Key notes

- ADA has made its first daily closure above the 200-day mobile average since March, signaling the inversion of potential trends.

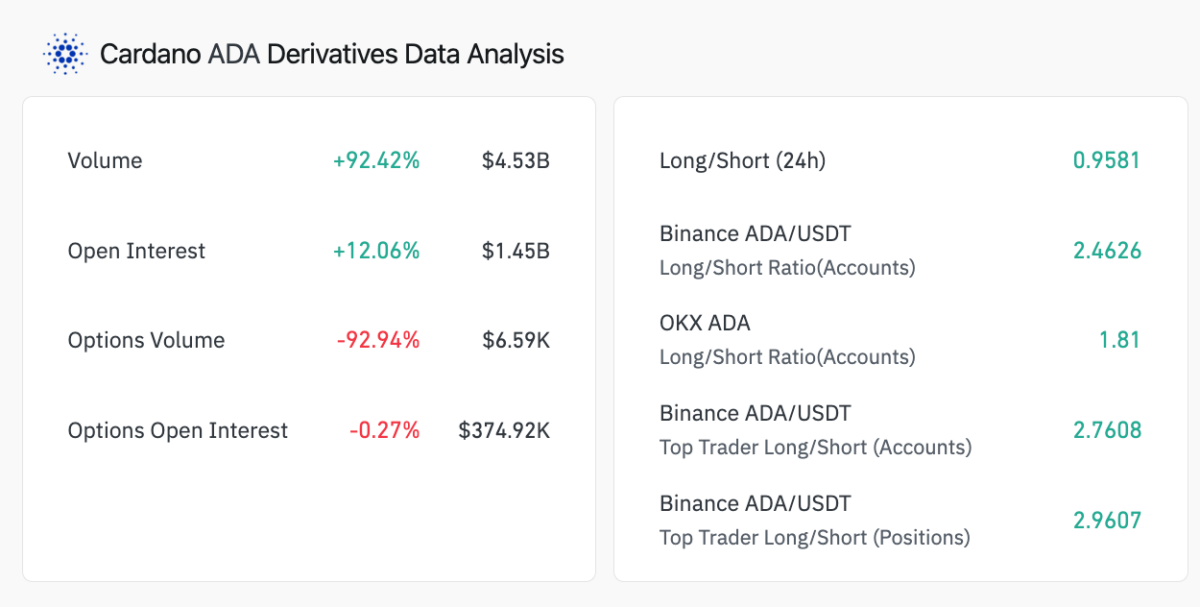

- Open interest jumped 12.06% to $ 1.45 billion while the commercial volume increased by 92.42%, indicating a solid institutional commitment.

- Critical support at $ 0.76 must contain the bulls to target the resistance of $ 0.9053 and validate the Macro Haussier Cassure scenario.

Cardano

ADA

$ 0.80

24h volatility:

3.1%

COURTIC CAPESSION:

$ 28.85 B

Flight. 24 hours:

$ 2.10 B

extended its increased sequence on Thursday, July 17, ending at $ 0.8101 with a strong gain of 5.98%. The price exceeded the critical mobile average of 200 days ($ 0.7476), forming its first daily closure above this level since March. The volume increased to $ 290.88 million, confirming a renewed punctual request.

The gathering was partially fed by an increased derivative activity. According to market data, Cardano’s open interest increased by 12.06% in the last 24 hours, going to $ 1.45 billion. This sharp increase in leverage exposure, without an equivalent increase in liquidations, suggests that bulls increase positions with confidence rather than chasing liquidations or reacting to volatility.

Cardano derivative market analysis | Source: Coringlass

Meanwhile, the volume of exchanges increased from 92.42% to $ 4.53 billion, while investors were spinning the capital of low -volatility altcoins in Cardano.

In the main exchanges, new positions have opposed Top Traders accounts of Binance Binance displaying a report of 2,7608 long / short the day. This concentration of long positions signals growing confidence in a sustained break.

Cardano price forecasts: Will ADA hold more than $ 0.76?

The ADA has now been testing its highest levels since March 2025, after having overturned the 200 -day SMA. If the bulls keep the line above $ 0.76, the next resistance is at $ 0.9053. The violation of this level would validate a macro bullish reversal, potentially propeling the ADA to $ 1.00.

Cardano price forecasts

Conversely, non-compliance with the momentum could trigger a decline to $ 0.7,476, or even $ 0.68. However, consolidation above the Golden Cross region (my 50/200 days) and a strong market interest surrounding

BTC

$ 119 136

24h volatility:

0.4%

COURTIC CAPESSION:

$ 2.37 T

Flight. 24 hours:

$ 47.31 B

All the high stages of this week suggest that this rally may not yet be finished.

Maintaining support greater than 0.76 could attract new capital as an institutional position and retail investors before the next macro.

The best portfolio presale is gaining ground while the Cardano rally warms up

While Cardano increases the key resistance levels, the best portfolio, an actor on the rise in the crypto wallet space, arouses the interest of investors with his presale.

Best portfolio presale

The $ Best token is now in pre -sales, providing early access to the rewards of staggered, rejuveno on transaction costs and governance rights. With more than $ 13.9 million collected, investors can still join before the next price increase.

Visit the official website for the best portfolio to participate in the prevent of token $ best and secure premium advantages before launch.

following

Non-liability clause: Coinspeaker undertakes to provide impartial and transparent reports. This article aims to provide precise and timely information, but should not be considered as financial or investment advice. Since market conditions can change quickly, we encourage you to check the information for yourself and consult a professional before making decisions according to this content.

Ibrahim Ajibade is a seasoned research analyst with training by supporting various web3 and financial organizations. He obtained his undergraduate diploma in economics and is currently studying for a master’s degree in blockchain and distributed major book technologies at the University of Malta.

Ibrahim Ajibade on LinkedIn