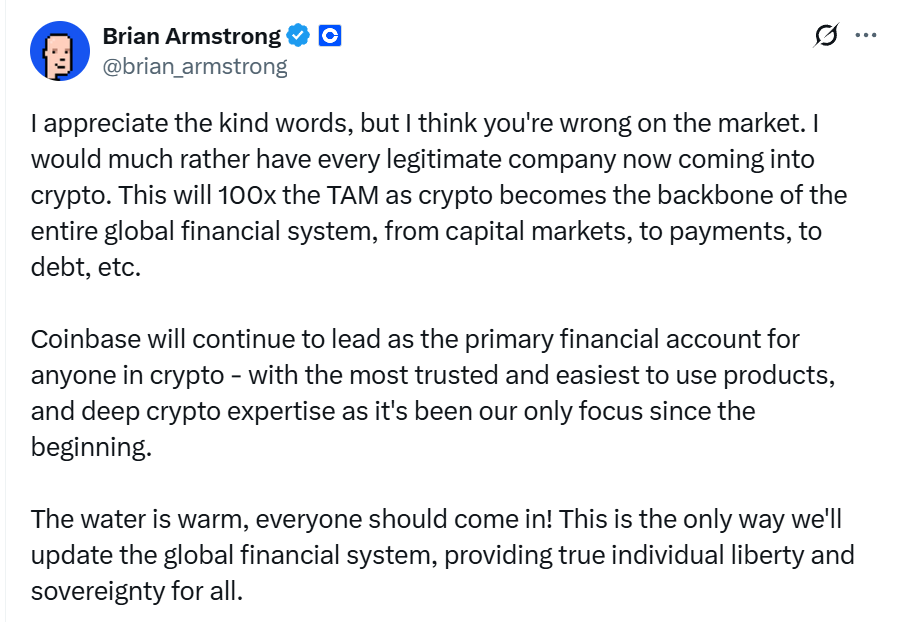

CEO of Coinbase, Brian Armstrong, has made a daring prediction. He went to X to say that the total addressing market (TAM) of the cryptography market will extend 100x as the more legitimate companies join the space.

“I would prefer by far that all legitimate companies enter crypto.

According to @ Loganb.suiui“It is underestimated how much @coinbase has done for industry in the past four years from a legal and political point of view. »»

The user continued by saying that now the new administrator is more user -friendly, the new Sec is constructive, and the results of this will be regulator Clarity, a substantial scale of the industry, a greater institutional commitment with industry and general maturation.

“However, this will also inevitably and undoubtedly mean ever -increasing and intense competition for all aspects of Coinbase activity,” concluded the user.

It is underestimated how much @coinbase has done for industry in the past four years from a legal and political point of view. Especially since the fruits of this work, although deeply beneficial for the whole space, will probably do $ Part on the market.

For a long time …

– Loganb.sui (@thewhyoffi) April 28, 2025

Responding to this Armstrong said that the water is hot, everyone should enter! It is the only way to update the global financial system, offering real individual freedom and sovereignty for all.

Explore: TOP Solana same corners to buy in 2025

Coinbase Asset Management is preparing to launch Bitcoin Fund yield

Coinbase to offer a yield.

The objective is a yield of 4 to 8%.

Here are the things you need to know:

Bitcoin does not generate yield.

Coinbase will try to collect arbitration on a business between support and term contracts.

This will be called the Bitcoin Fund The yield.

Place the bitcoin, withdraw … pic.twitter.com/nsly7ucqyz

– George Bodine (@ jethroe111) April 28, 2025

At April 28, 2025 Bloomberg report revealed that the management of assets Coinbase is preparing to launch a Bitcoin yield fund on May 1, 2025. Apparently, Coinbase will exclusively target non -American institutional investors and give them another way to win a return on their Bitcoin farms.

Commenting on the new version, Sebastian Bea, president of Coinbase Asset Management, said: “We believe that the Bitcoin return fund is particularly well suited to the task, taking into account its conservative and compliant investment strategy.”

Armstrong has added: “Coinbase will continue to direct as the main financial account of anyone in crypto – with the most reliable and easiest to use products, and expertise in deep cryptography because it has been our only goal from the start.”

Explore: The hottest cryptography claims to buy now

Key dishes to remember

-

Armstrong’s comments arise while the cryptography market shakes years of regulatory turbulence and reputation setbacks.

-

Coinbase, with its share of 66% of the American market for crypto exchanges and around 10 million users, is well positioned to benefit from this next phase, even if it faces new rivals.

The post “Water is hot, everyone should enter,” explains Brian Armstrong, while Coinbase is preparing to launch the Bitcoin yield fund appeared first on 99Bitcoins.