Tether (USDT), one of the most popular stablecoins in the cryptocurrency world, is facing a great danger. The European MiCA (Markets in Crypto Assets) regulation is making things difficult. These new rules could have a serious impact on Tether’s operations in Europe. Paolo Ardoino, CEO of Tether and CTO of Bitfinex, explains that MiCA imposes strict limits on the volume and issuance of stablecoins. It also requires that 60% of stablecoin reserves be held in cash deposits in banks. The problem? These cash deposits are not insured beyond €100,000. This could lead to massive bank runs, causing instability for both stablecoins and traditional banks.

A symptom of the failure of national economies

In an interview with Cointelegraph, Ardoino shared his thoughts. He said that the success of USDT shows the failures of many national economies. Tether offers people an alternative when their economies are struggling. Take Japan, for example. The country’s stock market is crashing and the yen is unstable. Governments and central banks are printing too much money. This has led to economic instability. This is why more and more people are turning to cryptocurrencies and stablecoins like USDT.

Tether’s Compliance Strategy and Efforts

Despite the challenges, Tether is not backing down. The company is actively talking to European regulators to amend these new regulations. Ardoino stressed that Tether is not alone in facing these challenges; even its major competitors are concerned about the same issues. Ardoino hopes that through these discussions, they will be able to develop a regulatory framework that is both safe and practical. In the meantime, they plan to grow their Tether team to 200 employees by the middle of next year. The main focus will be on strengthening its compliance team. This move reflects the seriousness with which they tackle any issues related to illicit activities involving its stablecoin.

Achievements and future prospects

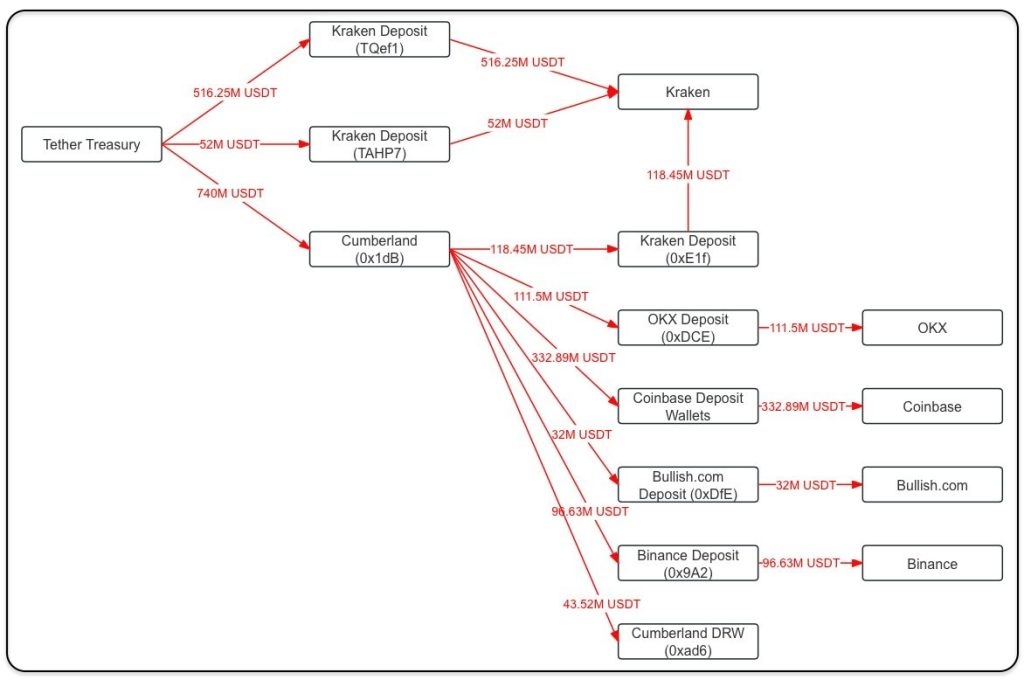

Despite all these challenges, Tether is making impressive progress. USDT recently hit a historic milestone by surpassing $115 billion in circulating supply. Last week, its market cap jumped by over $1 billion. This happened at the same time that Bitcoin’s price soared to $62,000. According to Lookonchain, $1.3 billion worth of USDT has been transferred to major exchanges like Kraken, OKX, and Coinbase. This surge has helped USDT cement its place as the dominant player in the stablecoin market, now holding about 70% of the market share.

According to Tether’s transparency page, over 50% of its supply is on Tron. About 41% is on Ethereum. Tether also reported record profits of $5.2 billion in the first half of 2024. This is impressive, especially considering that Tether has a smaller workforce than other tech and crypto giants.

Tether is promoting blockchain education. The company has partnered with the Africa Blockchain Institute. This collaboration aims to train students from five universities in Côte d’Ivoire on blockchain technology. This also includes teaching related to cryptocurrencies, smart contracts, DeFi, and industrial applications.

Conclusion: Meeting the challenges and celebrating the victories

The new MiCA regulations pose big challenges for Tether and the stablecoin market. The strict rules regarding reserve requirements could increase risks and make the future of USDT in Europe a little unstable. But despite these obstacles, Tether has shown that it is tough and determined to move forward. The company’s achievements speak volumes about its resilience and willingness to innovate. As the crypto world faces these changes, it is important that companies and regulators continue to engage in dialogue. Watching how Tether handles these regulatory issues will be essential for anyone investing in the crypto scene.

Also read: Gemini and Coinbase clash with CFTC over 2024 presidential betting ban!