- Toncoin looked ready for recovery, but these hopes were broken quickly after the whales started selling

- The token lost 32% of its value in five days and the sales pressure was not relieved

Toncoin (ton) looked quite optimistic a week ago. He had climbed over the local resistance of $ 3.95 towards the end of March and made higher stockings during the process. This suggested bullish potential and a recovery to $ 4.8 on graphics.

In early April, however, whale activity jumped. Daily transactions have increased above, but combined with whale activity, he underlined a potential sale. Since then, your has lost 26.6% in 8 days.

Do sellers become considerably stronger than at the end of March?

Disturbing signs for Toncoin bulls

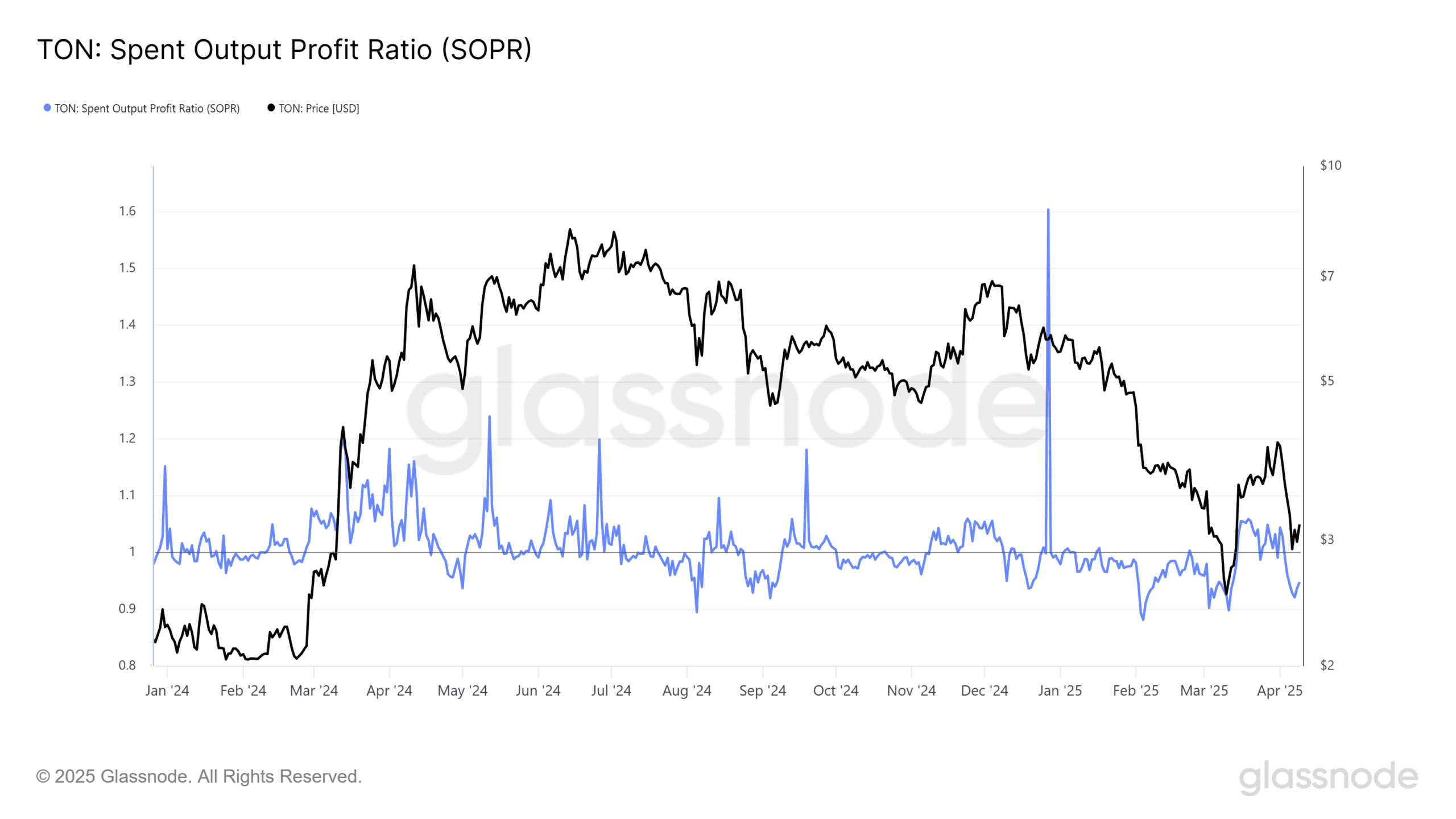

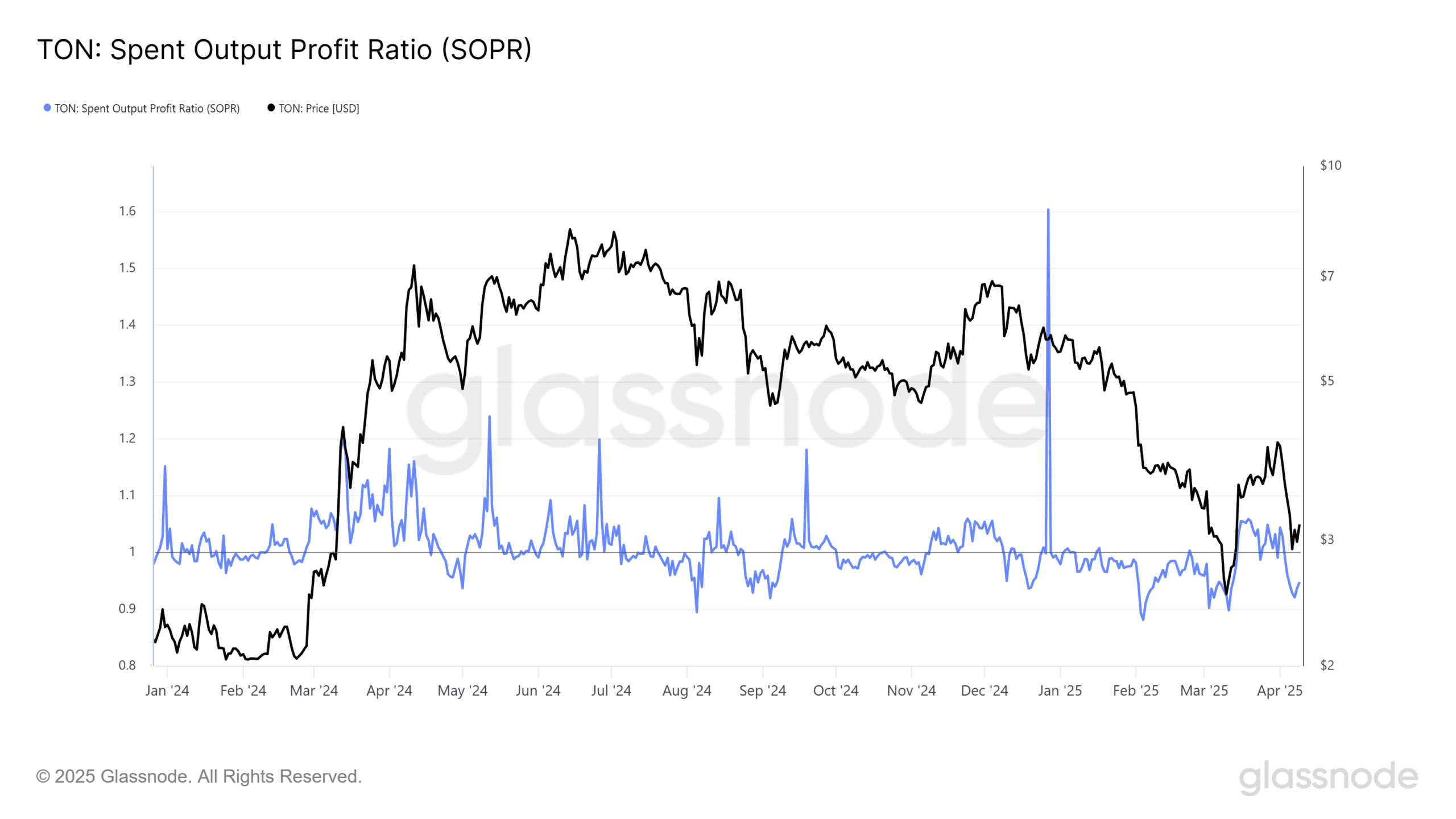

Source: Glassnode

The Production Profits Spew Speed (SOPR) does not only follow the ton of tone is sold for a profit or loss, but also compares the value achieved of the parts at their value. It is the value of the ton when spent, divided by the value from which it was purchased.

A drop below 1 meant that the parts were sold at a loss. Towards the end of March, the apparent recovery of Ton saw the rise of SOPR above 1. This ascent was short-lived.

Source: Glassnode

The metric of the change of position of the net Hodler revealed the change of monthly position of long -term holders. Derived from the metric of the liveliness of the parts, it makes it possible to calculate the metric of net position to understand if the market witnesses a transition from accumulation to distribution.

In February and March, accumulation seemed to be underway as the price tends to drop. Over the past ten days, the change in net position has dropped even lower, which indicates that holders were selling and that a potential distribution phase was underway.

It seemed to be well linked to the activity of whales and the weakness of the ton.

Source: Ton / USDT on tradingView

The rupture of the Haussier market structure occurred on March 27 when the lowest at $ 3.95 was exceeded. The CMF was greater than +0.05. report high capital entries since mid-March. It turned quickly.

Tonceoin dropped 32% in five days, and the current prospects are therefore lowering. At the time of writing this document, the $ 3.5 support area had not interrupted your Bears and the CMF was at -0.14 to indicate a high sale pressure.