As a new year approaches, the blockchain industry is poised for transformation. We look at three trends that are driving change and adoption.

As 2025 approaches, the cryptocurrency industry is poised for a major transformation. After a revolutionary year 2024 with the approval of spot Bitcoin ETFs in January, more substantial changes are on the horizon. These developments are reshaping investment strategies and attracting political attention.

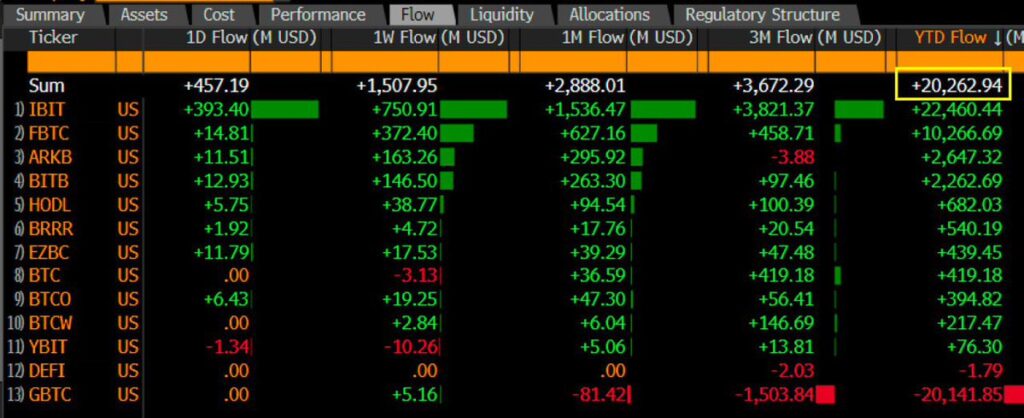

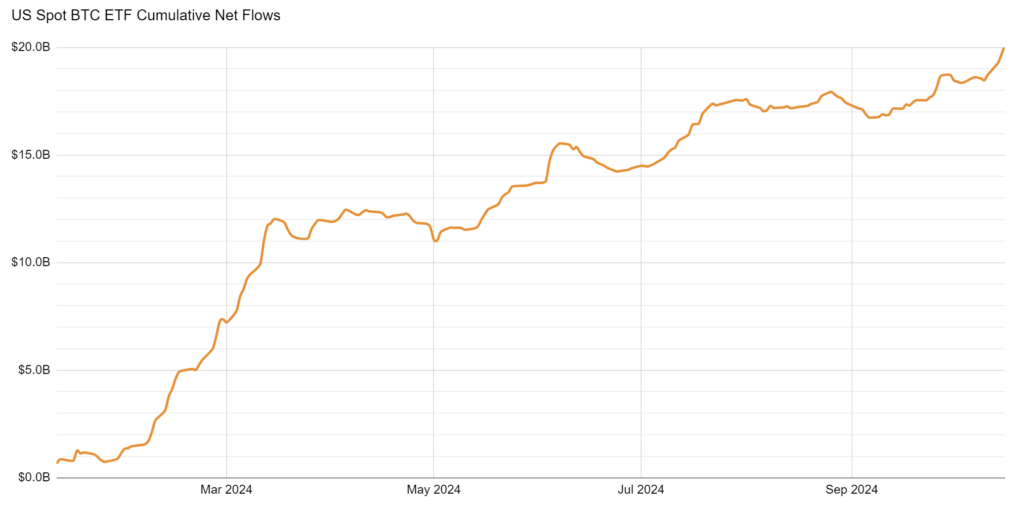

As January 2024 saw the introduction of spot bitcoin ETFsAccess to Bitcoin has become simple and regulated, bypassing the need for crypto trading brokers. The introduction of these ETFs raised more than $20 billion, exceeding expectations. Although there was a drop in August, the trend has since resumed, attracting a wide range of investors.

Cumulative net cash inflows Bitcoin ETF have exceeded 20 billion dollars since their launch. It took gold ETFs 5 years to reach this figure. This makes Bitcoin ETFs the most successful debut of any ETF in history.

Eric Balchunas, senior ETF analyst at Bloomberg, wrote on X that “Bitcoin ETFs crossed $20 billion in total net flows (the most unstoppable number, the hardest metric to develop in the ETF world) for the first time after a huge $1.5 billion week . As a reminder, it took gold ETFs about 5 years to reach the same figure. Total assets now stand at $65 billion, which is also a record.

Source:

Looking to 2025, momentum suggests more crypto ETFs will emerge. July introduction of Ethereum spot ETFshinting at future launches of other major cryptocurrencies like Solana and XRP. These assets, which have high market capitalization, are good candidates for inclusion in ETFs, further legitimizing the crypto market.

Bitwise filed for XRP ETF earlier this month.

US crypto regulations expected in 2025

The United States does not have a comprehensive set of crypto regulations, but it does. expected to change in 2025. Republicans and Democrats agree on the need for clear regulation, pushing for legislative reforms that could reshape crypto governance. Currently, the regulatory system, based on a 1946 Supreme Court case regarding Florida citrus groves, is outdated and unsuitable for modern financial tools like cryptocurrencies.

In response, new laws should provide clear guidelines for crypto regulation. There is an ongoing debate over whether the Securities and Exchange Commission (SEC) or the Commodity Futures Trading Commission (CFTC) should take the lead. Cryptocurrency supporters are also calling for a new leader at the SEC who supports cryptocurrency. These regulatory updates are essential to ensuring stability and clarity in the crypto market, as well as promoting growth and innovation.

Despite regulatory uncertainty, Coinbase Global advocates for fair and clear regulation, highlighting its conflicts with the SEC. The push for regulatory change is not just about governance; this is about ensuring that the crypto industry can thrive without being hampered by outdated rules that no longer apply to digital assets.

The role of Bitcoin in American economic strategy

Bitcoin is poised to become a key asset for the U.S. government in 2025. Calls for government support for the Bitcoin mining industry are growing, positioning Bitcoin as a tool to address national financial challenges. Some policymakers see Bitcoin as a potential solution to the $35 trillion national debt, suggesting its growth could outpace debt accumulation and help manage the debt burden.

Source: https://www.lummis.senate.gov/

U.S. Sen. Cynthia Lummis (R-Wyoming) introduced a bill for a strategic reserve of Bitcoin. The proposal involves purchasing one million BTC over several years, creating a reserve that could be used to pay down the national debt. This initiative highlights the growing connection between cryptocurrencies and national economic strategies, reflecting the growing legitimacy of Bitcoin.

Lummis speaks out in favor of a strategic Bitcoin reserve at Bitcoin 2024, via

The political landscape will strongly influence these developments. The potential re-election of Donald Trump, who declared himself the first pro-Bitcoin presidentcould accelerate these changes. Trump’s vision of making America the “crypto capital of the planet” resonates with many investors, even as it raises concerns among others who are wary of rapid, large-scale adoption. For crypto enthusiasts, Trump’s stance represents important support that could spur more investment and innovation in the sector.

Upcoming strategic investment opportunities

Investors looking ahead to 2025 should rethink their portfolios to capitalize on the expected changes. Bitcoin is in the lead, holding more than half of the crypto market capitalization. Regulatory and policy changes primarily affect Bitcoin, making it the biggest beneficiary of upcoming developments. Diversifying into other major cryptocurrencies like Ethereum, Solana and XRP via new ETFs could also be profitable.

However, the broader effects of the new crypto laws remain unclear. Observe international trends, such as European Regulation on Crypto-Asset Markets (MiCA) from December 2024, offers valuable information. MiCA establishes a legal framework for crypto assets in the EU, potentially influencing US regulations. These global trends will likely shape the U.S. crypto scene, so investors should stay informed and flexible.

The result of the 2024 presidential election is another key factor that could impact the crypto market for years to come. A post-election rally, especially under a pro-crypto administration, could spur growth and integrate cryptocurrencies into traditional finance. Conversely, a different policy outcome could create new challenges and uncertainties.