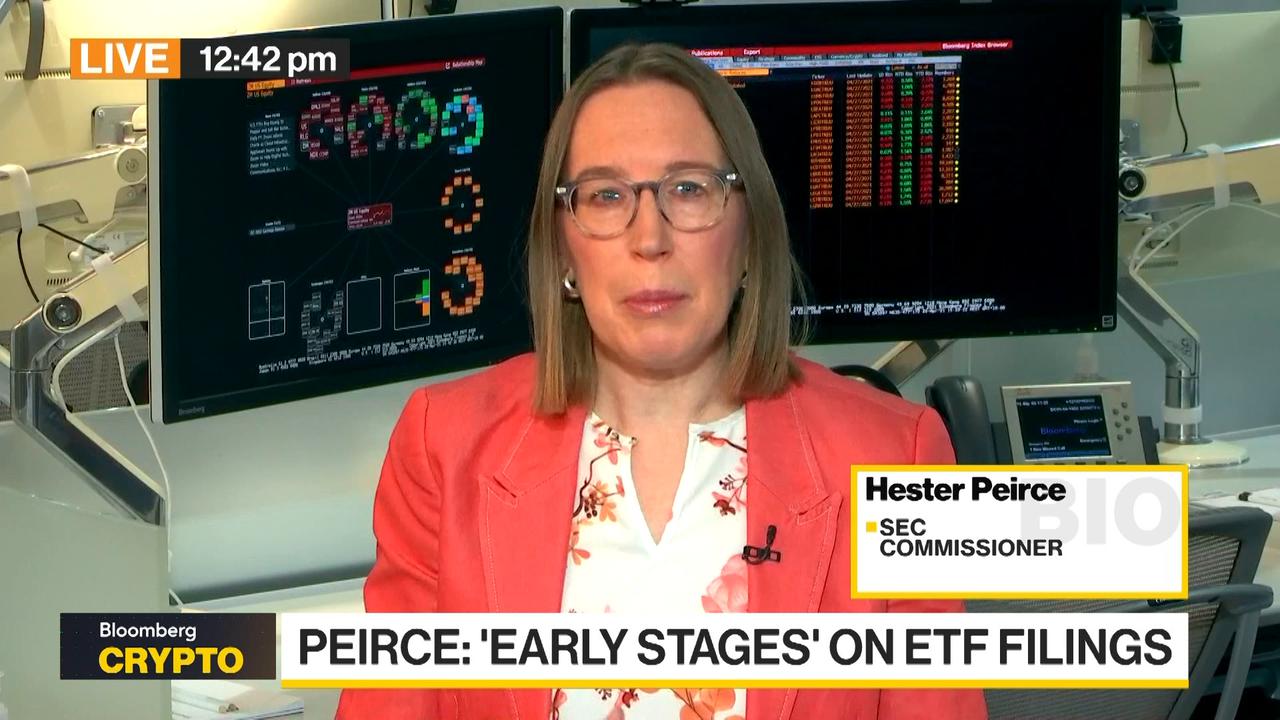

Most coins not under the jurisdiction of the dry: peirce

The chief of the dry crypto Task Force and the commissioner of the dry, Hester Peirce, gives him the vision of the pieces even and says that the dry will examine the facts and the circumstances, but says that most of the rooms even have probably no house on the current whole of regulations.

Bloomberg

In the past four months, XRP (Crypto: xrp) was easily one of the best interpreters on the cryptography market. During this period, XRP increased by 400% and recently negotiated about $ 2.50.

But the best may still be to come. XRP holders could soon obtain fantastic news on an important trial of the titles and exchange commission (sec) which has timed for more than four years now. If the case is finally rejected, XRP could set up.

The dry against Ripple

If you have not followed the long legal procedure traced involving XRP, Ripple (the company behind the XRP token) and the dry, consider yourself lucky. The case, which started in December 2020, took so many twists and turns that it was almost impossible to follow. Just when the case seems to be over, it stretches somehow even longer.

Basically, the trial comes down to a single question: is XRP a security or a commodity? And, believe it or not, to answer this question, the courts use a legal precedent (known as the test Howy) of a 1946 Supreme Court case involving a company selling orange groves in Florida. This could help explain why the case has dragged so long: if you think that comparing apples to oranges is difficult, what about comparing cryptos with oranges?

The good news is that it seems that a final decision arrives by April 16, which is the next audience date for the case. After more than four years of legal back and forth, we may have a final resolution. And there is nothing that the market loves better than certainty.

Factors in favor of XRP

Until now in 2025, the SEC has already rejected several high -level cryptography proceedings. But after having made a call in January, he was strangely silent on that involving Ripple.

Given the Clear-Crypto accent of the Trump administration, thought is now that, whatever happens, it will be in favor of XRP. As difficult as the dry has pressed on his case, he simply no longer holds the right cards.

Even if the dry finds a way to extend this affair beyond April, the Trump administration has several important levers which it can draw to end it once and for all. Some have hypothesized that Trump could send Elon Musk and Doge to examine the activity of the dry. Or it could encourage the Senate cryptography subcommittee recently formed to investigate the dry for regulatory overtaking. And if it doesn’t work, it could simply sign a decree.

What is the height of XRP?

The sky is the limit of the increase in XRP. In a better case which only involves the final resolution of the Dry Court case, XRP may recover its summit of $ 3.84.

But let’s think bigger. XRP could be included as part of the new Crypto strategic reserve proposed by the Trump administration, so it is easy to find price forecasts of up to $ 10 for XRP. In fact, some analysts think that XRP could possibly rise up that $ 100 as long as the entire cryptography market is increasing.

In addition, there is another factor that could send XRP above: the launch of a new fund negotiated on the stock market (ETF). The probability that XRP obtains an ETF Spot this year will be considerably improved if the regulatory cloud on Ripple and XRP are lifting. The launch of a new ETF Spot is essential because it ensures a new influx of investors’ money in XRP.

Currently, Bloomberg projects the probability of an ETF XRP spot at 65%. This was based on understanding that there is no way that the SEC approves an ETF if there are still problems with swirling regulation around XRP. So, if the case of the dry is resolved by April, it becomes very likely that an ETF spot could arrive later this year.

The end of the regulatory risk?

What you need to know as an investor is that a very large catalyst arrives in the next 45 days, and it makes XRP very attractive as an investment objective at the moment. So keep your powder dry. The lifting of regulatory clouds on cryptographic industry creates many new investment opportunities with significant increase potential.

Dominic Basulto has no position in any of the actions mentioned. The Motley Fool has positions and recommends XRP. The Motley Fool has a policy of disclosure.

The Motley Fool is a USA Today content partner offering financial news, analyzes and comments designed to help people take control of their financial life. Its content is produced independently of USA Today.

Should you invest $ 1,000 in XRP now?

Motley Fool offer: Before buying actions in XRP, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they believe to be the 10 best actions that investors can buy now … and XRP was not part of it. The 10 actions that cut could produce monster yields in the coming years.

Consider when Nvidia made this list on April 15, 2005 … If you have invested $ 1,000 at the time of our recommendation, you would have $ 690,624! *

Stock advisor Provides investors with an easy -to -follow plan to succeed, including advice on building a portfolio, regular updates of analysts and two new stock choices each month. THEStock advisorService has More than quadrupled The return of S&P 500 since 2002 *. Do not miss the last list of the 10 best, available when you joinStock advisor.

See the 10 actions “