The cryptography market is entering a new phase, many investors calling for a prolonged bull cycle that could reshape the coming months. While Bitcoin, Ethereum and the main altcoins continue to dominate the titles, the real pilots of this momentum seem to be stablecoins. These digital assets, often neglected in favor of more volatile tokens, quietly feed the liquidity engine on the market. According to Top Darkfost analyst, “it’s the stable season”, a sentence capturing the idea that unprecedented amounts of capital flow in the stablecoin supply.

This increase in stablecose demand signals a solid purchasing power awaiting discharge through exchanges, amplifying the potential for reducing risk assets. Stablecoins serve as the basis for cryptographic trading, providing liquidity which allows rapid movement between assets and acting as a measure of market confidence. Their increasing entrances suggest that investors are preparing for large -scale positioning, which could trigger stronger rallies in the sector.

While the market accumulates for this potential expansion focused on liquidity, the stabbed have become the unknown heroes of the bull cycle. They prepare the way to Bitcoin, Ethereum and Altcoins to capture the rise up, marking an important change in the dynamics of this evolving market.

Stablecoins point out that liquidity floods in cryptography

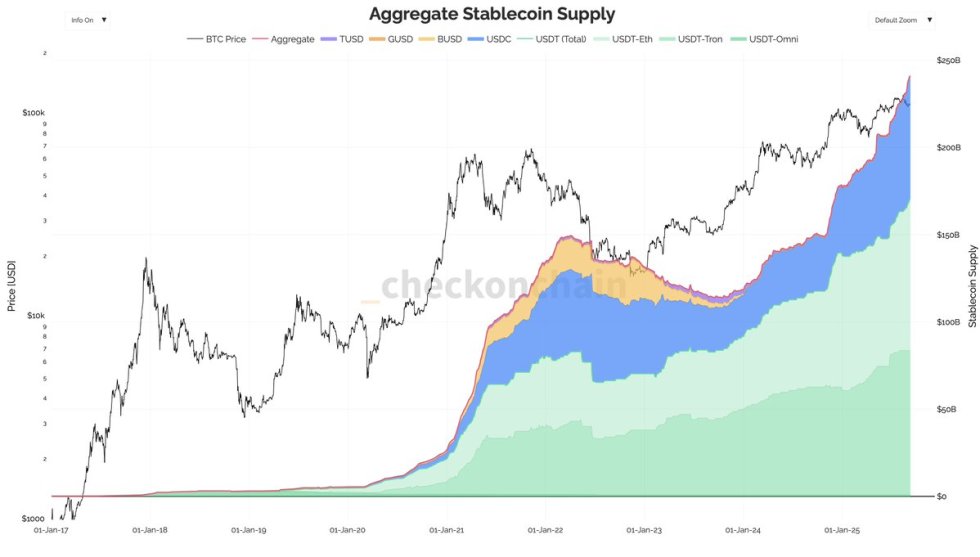

Darkfost recently shared information that highlights the critical role of stablecoins in the current market cycle. He explained that, reserving the rebalancing mechanisms, each Stablecoin struck represents a corresponding Fiat influx in the cryptographic ecosystem. This means that when investors convert dollars into stablescoins, the real liquidity between exchanges, ready to be deployed in Bitcoin, Ethereum or Altcoins. Conversely, when capital leaves the market, unused stablecoins are burned, reducing the offer and signaling decrease entries.

Currently, the total offer of Stablecoins is an impressive 240 billion dollars. However, this figure does not yet include some of the new participants in the sector, such as ENA, which already has a circulating offer of around 14 billion dollars. The growth of established and emerging stables shows how the demand for liquidity tools develops in parallel with a wider market participation.

Darkfost stresses that the stablecoin supply “literally explodes”, tirelessly climbing higher and showing little sign of slowdown. This acceleration indicates that capital takes place actively in the ecosystem, preparing the way for higher assessments between risk assets. For merchants and investors, it is a hinged indicator of the momentum, which suggests that the bull cycle can have deeper legs than previously expected.

After a year marked by volatility and changing stories, the relentless increase in the stabling issue underlines a market entering a decisive phase. Liquidity, more than feeling or speculation, is fuel behind the lasting rallies.

The stablecoins developing at a record rate, Crypto appears prepared for another wave, supported by a base of fresh capital waiting to deploy. This dynamic makes stablecoins not only a utility, but also the clearest signal of the market management towards the next stage of the cycle.

Market size and growth analysis

The total market capitalization of cryptography is currently 3.85 billions of dollars, reflecting resilience after a volatile section. The graph shows a strong resumption of previous declines this year, the prices consolidating just below the psychological barrier of 4 dollars. This level turns out to be a key resistance area, because several higher breakdown attempts have been greeted by a sale pressure.

The 50 -week simple mobile average (SMA) is up to around 3.16 billions of dollars, offering a solid support base. Meanwhile, the SMA from 100 weeks to 2.58 billions of dollars and the 200 -week SMA at 1.92 Billion of dollars remain well below current levels, confirming that the wider structure remains firmly optimistic. As long as the market is above these long-term averages, the downward risks appear contained, with corrections likely to be considered as accumulation opportunities.

A movement supported above 4 dollars would mark a significant escape, potentially opening the door to fresh summits and extending the current bull cycle. Conversely, the fact of not recovering this level could see the market to consolidate between 3.5 billions of dollars and 3.9 billions of short -term dollars.

Dall-e star image, tradingview graphic

Editorial process Because the bitcoinist is centered on the supply of in -depth, precise and impartial content. We confirm strict supply standards, and each page undergoes a diligent review by our team of high -level technology experts and experienced editors. This process guarantees the integrity, relevance and value of our content for our readers.