Main to remember

- The strategy acquired 15,355 bitcoin for $ 1.4 billion, increasing its assets to 553,555 BTC.

- The acquisition was funded by the sale of shares.

Share this article

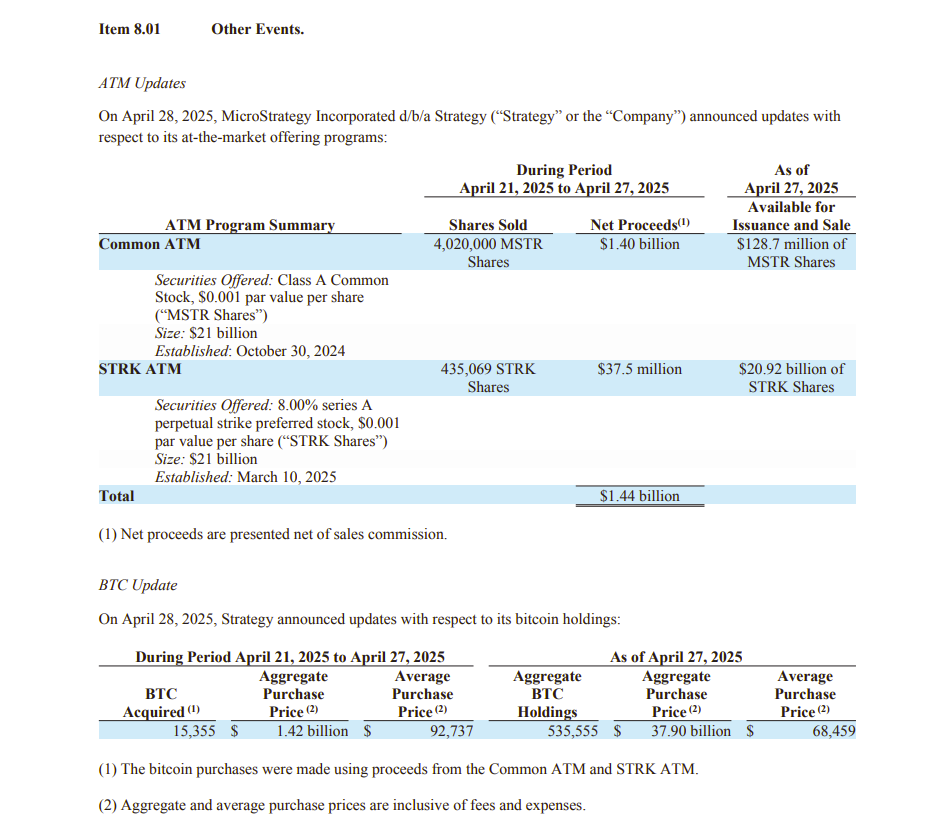

Strategy, the largest holder of the Bitcoin company, announced on Monday that it had acquired an additional 15,355 bitcoin for approximately $ 1.4 billion. Purchases, made between April 21 and April 27, were executed at an average price of $ 92,737 per room.

The strategy acquired 15,355 BTC for approximately $ 1.42 billion at ~ 92,737 $ per Bitcoin and reached BTC yield of 13.7% YTD 2025. At 27/04/2025, we have Hodl 553 555 $ BTC Acquired for ~ 37.90 billion dollars at ~ ~ $ 68,459 per Bitcoin. $ Mstr $ Strk $ STRF

– Strategy (@strategy) April 28, 2025

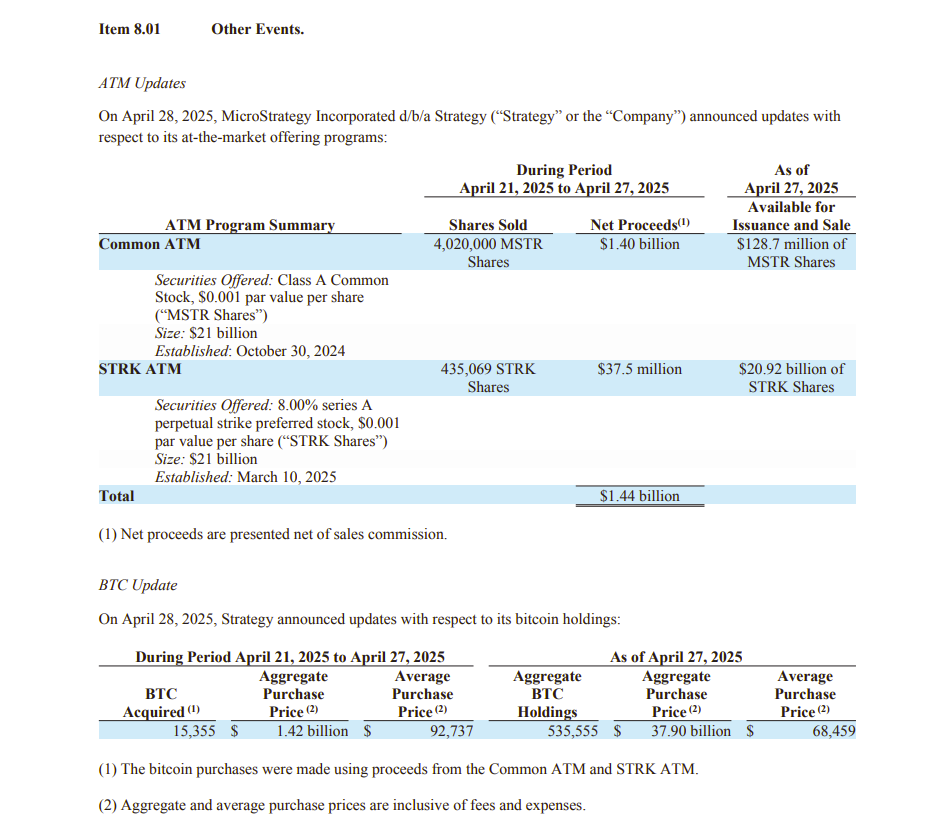

The strategy funded its latest Bitcoin acquisition thanks to the product of its action offers, as shown in a new dry file. Between April 21 and April 27, the company raised approximately $ 1.4 billion by selling 4.02 million shares in its category A (MSTR) and 435,069 shares of 8.00% in the favored series (Strk).

The last acquisition relates to Total Bitcoin Holdings of the strategy to 553,555 BTC, worth around 52.7 billion dollars at current market prices. At the time of the press, Bitcoin is negotiated nearly $ 95,300, according to tradingView data.

Bitcoin’s rise in power at $ 95,300 has turbocharged Bitcoin Holdings of the turbocharger strategy, transforming its investment of $ 37.9 billion, acquired at an average price of $ 68,459 per room, in about 15 billion dollars of unrealized gains.

This marks the third consecutive weekly strategy added to its Bitcoin reserves. Last week, the company said it bought 6,556 BTC during the week ending on April 20.

The announcement follows an article by Michael Saylor on Sunday, highlighting the tracker of the Bitcoin portfolio of Strategy, often interpreted by the market as a precursor of a large acquisition update.

Strategy shares (MSTR) increased 1.6% in the market before the market on Monday, after a gain of 5% last Friday, according to Yahoo Finance.

Share this article