Reason to trust

Strict editorial policy which focuses on precision, relevance and impartiality

Created by industry experts and meticulously revised

The highest standards in the declaration and publishing

Strict editorial policy which focuses on precision, relevance and impartiality

Morbi Pretium Leo and Nisl Aliquam Mollis. Quisque Arcu Lorem, quis pellentesque nec, ultlamcorper eu odio.

Este Artículo También is respondable in Español.

Channel data show that the biggest Bitcoin investors have continued to buy recently. Here is if the other cohorts followed or not the traces of these titans.

Medium -sized bitcoin holders can finally show a change

In a new article on X, the Glassnod chain analysis company discussed how the accumulation trend score has sought the different cohorts on the Bitcoin market.

The “accumulation trend score” is an indicator that tells us if Bitcoin investors participate in purchase or sale. The metric does not only check the balancing changes that occur in carriers’ wallets, but also the size of the assets themselves. This means that the indicator has a higher weight on the changes that involve major investors.

When metric has a value greater than 0.5, this means that large addresses (or a large number of small entities) participate in accumulation. The closer the metric is closer to brand 1, the stronger this behavior becomes.

Related reading

On the other hand, the indicator being less than 0.5 implies that holders participate in the distribution or simply do not make any accumulation. Here, the extreme point is at level 0.

In the context of the current subject, the score of tendency to accumulate the whole sector is not interesting, but rather that of each cohort of investors separately. There are different ways to classify holders, but the relevant here is based on the size of the wallet.

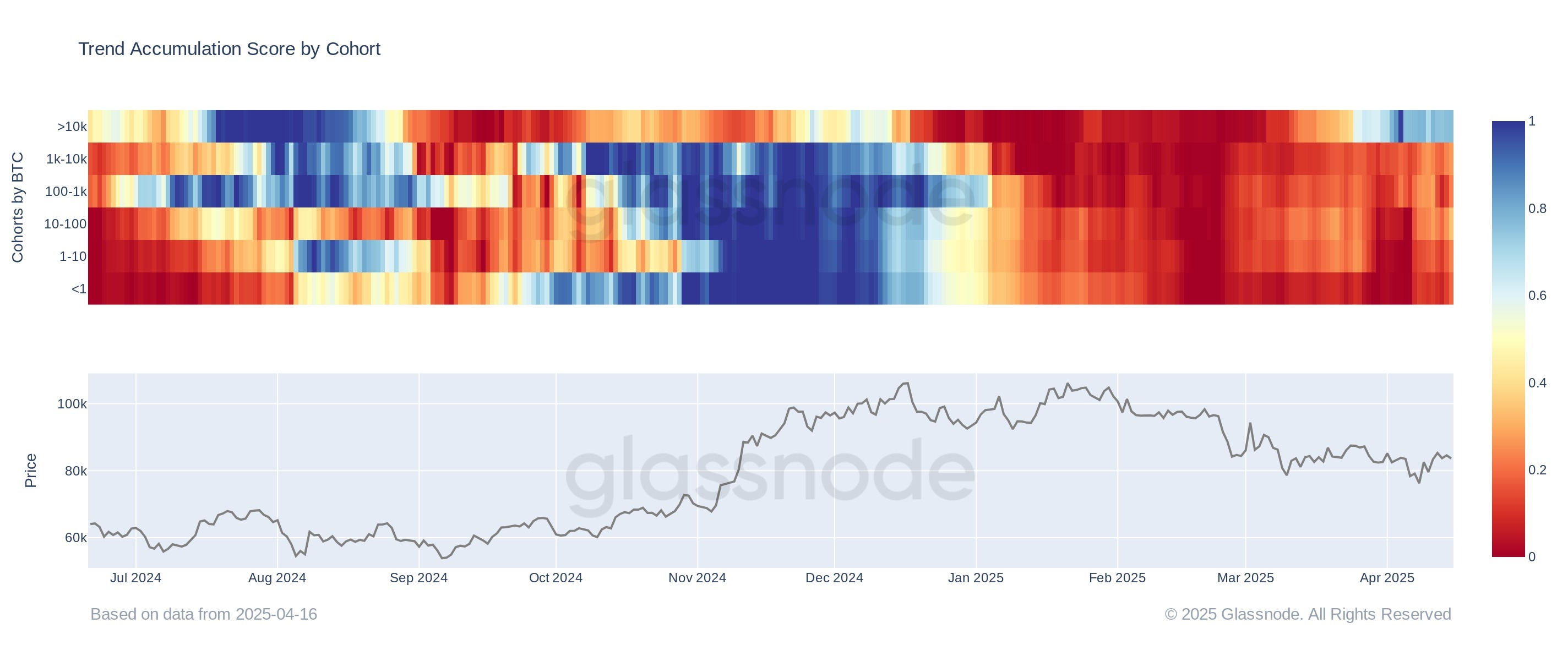

You will find below the graphic of the indicator shared by the analytical company which shows how the behavior has changed for the group holder groups in the past year.

As it is visible in the graph above, the Bitcoin accumulation trend score has taken a bright red shade for all cohorts in February, indicating a strong distribution on a market scale.

Since this sale, the value of the indicator has increased for the different cohorts, which implies that a sales time sales time has occurred. This recharge time has varied between groups, however, with a particular cohort diverging far from the others: the more than 10,000 BTC carriers.

Popularly, investors carrying between 1,000 and 10,000 BTC are known to whales, so that these holders, who are even more gigantic, could be called “mega whales”.

From the table, it is obvious that this group has taken the purchase in March and has since given its accumulation deepening while the score of the trend of Bitcoin accumulation reached a value of approximately 0.7.

The rest of the market also softened its distribution during this period, but none of them has yet moved into the accumulation territory. That said, the 10 to 100 BTC investors are close, the score now being seated at 0.5 for them. “This suggests a possible change in feeling of medium -sized holders,” notes Glassnode.

Related reading

It now remains to be seen whether the trend in the increase in the indicator would continue in the coming days and that the rest of the Bitcoin cohorts would catch up with mega whales or not.

BTC price

Bitcoin recently took the movement laterally because its price is still negotiated about $ 84,500.

Dall-E star image, Glassnode.com, tradingView.com graphic