Join our Telegram chain to stay informed of the latest news

The price of Bitcoin has slightly fell with a fraction of percent in the last 24 hours to exchange $ 123,748 to 4 h 29 hne, because Vaneck claims that the BTC could be worth less than gold by its next reduction in half, scheduled for 2028.

According to Mathew Sigel, manager of digital asset research at Vaneck, “we say that Bitcoin should reach half of the Gold market capitalization after the next reduction in half.”

The recent increase in gold prices would place Bitcoin at $ 644,000 in “equivalent value”.

The capacity of the king of cryptocurrencies has long been compared to that of gold. However, gold has outperformed the BTC so far this year, increasing by 50 % in a context of increasing uncertainty about political developments.

However, according to Sigel, young investors prefer Bitcoin as a value reserve.

“About half of the value of gold reflects its use as a reserve of value rather than industrial demand or jewelry, and surveys show that young consumers of emerging markets prefer more and more bitcoin for this role,” he said.

We say that Bitcoin should reach half of the Golden market capitalization after the next reduction in half. About half of the value of gold reflects its use as a reserve of value rather than industrial demand or jewelry, and surveys show that young consumers of emerging markets prefer more and more bitcoin …

– Matthew Sigel, recovering the CFA (@matthew_sigel) October 7, 2025

Institutions are embarking on Bitcoin while ETFs reach record levels

Sigel’s prediction intervenes in a context of strong interest in cashcoin in cash (negotiated funds on the stock market) based in the United States. These products yesterday recorded $ 1.18 billion entries in a single day, the second largest ever recorded, coinciding with the breakthrough of Bitcoin to a new historic summit.

Total of October ETF entries Now amounts to around $ 3.47 billion over only four days by scholarship.

Meanwhile, the BlackRock Ishares Bitcoin Trust (IBIT) has dominated the increase, attracting around $ 970 million in new capital. Since their beginnings, Bitcoin ETF have accumulated about 60 billion dollars in total entrances, highlighting increasing institutional confidence.

The Bitcoin ETF have reported about 60 billion dollars since their launch pic.twitter.com/uyjkhm5f8y

—James seyffart (@jseyff) October 6, 2025

BTC reached a new ATH on Monday, but is now down 2%. Can the price bounce back to reach the predicted levels by Sigel?

Bitcoin prices’ action shows a bullish prosecution in the ascending canal

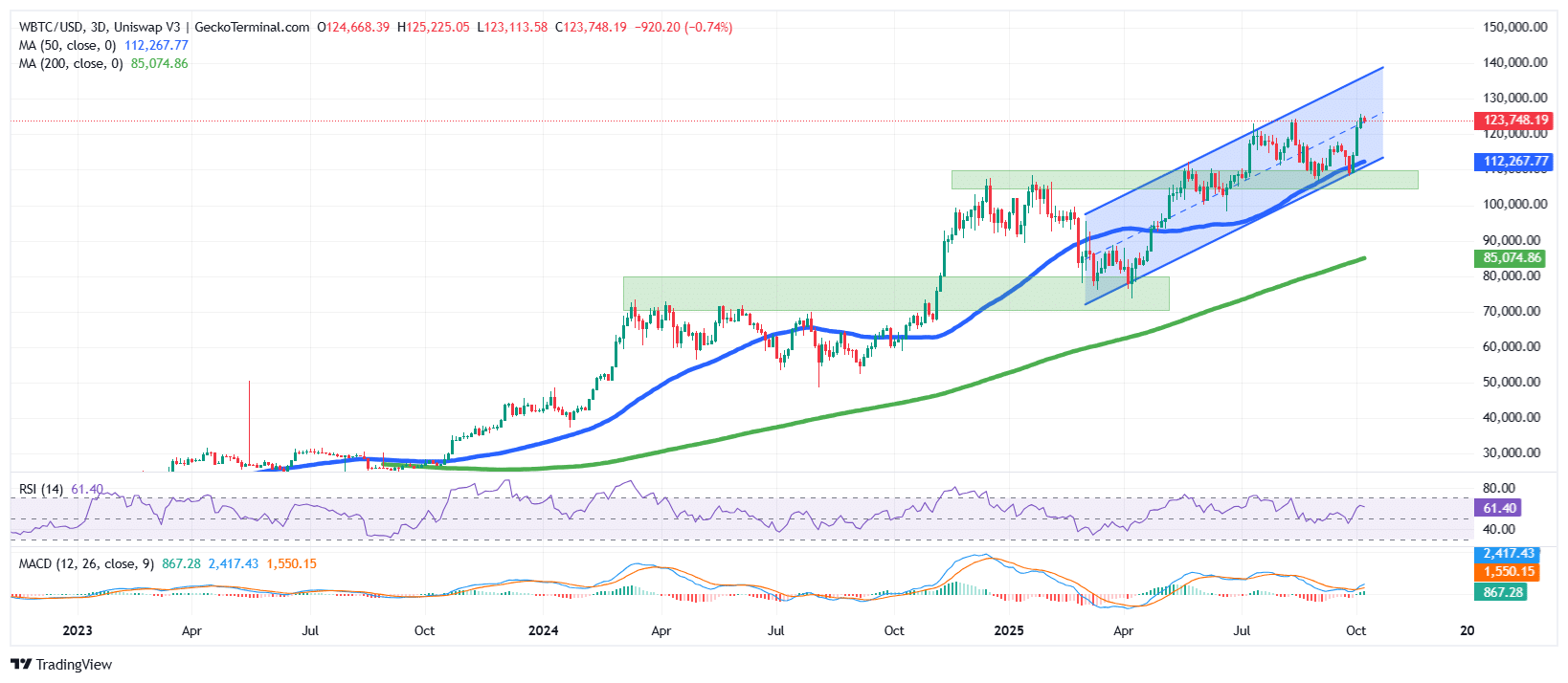

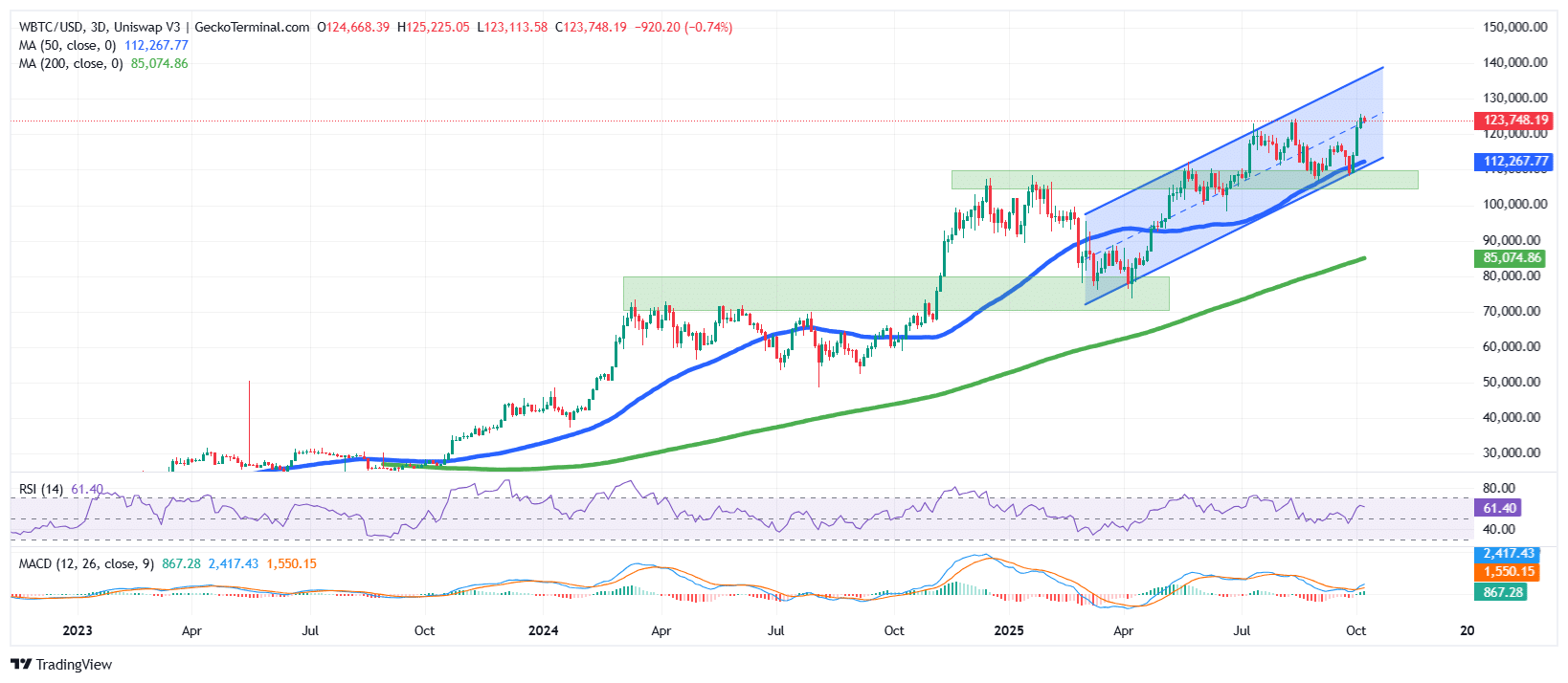

THE BTC price On the graph of 3 days reveals a strong upward structure which persisted throughout 2024 and until the end of 2025.

The evolution of bitcoin prices took place within the framework of an ascending canal model, marked by higher ups and stockings, which is the signal of a bullish trend.

After a brief period of consolidation close to the range of 90,000 to 100,000 dollars, buyers regained control, pushing the price of bitcoin above single mobile averages (SMA) of 50 and 200 on the graph at 3 days.

The 50 SMA (around $ 112,000) currently serves as a dynamic support, while the 200 SMA (almost $ 85,000) remains well below, confirming the strength of the long -term bull -up dynamics.

According to the graph, the old resistances have now turned into solid support levels, especially around $ 100,000.

Each withdrawal in these areas has come up against a new purchase pressure, which suggests that institutional demand continues to support the market.

BTC dynamics indicators report force but warn against short -term cooling

The graph’s dynamic indicators still strengthen the bullish feeling, although they suggest the possibility of short -term consolidation.

The relative force index (RSI) is around 61, comfortably above the bar neutral of 50 but still below the overcrowding threshold of 70. This suggests that even if the purchase pressure remains dominant, it is possible either from upward prosecution, or a brief break before the next break.

Meanwhile, the indicator of divergence of mobile average convergence (MacD) has an equally encouraging vision.

The MacD blue line has exceeded the orange signal line and the histogram shows a positive dynamic, a bull crossing that often precedes the price expansion phases.

If the structure of the channels is maintained, the price of the BTC could climb between 135,000 and $ 140,000 in the coming weeks, provided it maintains support over $ 112,000.

However, a decisive break below this level could open the door to a deeper correction to $ 100,000 before buyers returned.

Related news:

Best wallet – diversify your crypto wallet

- Easy to use cryptographic wallet focused on features

- Get early access to the next ICOs of tokens

- Multi-chaînes, multi-door, non-depositaries

- Now on App Store, Google Play

- Bet to win a native token $ Best

- More than 250,000 active users per month

Join our Telegram chain to stay informed of the latest news