Thumzup Media Corporation’s actions fell sharply on Wednesday after the company revealed an investment of $ 2 million in Dogecoin, showing its in-depth interest in cryptocurrencies and digital asset infrastructure.

The company listed at NASDAQ announced Thursday that it bought approximately 7.5 million Dogecoin chips at a weighted average price of $ 0.2,665, marking its first Open Market Doge acquisition.

This decision comes as Thumzup is preparing to develop in large -scale Dogecoin extraction thanks to its acquisition awaiting Dogehash technologies.

Thumzup deepens the pivot of digital assets with the DOGECOIN operating and cash strategy

Despite the announcement, Thumzup’s actions decreased by $ 4.61 by $ 4.61 on Wednesday. The action recovered approximately 4.5% in the event of negotiation after the opening hours after the deposit. The price of Dogecoin, on the other hand, increased by 5.4% to $ 0.28, according to Coingecko.

The pivot of Thumzup to Dogecoin has accelerated in recent months. Earlier this month, the company revealed its intention to deploy 3,500 mining platforms by the end of the year, following its Dogehash acquisition agreement.

Dogehash is currently operating around 2,500 SCRYPT ASIC minors across North America, focused on the production of Dogecoin and Litecoin, with 1,000 other platforms expected later in 2025.

The approval of the shareholders pending, the agreement will see the shareholders of Dogehash exchange their assets for 30.7 million Thumzup actions, after which the merged entity will be renamed as Dogehash Technologies Holdings and will exchange under the XDOG Ticker.

To support its expansion, Thumzup has also strengthened its leadership.

This week, he appointed Jordan Jefferson, CEO and co-founder of Dogeos and chief of the Dogecoin Mydoge portfolio, to his Crypto Advisory Council, alongside the Executive of Dogeos, Alex Hoffman.

Jefferson, whose Dogeos platform is supported by Polychain Capital, has been active in the development of bitcoin and blockchain since 2011.

He said Thumzup’s strategy to deploy its Dogeying assets in the ecosystem rather than simply storing them could help strengthen the economy of Dogecoin.

The director general of the company, Robert Steele, said that Jefferson’s appointment shows Thumzup’s commitment to extend its role in digital assets, citing its leadership in the creation of applications that increase the usefulness of Dogecoin.

Thumzup quickly reshaped a marketing company on social networks in a crypto focused company. Founded in 2020 and based in Los Angeles, the company initially exploited a platform that rewarded users with money to promote brand content on social networks.

In January, he launched a cryptographic treasure with an investment of $ 1 million in Bitcoin and has since diversified his assets.

In July, its board of directors authorized the company to contain up to $ 250 million in cryptocurrencies, notably Bitcoin, Ether, Solana, XRP, Dogecoin, Litecoin and USDC.

In August, Thumzup raised $ 50 million in a share in stocks at $ 10 per share, with the product intended for cryptographic mining infrastructures and targeted blockchain investments.

The company said he had 19.1 BTC in mid-year and said she intended to diversify more in major tokens.

The Thumzup investor base also drew attention in July when it was revealed that Donald Trump Jr., the son of former American president Donald Trump, holds 350,000 shares of the company.

In particular, the participation has been acquired on the advice of an investment advisor, and Trump Jr. does not play any role in management or operations.

Dogecoin climbs before the first launch of the American ETF

Dogecoin exchanged $ 0.28 Thursday, recovering 12% from a local hollow of $ 0.25 earlier this week. The token remains almost 62% below its summit of $ 0.7316, reached in May 2021.

The rebound occurs while the first fund negotiated in exchange for Dogecon (ETF) is preparing to be launched in the United States. Rex-Osprey Dogecoin Etf made its debut on Thursday, becoming the first regulated product dedicated to a same.

Sponsored by Rex Actions and Osprey Funds, the team behind the Solana Staking ETF earlier this year, the product was filed under the 1940 investment company, allowing faster approval than the traditional deposits of the securities law.

Analysts say that the FNB could channel institutional capital on the Dogecoin market while granting broader legitimacy to an active actor formerly considered a novelty.

“The first ETF Doge launches tomorrow,” wrote the president of the ETF store, Nate Geraci, on X, predicting “wild” months to come.

Influencer SMC Kapil Dev qualified the beginnings of milestone for Wall Street, adding that Dogecoin changes “the same to a traditional asset”.

The American Commission for Securities and Exchange also examines the requests of the FNB Spot Doge, including Graycale’s proposal to convert its Dogecoin confidence.

A decision on this deposit is expected in mid-October. The Paris Polymarket platform shows that traders attribute 98% of approval for an ETF Spot Doge in 2025.

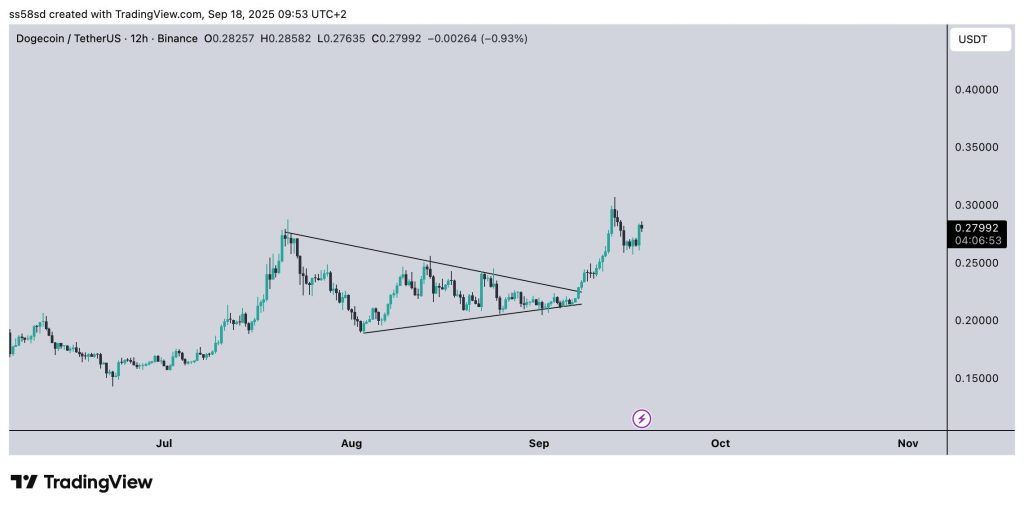

Technical indicators support optimism. The graphic data show that Dogecoin broke out a symmetrical triangle model in early September, gathering around $ 0.30. Immediate resistance is $ 0.30 at $ 0.35, with a support nearly $ 0.26 to $ 0.25.

Analysts indicate that the above detention could open the way to a thrust to $ 0.35 to $ 0.40, while a breakdown of $ 0.25 would invalidate the upward trend.

The Thumzup position, linked to Trump Jr., flows 7.7% after $ 2 million, the bet of Dogecoin appeared first on cryptonews.

Thumzup, linked to Trump, acquires Dogehash, a Dogecoin extraction operation, with plans to list as Dogehash Technologies Holdings.

Thumzup, linked to Trump, acquires Dogehash, a Dogecoin extraction operation, with plans to list as Dogehash Technologies Holdings.

XRP ETF,

XRP ETF,