- Cardano’s circulating offer increased as old parts moved, signaling a mixture of long -term benefits and accumulation.

- What will do with Ada to hold over $ 1?

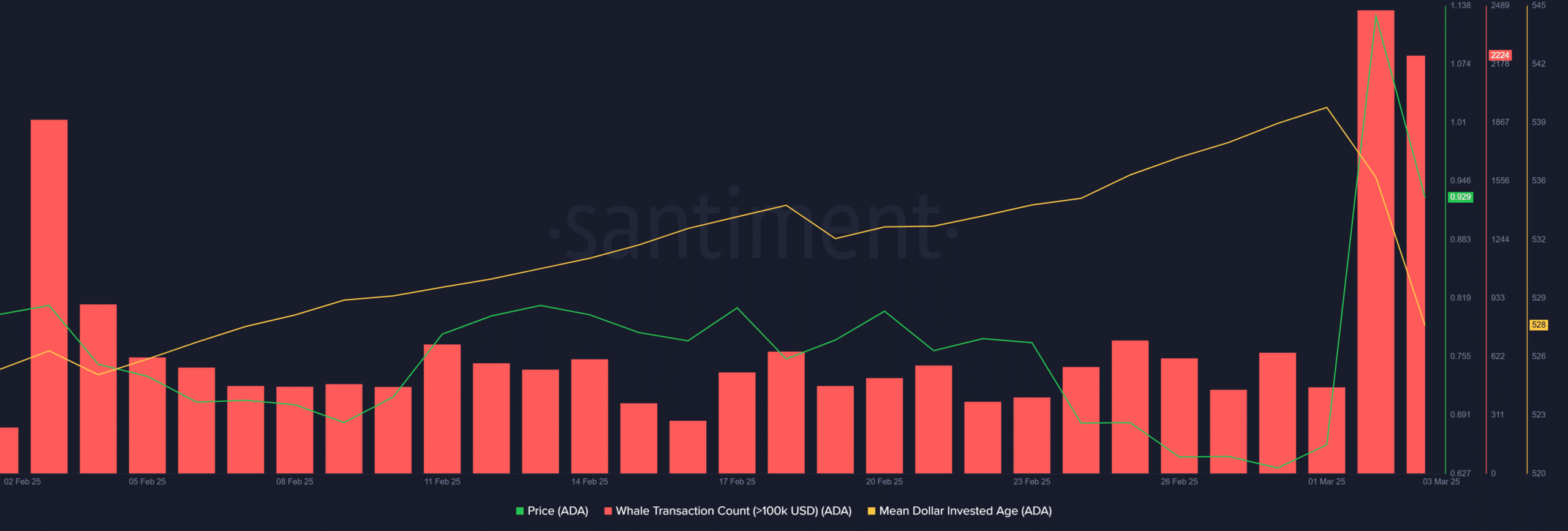

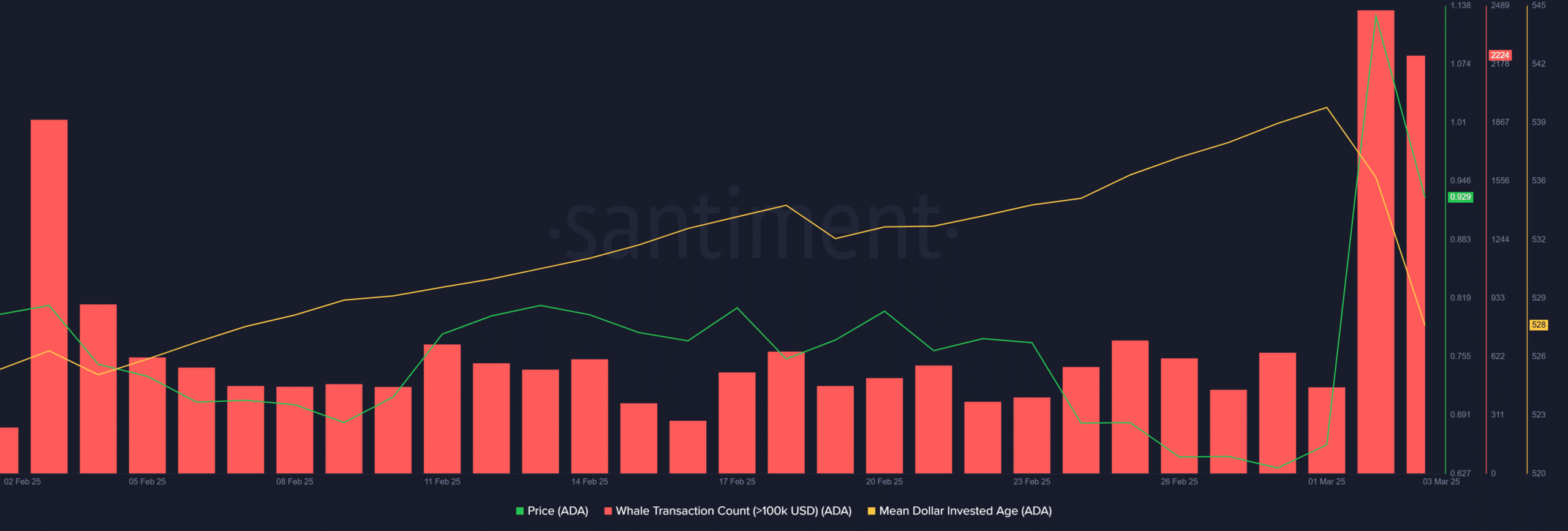

Cardano (ADA) increased to $ 1.13 in the middle of the advanced whale activity, recording 2,645 transactions more than $ 100,000 – the highest in three months. This strategic accumulation followed the historic rally of 72.15% of a day of ADA.

However, ADA is struggling to maintain above $ 1, now negotiating $ 0.94 despite a rebound in the cryptography market of 4.77% and a bitcoin bullish recovery.

Santiment data has highlighted a decrease in the average age of the ADA portfolio, the signaling increased the circulation of tokens. Is it a sign of profit reposition or strategic repositioning for long-term accumulation? Ambcrypto has investigated.

Volatility of Cardano prices exposed

Despite whale transactions reaching a three-month summit, Cardano had trouble maintaining over $ 1, coinciding with a sharp decline in the average age invested in dollars (MDIA).

A declining MDIA suggests an increase in the circulation of tokens, which indicates that the older parts are moved – a potential sign of profit or redistribution.

Source: Santiment

However, this MDIA dip aligned itself with a overvoltage of the total locked value (TVL) on the Cardano DEFI platforms, from $ 397.98 million to $ 573.3 million in just two days.

This suggests that rather than getting out, investors redeploy the capital to mark out, strengthening a long -term accumulation strategy.

However, TVL remains well below its post -electoral peak of $ 800 million, indicating a significant gap activity which has aligned with the decline of ADA below its elections high at $ 1.25 – pointing to aggressive profits.

However, the net TVL rebound – despite a broader correction of the market in large capitalization assets – suggests sustained confidence in future gains.

Keeping an eye on this trend will reveal if the feeling of hodling is loud in the days to come, While Cardano again approaches critical resistance at $ 1.

What is the next step for Ada?

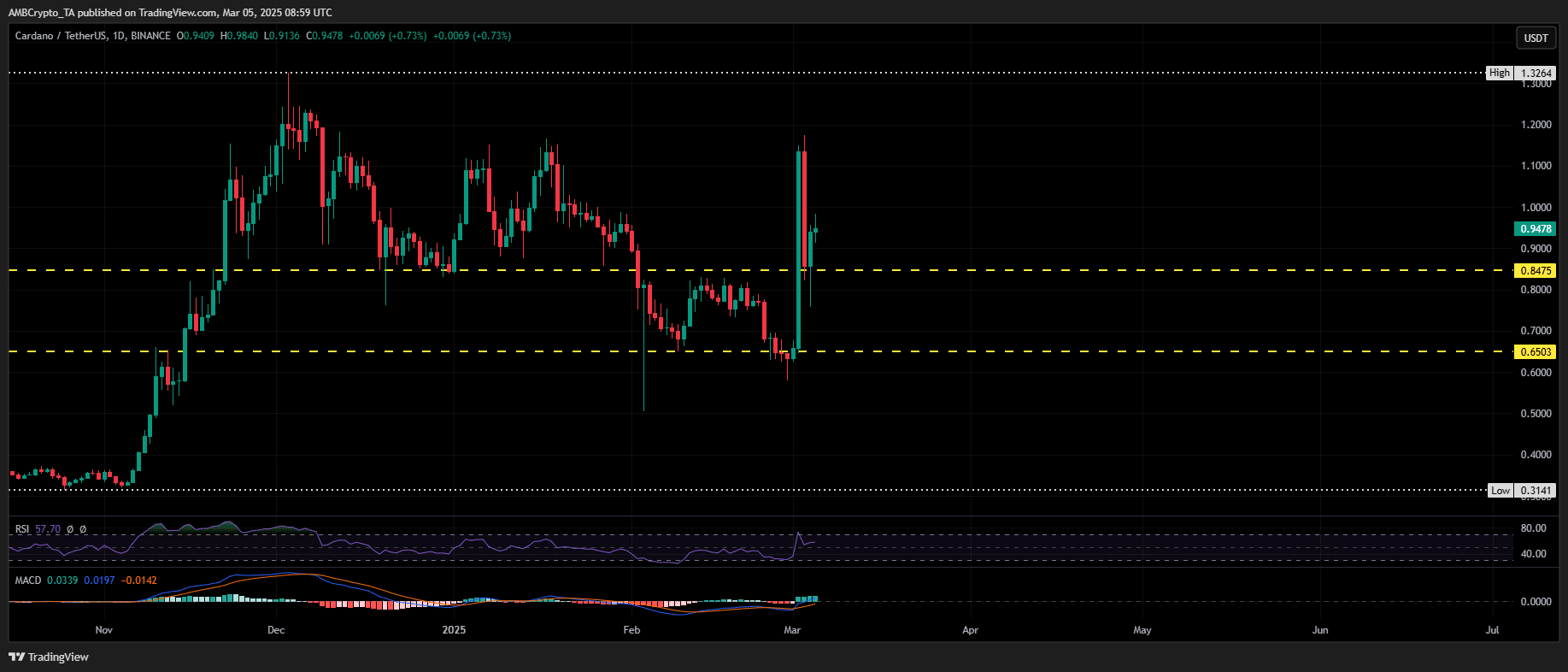

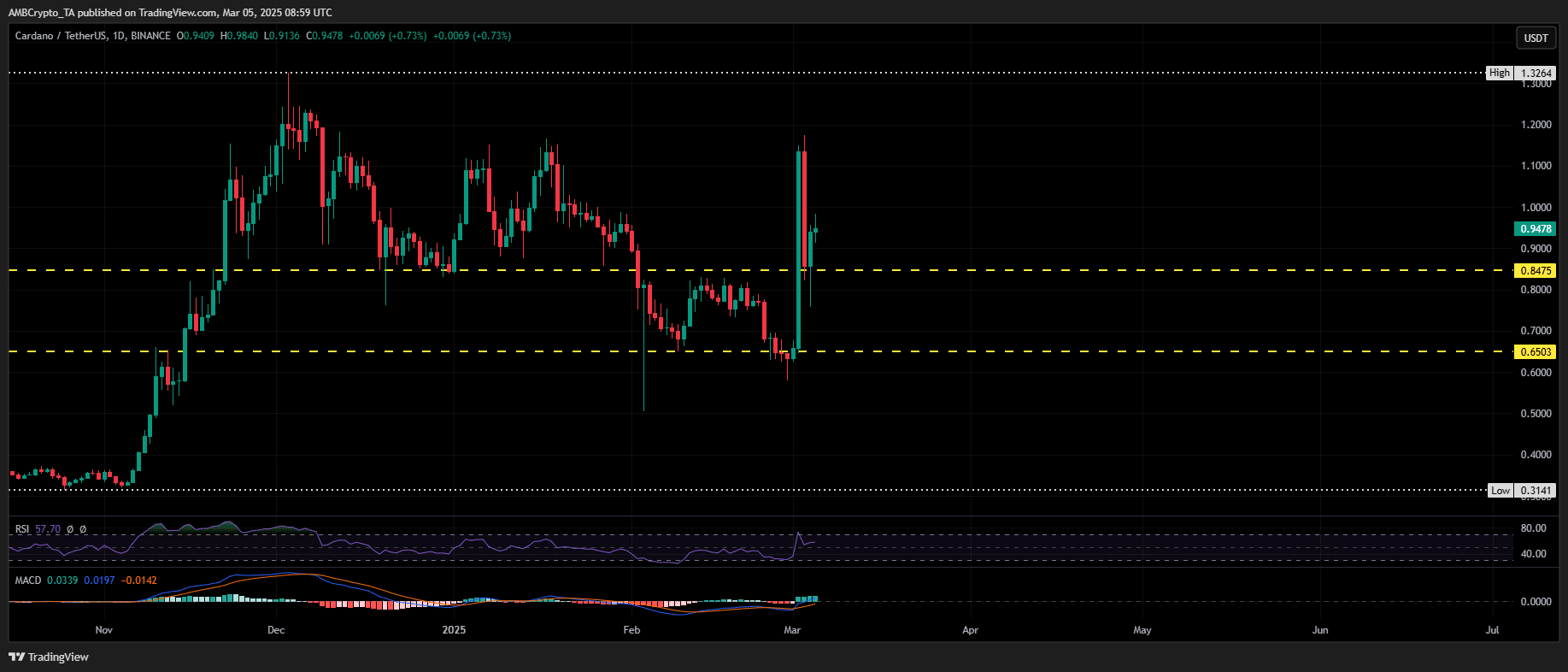

Since its post-electoral peak, Cardano has formed three lower stockings, establishing key demand zones at $ 0.80 and $ 0.60.

Source: TradingView (ADA / USDT)

Its short -term trajectory depends on the broader trends on the market – if the momentum is weakening, a support of $ 0.85 is likely. However, the current structure of the Haussier market suggests a potential rupture greater than $ 1.

The challenge lies in maintaining this level, because the volume of exchanges increased from $ 7 billion to $ 5 billion in two days, with $ 1.14 as a major resistance area.

In addition, whale transactions decrease, adding to sales pressure. Unless the volume, the activity of whales and the TVL rebound, Cardano’s ability to maintain more than $ 1 remains low.