Can striking parallels can be found between Tradfi and Defi – can this be used to predict the market?

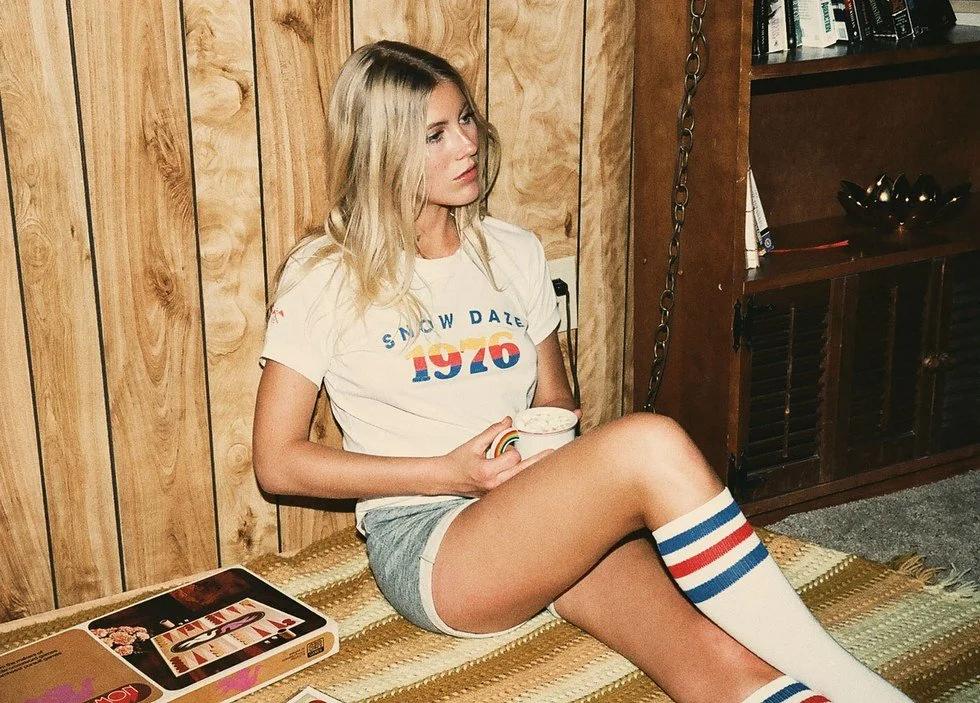

Decentralized finance (DEFI) does not only revive another financial market; Instead, he follows a game book written centuries ago by traditional finance (tradfi). In our latest blog article, “Stuck in the 1970s”, we revealed a striking truth: the evolution of Defi reflected so closely the historic stages of Tradfi that it served as a crystal ball to predict its future. We argued that DEFI entered a phase similar to the 1970s in Tradfi, a pivot era of conformity, liquidity and trust infrastructure. This parallel offered a roadmap for the next breakthroughs of Defi, assets of the real world tokenized with decentralized performance and stablecoin strategies, while sailing on regulatory mounting pressure.

We have highlighted striking parallels between Tradfi and Defi. From coins from Mesopotamia to Bitcoin’s digital currency (2009), medieval tickets to Makerdao (2018) and UNISWAP markets (2018) and UNISWAP (2021), each financial primitive was emerged in the same logical sequence, motivated by the need. The secure guard and the integration of Defi de Fireblocks (2021) echoed the assets of the Central Bank of Tradfi in the years 1600 – 1800, while the derivatives of Synthetix (2021) reflected the future of the 1900s. Insurance followed: Lloyd’s of London, formed in 1688, found his counterpart in Nexus Mutual, which reached $ 1 billion TVL dollars in 2021. The silver market funds of Ondo and Ethena (2024) echoed retail liquidity in the mid -20th century. Subsequent additions such as fiery objects, allowing institutional institutional access, are perfectly written in this model, strengthening its precision. As we have noted, quoting Morpheus to The matrix“What happened, happened and could not have happened differently,” testimony to the deterministic nature of the crypto trip.

DEFI was held at a style inflection point from the 1970s. We drew a convincing analogy: just like the Eurodollar market in the 1960s fueled global finance with slightly regulated offshore liquidity, the “defidollars” of DEFI, the stablecoins carrying the yield, led the lever and decentralized growth. But with great power was an excellent meticulous exam. The 1970s saw the Bank Secrecy Act (BSA) limit financial crime and tax evasion, restoring confidence in banking services. DEFI was faced with similar pressures, with exploits of intelligent contracts and highly publicized crimes, such as recent kidnappings linked to crypto, echoing the concerns focused on the mafia of Tradfi’s past. We have underlined imminent regulations, such as the Crypto-Asset Reporting framework (CARF) set for 2026, which reflected tax transparency disks of the 1970s and would oblige to adopt indigenous compliance and identity solutions.

The time of the 1970s of Defi was a springboard, not a ceiling. By adopting the infrastructure of conformity and confidence, DEFI could transcend its speculative roots and its rival global markets. Imagine tokenized real estate accessible to retail investors or decentralized loans for small businesses, all guaranteed by verified identities. Defidollars fueled a parallel and DEFI financing system did not just follow Tradfi. He built a financial network for billions, where the tools of trust and conformity showed a system ready on a scale. Was Defi about to meet Gordon Gekko and Ur in the 1980s?