- Hype has overcome a major level of resistance in the past 24 hours, but has more obstacles to come.

- The hyperliquid has dominated several chain measures, including TVL growth, costs and perpetual volume.

The hyperliquid (hype) has experienced a significant rise in the past 24 hours, earning more than 16%. This continues its weekly gain of 14.29%.

According to the Ambcrypto analysis, despite the current obstacles in place, the beateering has a high probability of hitting a new high market while feeling is starting to turn in favor of the Bulls.

Obstacles to come for media threshing: where then?

The significant hype rally in the last 24 hours came after breaking a major level of resistance marked by a level of fibonacci on the graph at $ 25.08, the price now heading for its January summit at 27.05 $.

If the momentum of the current market is durable, then the media threshing would probably cross its monthly summit while heading towards higher levels.

However, he would face a certain resistance on the graph, in particular at $ 27.115, $ 29.148 and $ 32,043, because he gathers.

Assuming that the trend remains optimistic, these levels would be minor retraction points before a continuous rise.

Source: tradingView

To determine whether the current feeling of the market supports media threshing establishing new vertices on the market, Ambcrypto has examined other measures, suggesting a high probability.

Liquidity influx and use increase

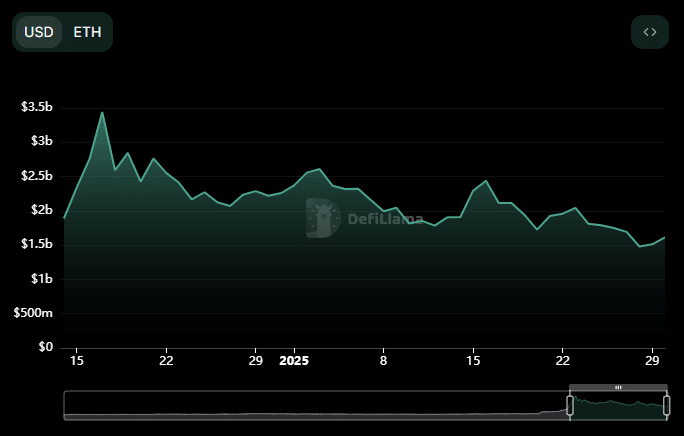

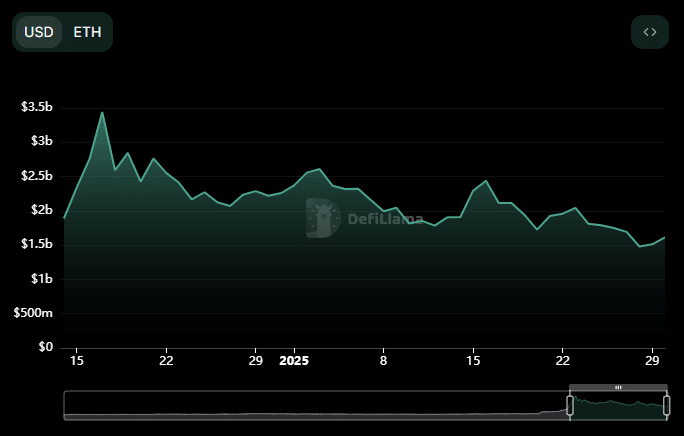

An overview of Defillama’s emissions, there was a constant drop in the total value of the threatened threshing (TVL) over the days, the establishment of low news and maintenance of this level.

TVL measures the liquidity flow in the protocols. It generally reflects the feeling of the market towards an asset. An increase in confidence in the TVL signal market, while decreasing indicates a potential decline.

In the last 48 hours, however, a directional change has occurred, and Hype TVL seeks to establish a new summit, now reaching $ 1.651 billion, against a hollow of $ 1.48 billion on January 28.

Source: Defillama

Likewise, there has been an increase in the costs generated in the last 24 hours, from $ 1.5 million to $ 2.0 million. When the costs increase, this indicates a high use of protocols in the ecosystem, whose media threshing now benefits.

Greater use tends to have a positive impact on the price of an asset and indicates that the potential of its increase is even higher.

Media is dominant

According to the classification by Artemis of the 10 main perpetual protocols on the market, the media threshing takes the lead, passing by the others.

Read the Prix for Hyperliquid Prices (Hype) 2025-2026

In the past seven days, total trading volume through these main perpetual protocols has reached $ 43.6 billion, with a hyperliquidal contributing to 56.0%, recording a commercial volume of 24.2 billion dollars during of this period.

If this volume of trading continued to rise in full swing, in parallel with transaction costs and TVL, the threshing media is well positioned for a continuous movement on the market and could potentially exceed the major obstacle marked on the graph.