain of Forbes advisor Where you can “discover blockchain blockbusters ready for 1,000% more earnings!”

The price of Bitcoin has climbed up its summit of $ 112,000 per Bitcoin, the traders’ parsment of an imminent federal reserve flip will be dependent on the cryptography market.

Now, while US President Donald Trump predicted a surprise crypto prediction, bitcoin and crypto are prepared for a “huge” BlackRock Crypto Market bomb which suddenly appeared to “Horizon”.

Register now for free Cryptocurrency–A five-minute daily newsletter for merchants, investors and cryptocurrency will update you and keep you in advance on Bitcoin and the Bull Run Crypto-Marché

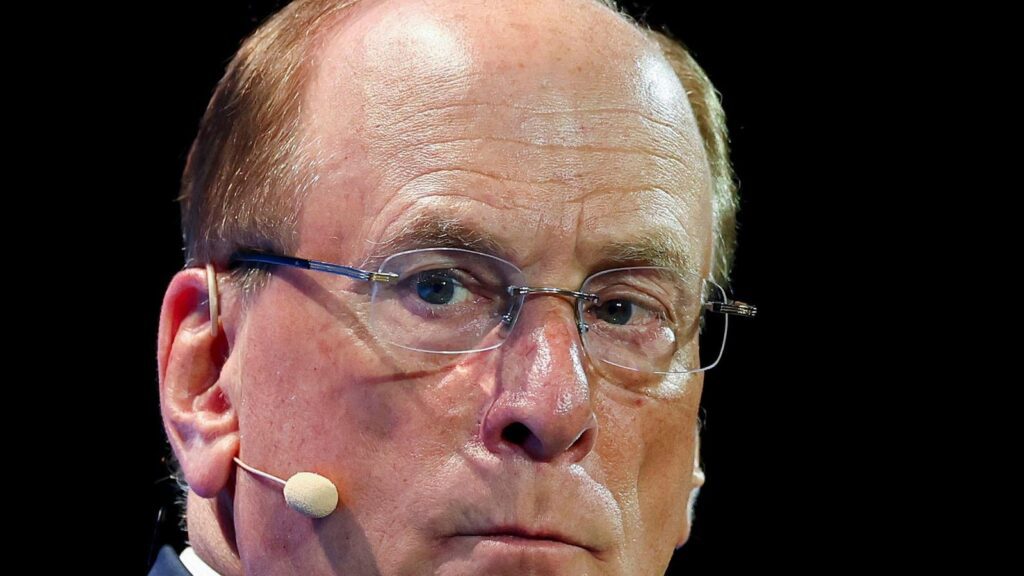

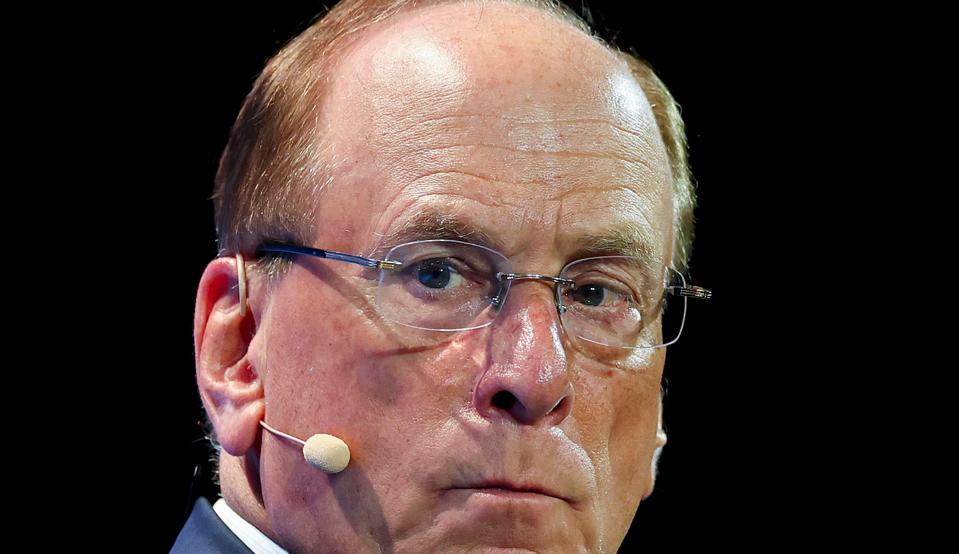

Blackrock director general, Larry Fink, has become one of the most optimistic Bitcoin prices on Wall … More

Research in kind for the Bitcoin negotiated funds and cryptocurrency (ETF) who have stormed Wall Street in the last 18 months could soon arrive, according to the Commissioner of the Security and Exchange Commission (SEC), Hester Peirce.

“I cannot prejudge myself, but we hear that there is a lot of interest,” said Peirce, who directs the working group on the Crypto de la Dry, on stage during a Bitcoin Policy Institute event, adding that Bitcoin and Crypto Etf are now “on the horizon”.

Research in kind allow investors to exchange stocks ETF directly for the underlying assets rather than receiving species, which is currently the case for the Bitcoin spot and the Crypto ETF approved by the SEC at the beginning of 2024 – a change described as “huge” by the analyst of Bloomberg Intelligence Etric Balchunas.

Research in kind for Bitcoin and Cryptography funds would make it more expensive and faster for traders to buy and sell ETF shares, which potentially makes them more attractive for institutional investors at Wall Street.

Earlier this year, Blackrock, which dominated the Bitcoin Spot ETF market with its ibit fund of $ 75 billion, asked the dry to allow creations and redemptions in kind for Bitcoin ETF, instead of having to use species, with Fidelity and other Bitcoin and Smallest Bitcoin suppliers.

“These (forms) are going through the process now,” said Peirce.

Register now for Cryptocurrency– a free and daily newsletter for the crypto-lecious

The price of Bitcoin has increased at a record level this year, helped by Massive 75 of Blackrock … More

Blackrock, which manages after about 10 billions of dollars of active ingredients for investors, directed the Wall Street campaign to put on the market a bitcoin bitcoin spot long awaited in 2023, with a fleet of funds starting in January 2024 which now contain 1.4 million bitcoin worth $ 152 billion.

The BlackRock Fund alone holds around 3% of the 21 million bitcoin that will ever exist, worth almost $ 75 billion at the cost of current bitcoin, which some have warned could give excessive control on the BlackRock network.

Meanwhile, the combined price of the price of bitcoin and cryptography is on the verge of a “turning point” because it reaches 3.4 billions of dollars, according to an analyst.

“The fork of 3.4 Billions at 3.55 Billions is a turning point, which activated the sellers and prevented the market from consolidating itself higher,” said Alex Kuptsikevich, chief analyst of the FXPro market, in the comments sent by e-mail.

“Since the end of Wednesday, Bitcoin has tested the $ 108,000 mark, but she will sell when she touches this level. Over the past two days, we have seen a fluid but regular intra -day trend, accompanied by heavy purchases from medium -term and long -term investors. week.”