- The XRP price is more than 3% withdrawn from the market -scale correction led by Bitcoin.

- The drop in the market for open derivative derivatives to 3.84 billion dollars in signals decrease confidence in the upward trend of XRP

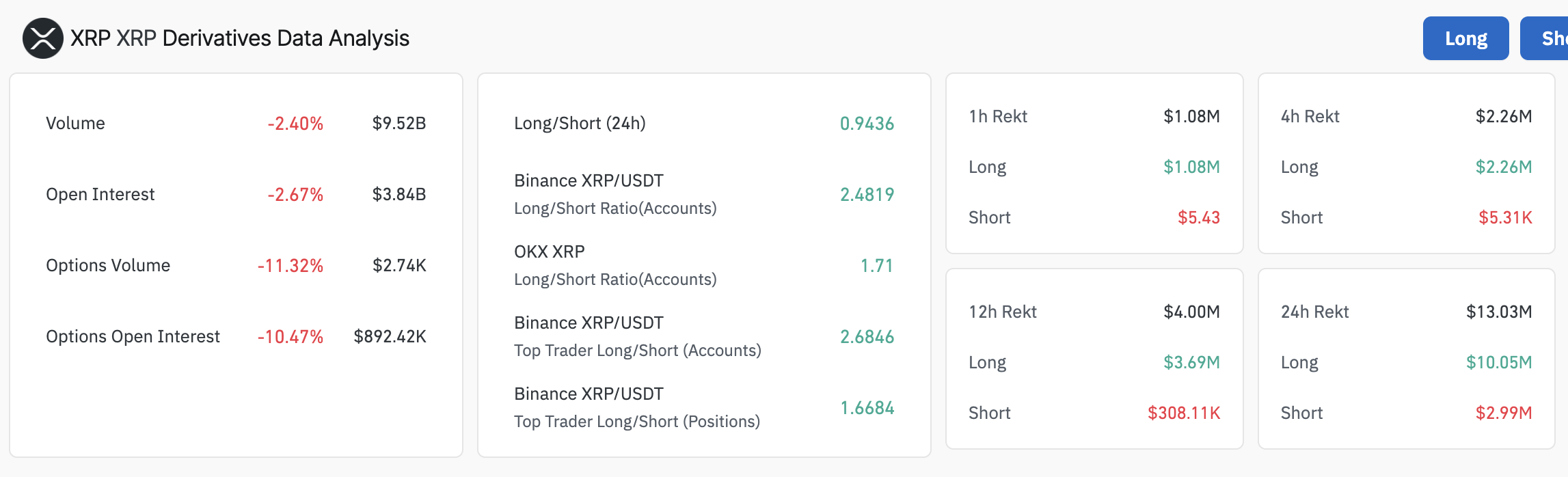

- In the past 24 hours, long -standing liquidations have exceeded $ 10 million, compared to almost $ 3 million in short positions.

The Prix de Ripple (XRP) Reverse the gains when writing the time of writing of the time of the generalized recovery on the cryptocurrency market on Wednesday. XRP jumped alongside Bitcoin (BTC), reaching a daily top of $ 2.30 on Wednesday, while investors reacted positively to the more conciliatory position of the United States (United States) Donald Trump president of the president of the Federal Reserve (Fed) Jerome Powell and China. The United States is optimistic that it will soon resolve trade and price confrontation with China, referring to the potential relaxation of prices before a complete agreement in two years.

The XRP price retains short -term support as liquidations increase

The XRP price oscillates $ 2.14 at the time of writing the editorial’s moment, reflecting the lowering feeling on the wider market of cryptocurrencies. According to data from the quince derivative market, the open interest XRP (OI) decreased by 2.67% to 3.84 billion dollars in the last 24 hours. This disadvantage in the XRP price sparked liquidations on the last day, where long positions valued at $ 10.05 million was forcibly closed, compared to around 3 million dollars in short positions.

The drop in XRP OI derivatives reflects a significant drop in the confidence of traders, which could lead to a reduction in market participation. In addition to the liquidation of long positions, these reflections are increased sales pressure, because bullish merchants are ejected with market force.

XRP derivative data | Source: Coringlass

The 24 -hour / short ratio of 0.9436, combined with a 2.4% drop in the negotiation volume to $ 9.52 billion, suggests market activity. The XRP price could cope with an increase in downward pressure, potentially below key support areas and accelerating its short -term decline.

Is the XRP price draw temporary?

The XRP price hovers near the exponential mobile average (EMA) at $ 2.14 after testing the immediate support at $ 2.11 provided by the 50 EMA on the table 8 hours below. This follows a reversal of the Wednesday summit of $ 2.30.

The position of the relative resistance index (RSI) at 52.42, as the midline approaches, strengthens the lowering feeling. Beyond the EMA 50 support, the next critical level for XRP is $ 2.00, an important anchor since March. The bottom of April, about $ 1.62, is another level to keep in mind in the coming days and weeks.

XRP / USD 8 hours

If the XRP price faces the current challenges and reverses the upward trend, a reverse head and shoulder model highlighted on the above graph could return in sight, projecting an increase of 26% to $ 2.74. This target is determined by measuring the distance between the dotted line and the lowest point of the head of the pattern, then extrapolating above the escape point.