- Bitcoin’s rainbow table has shown that the recent Bengarme was an opportunity to buy, even if fear was prevailing.

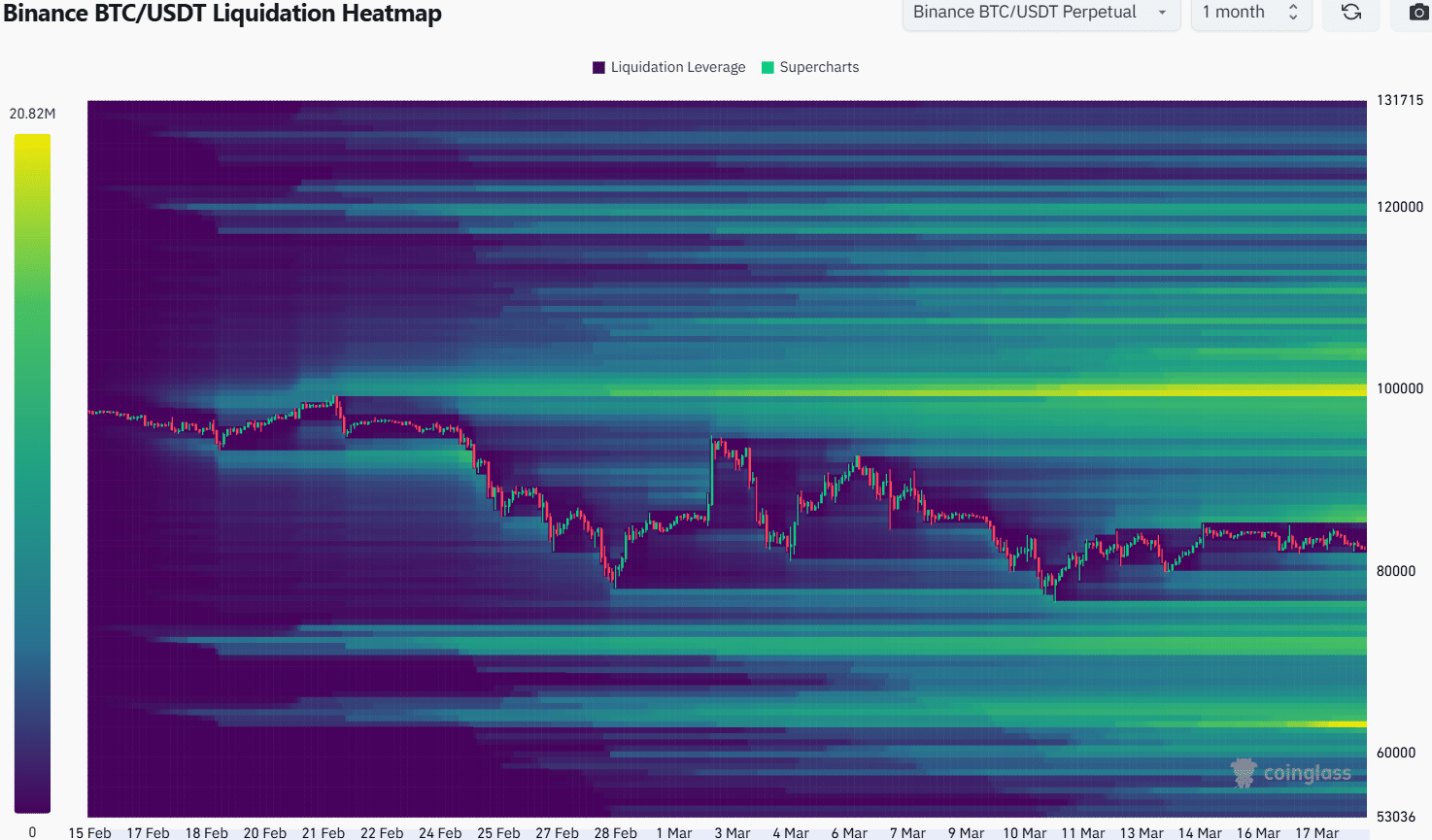

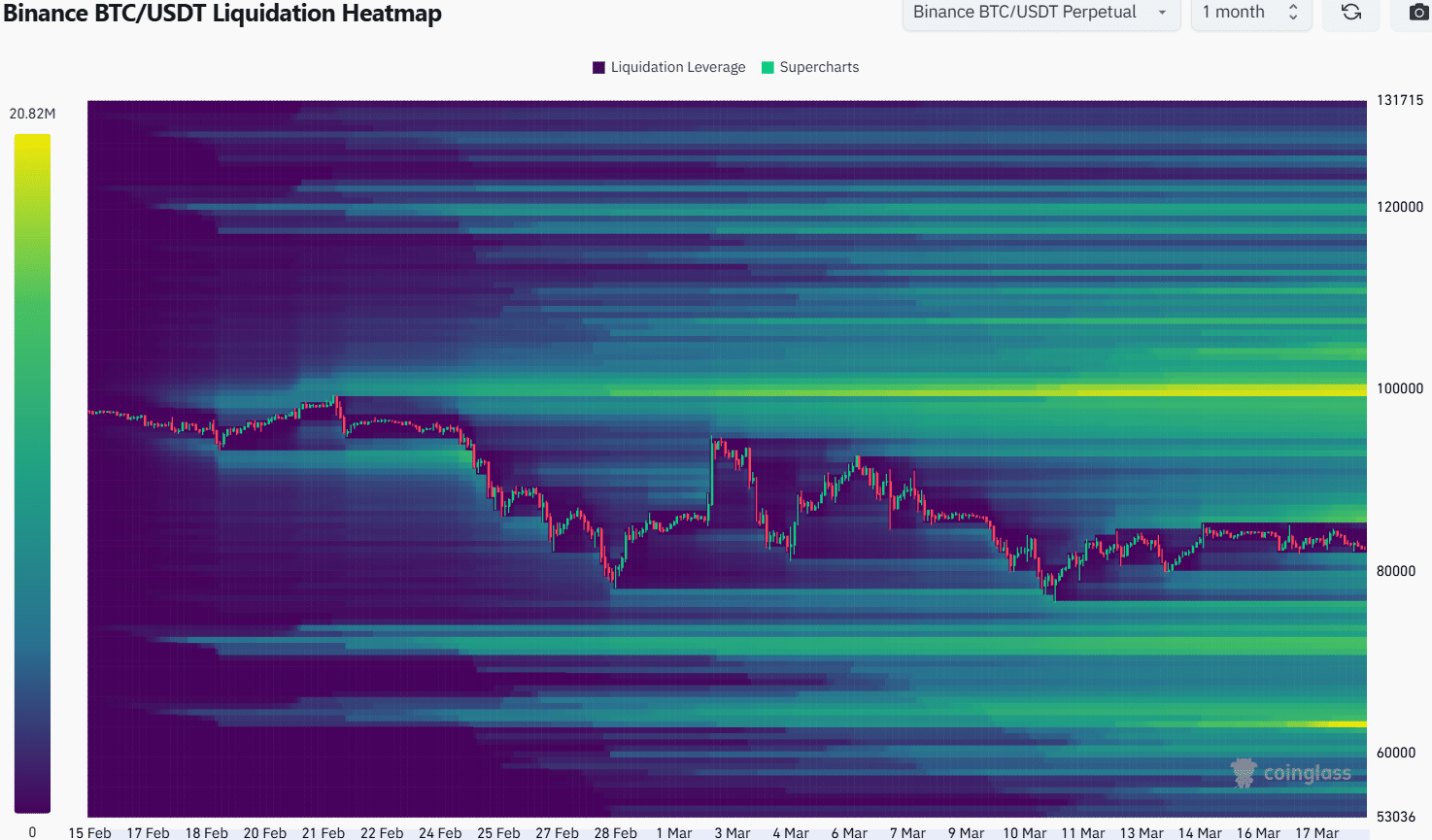

- The thermal liquidation cards have indicated a price rebound at $ 86.3K in the coming days.

Bitcoin (BTC) saw a price of 6.89% rebound compared to the price of the day’s negotiation session in March, ending $ 78.6,000. He has already encountered significant resistance in the region of $ 84,000.

Analysis of the price and liquidation levels showed that short -term consolidation was likely.

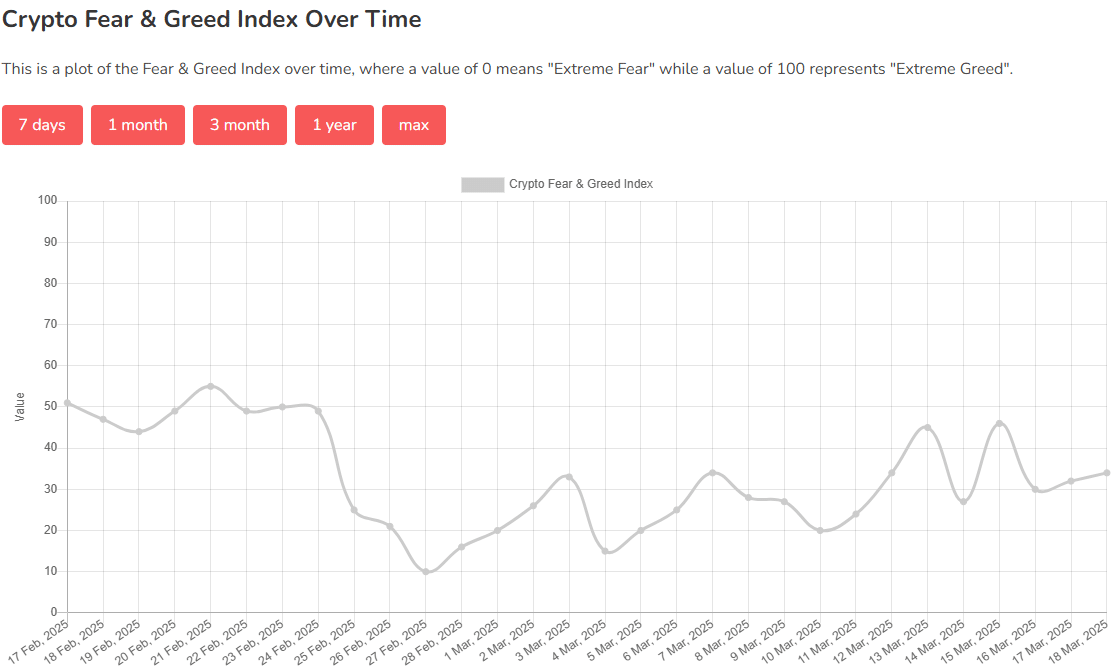

Source: alternative.me

The Bitcoin Fear and Greed index was 34 years old, showing fear. During last week, he oscillated around 30 to 40 years old, plunging to an extreme fear and a value of 24 on March 11.

The FNB Bitcoin Spot have seen outings of $ 900 million in the past five weeks, highlighting the feeling of the lower market.

Buy bitcoin while fear enters the wider market

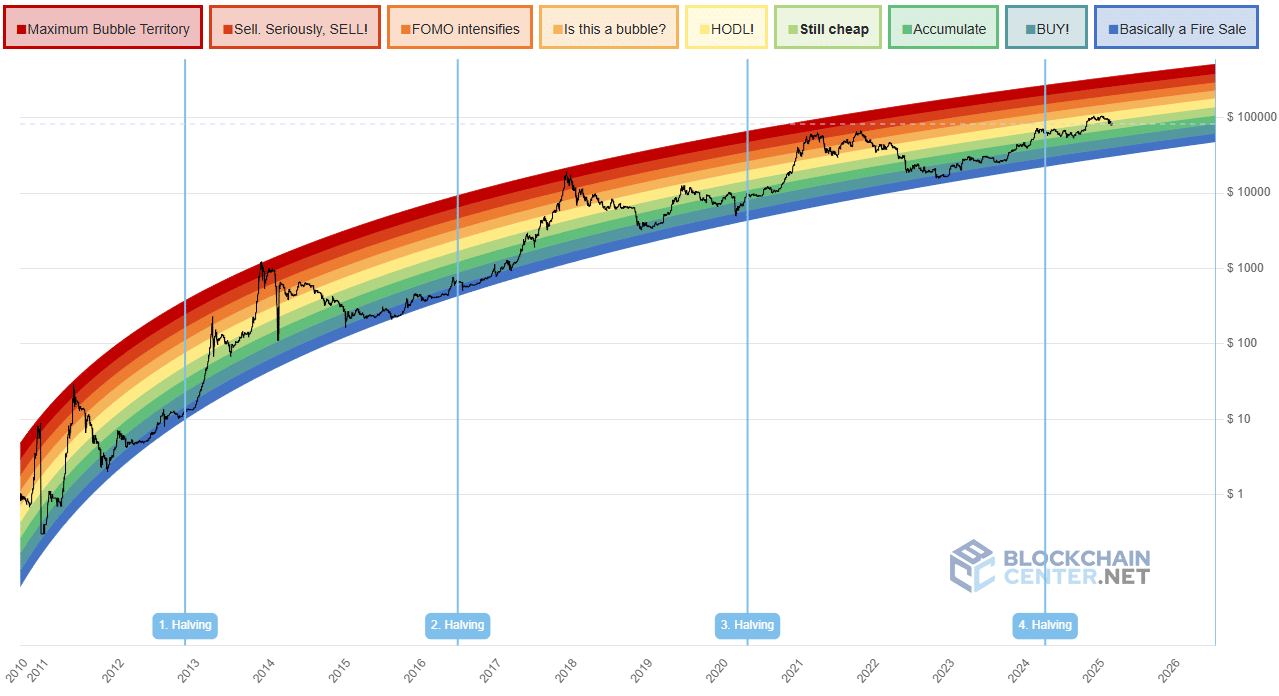

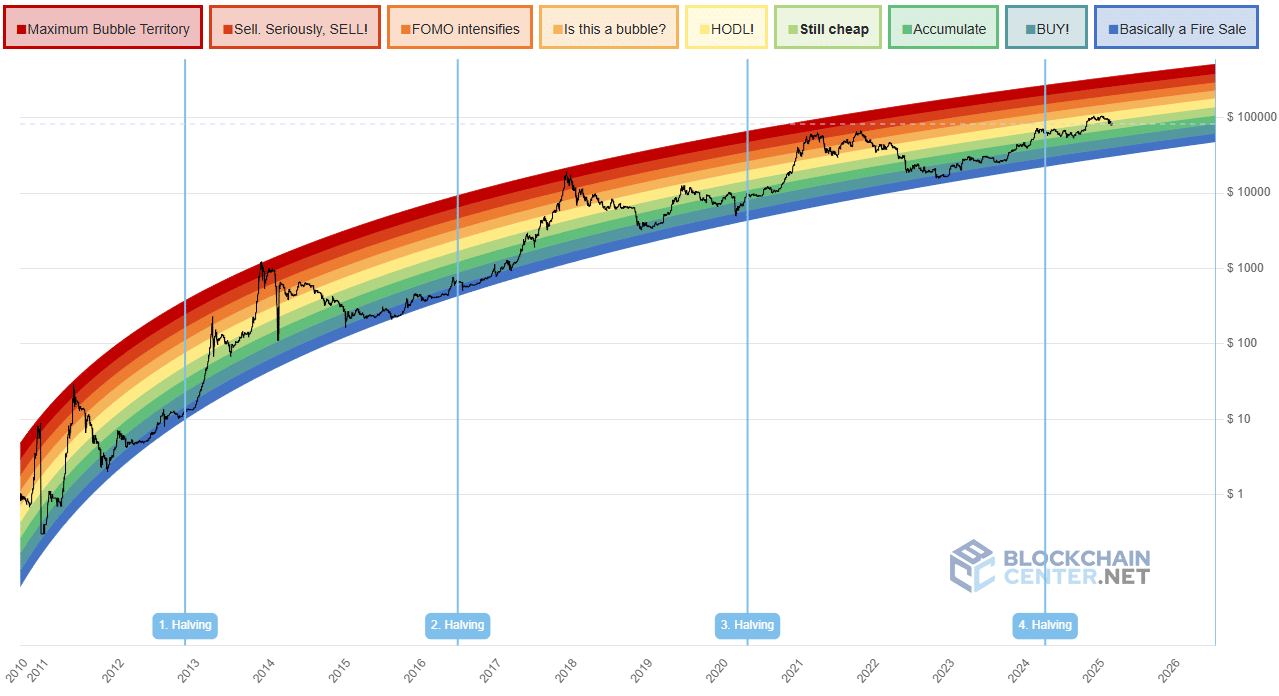

Source: Blockchain Center

At least it was the message from the Bitcoin rainbow table. The long -term evaluation tool for Bitcoin with fun colors can be useful for investors. It is based on the idea that Bitcoin price growth follows a logarithmic model over time.

The graph has done a good work of identifying the top and the bottom of the cycle, but it should be noted that it was done mainly with hindsight. Currently, the Bitcoin rainbow board shows that the largest crypto was “always cheap”.

At $ 82,000, it was a fairly large complaint, especially in the background of the stock markets around the world. Again, this could be the call for investors – the risk of reward was always attractive.

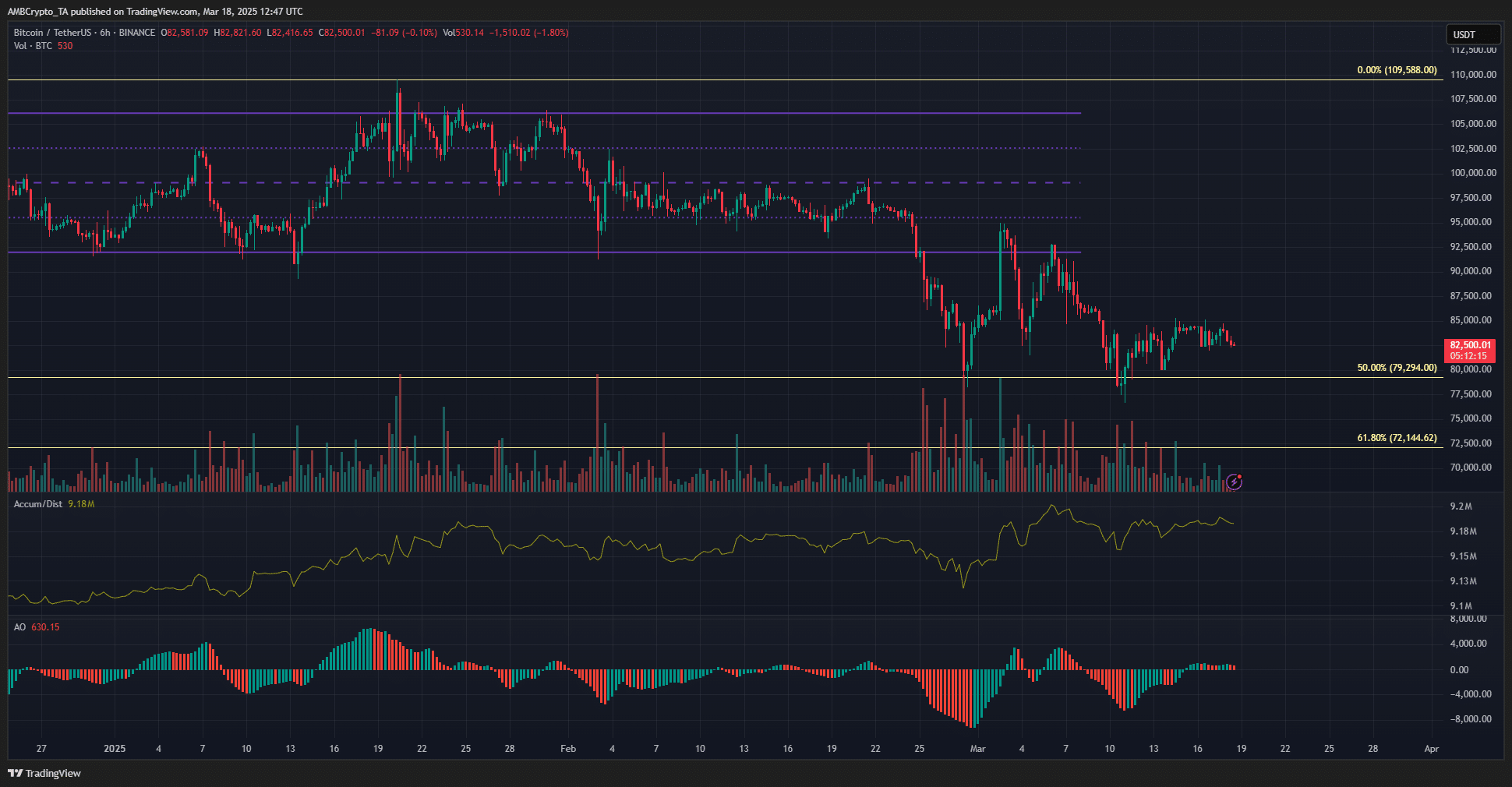

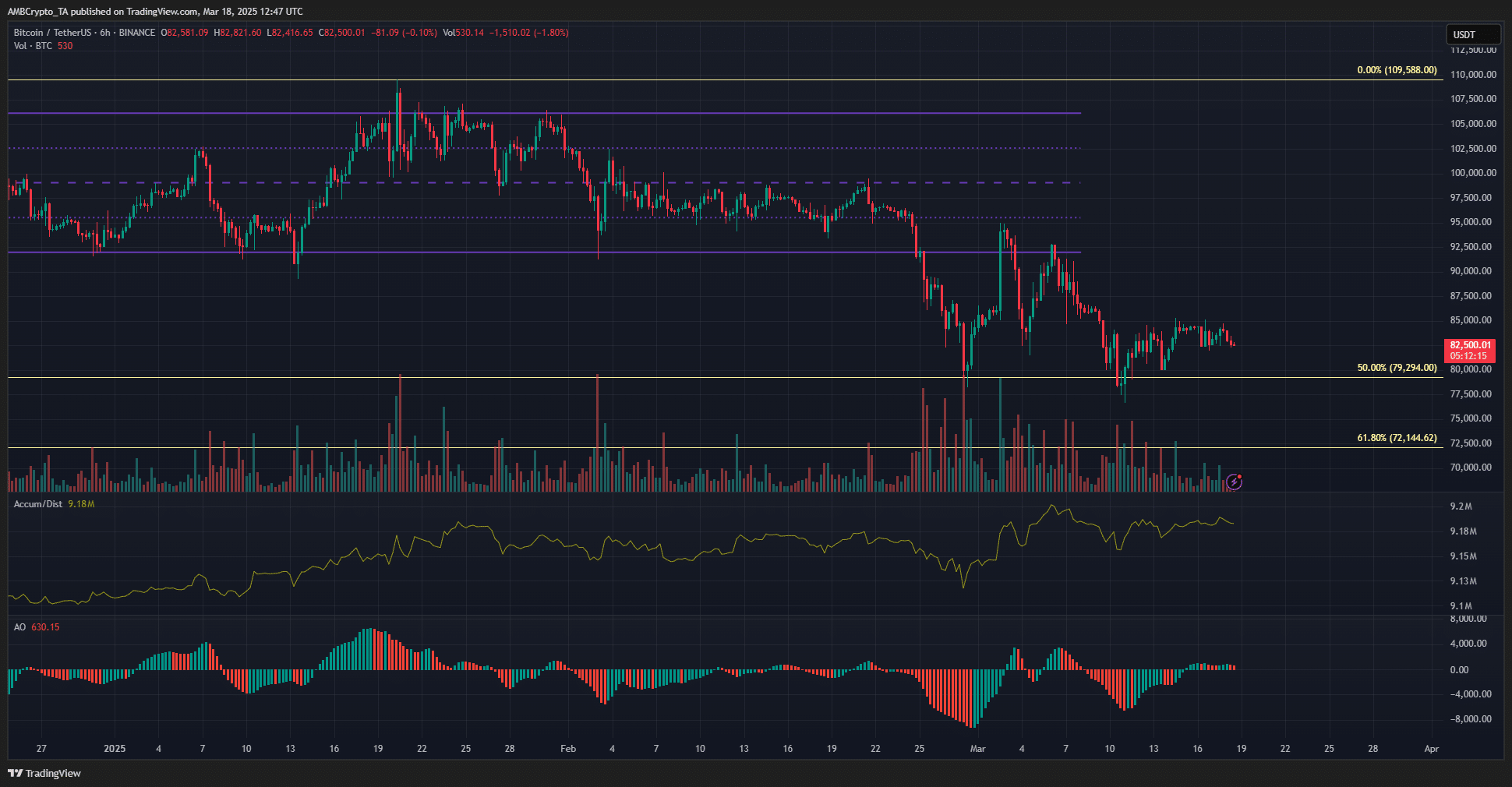

Source: BTC / USDT on tradingView

Examination of the 6 -hour graph has shown that the short -term structure was lower. The level of $ 85,000 served as resistance in last week. The A / D indicator has shown an upward trend in March, while the price tends to $ 80,000.

It was an encouraging discovery. He showed an increased accumulation and a purchase activity was increasing, according to the indicator.

The impressive oscillator showed momentum was slightly optimistic, but not high enough to drive trends.

Source: Coringlass

The one month’s thermal liquidation card described $ 100,000 and $ 71.7,000 to $ 72.3K in significant liquidity clusters. Closer to the price, $ 86.3,000 and $ 76.3K were also levels that could attract prices to them.

Given the downward structure of BTC, a movement towards the south has appeared probable. However, the A / D indicator has shown that a rebound was possible.

In addition, such a rebound beyond the local resistance at $ 85,000 could return the participants to the optimistic market, before the lowering overthrow was launched in the magnetic zone of $ 86.3,000.

Consequently, traders should maintain a downward perspective until the local resistance regions are raped.

Notice of non-responsibility: The information presented does not constitute financial investments, exchanges or other types of advice and is only the opinion of the writer