Key notes

- Pump.fun exceeded the domination of LetsBonk, capturing 67% of daily launches against the presence of the market in narrowing of the rival.

- The pump -term volumes increased by 168% to $ 1.38 billion, exceeding the cashier capitalization in cash and indicating strong speculation.

- Technical analysis shows a gold crossing training with RSI at 62, suggesting a continuous bullish momentum around $ 0.0005.

Pump jumped 15% on Monday at $ 0.0004, evaluating the token at $ 1.3 billion, its highest level this month. This decision coincided with Pump.

For more than a year, Pump.fun had dominated the creation of coins on Solana. According to the dashboard of analyst Adam Tehc, this lead slipped in July while LetsBonk jumped to control up to 74% of daily launches. But Sunday, Pump’s share.

The commercial volume metrics reflected the change of domination between the two rival projects, with Pump.

The reversal prior week the unveiling of the complete glass foundation, an initiative of liquidity injection aimed at supporting the pieces of high potential and their communities. However, the new program has added momentum, attracting the renewed attention of users and investors.

Analysis of the pump chip derivative market | Rinsing

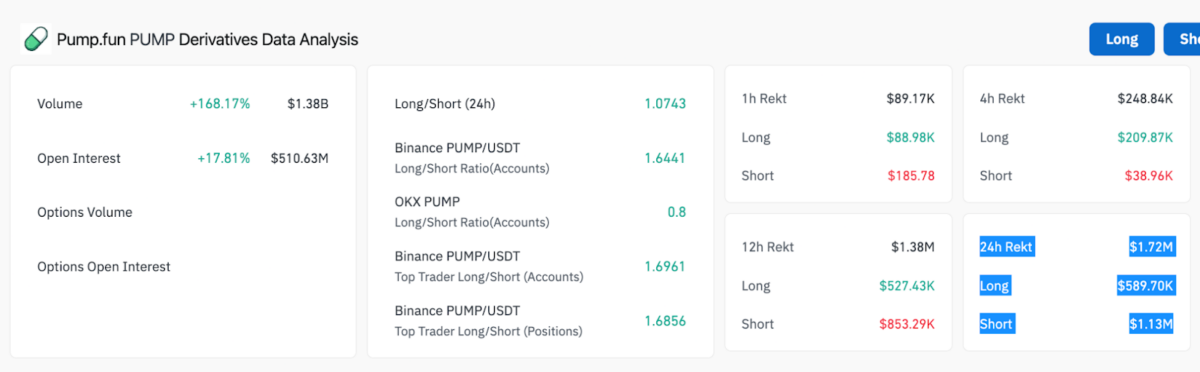

In derived markets, feeling seems even more aggressive. According to Coinglass, the volumes of negotiations on pump -term contracts jumped from 168.17% to $ 1.38 billion, exceeding market capitalization of $ 1.26 billion at the time of the press, indicating that the asset notes an unusually high speculative volume compared to its size.

Open interests increased by 17.81% to 510.63 million dollars on intrajurnal price gains, which suggests that traders are positioning to continue to increase. Liquidations totaled $ 1.72 million, with short films absorbing $ 1.13 million, more emphasis on bullish domination.

Pump price forecasts: Golden Cross Signals Momentum for $ 0.0005 Breakout

Despite an intraday already at 15%, the technical signals on the 4 -hour Pumpusd table reflect the continuation of the current rally. As shown below, a golden cross has been formed while the 5-day SMA exceeds 8 days and 13 days SMAS, a technical model often associated with sustained increase trends.

As we can see below, the price of the pump remains above the 5-day SMA despite a soft withdrawal on the 4-hour table, a sign that the rally is always intact.

Price of the pump part | 4 -hour Pumpusd technical analysis

The RSI has cooled from an intra -day summit of 70.2 to 62, driving out the surachat conditions without breaking the trend structure. The 13 -day SMA to 0.0033 $ 0.0033 offers immediate short -term support, while resistance nearly $ 0.0042 CAPS.

A decisive fence greater than 0.0042 could open a path to the withdrawal of $ 0.0048, while a rupture less than 0.00033 would drop to $ 0.0030. For the moment, given the active speculative interest in the pump token and the feeling of a positive macro-market, the momentum promotes bulls, with higher-term consolidation probably before the next higher leg.

following

Non-liability clause: Coinspeaker undertakes to provide impartial and transparent reports. This article aims to provide precise and timely information, but should not be considered as financial or investment advice. Since market conditions can change quickly, we encourage you to check the information for yourself and consult a professional before making decisions according to this content.

Ibrahim Ajibade is a seasoned research analyst with training by supporting various web3 and financial organizations. He obtained his undergraduate diploma in economics and is currently studying for a master’s degree in blockchain and distributed major book technologies at the University of Malta.

Ibrahim Ajibade on LinkedIn