Ethereum has been one of the strongest artists on the cryptography market in the past two months, increasing regularly to reach new heights of all time just a few days ago. Its rally has strengthened the role of Ethereum as a leader leader, attracting both institutional attention and retail speculation. However, the landscape moves while the sales pressure begins to slip. Some analysts warn that ETH may risk reducing more in the coming days, volatility testing investors’ confidence after such an aggressive race.

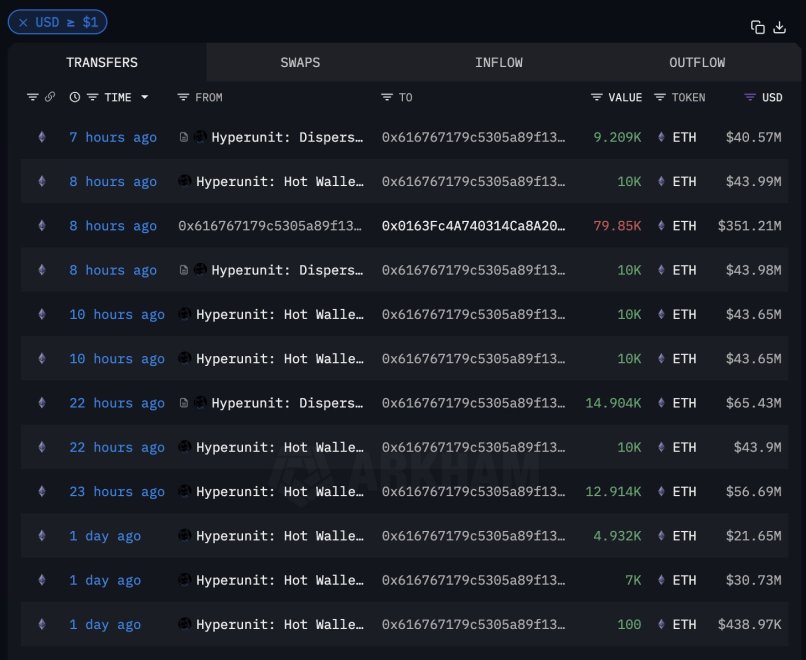

However, while concerns increase, data on the chain reveal that whales continue to accumulate on a large scale. According to Arkham, a massive whale holding $ 5.97 billion in Bitcoin has now bought $ 434.7 million from ETH. Yesterday, this whale moved $ 1.1 billion on a new portfolio (169q) and actively bought ETH via Hyperunit. In total, it has accumulated more than $ 3 billion ETH, by gushing the majority, a decision which signals a strong conviction despite short -term uncertainty.

This war tug between the sale pressure and the accumulation of whales opens the way at a critical moment in the trajectory of Ethereum. The next few days reveal whether the whales are strong enough to maintain the ethn sustained or if other retractions are waiting.

The challenges of billions of Ethereum as capital rotation increases

According to Arkham, one of the largest whales on the market has now bought more than $ 3 billion in Ethereum (ETH), stimulating the majority. This activity has drawn the attention of analysts and investors, because it highlights a growing tendency of capital rotation far from Bitcoin and Ethereum. The whale in question, which initially held $ 5.97 billion in BTC, gradually converted its position, deployment of large -scale funds via Hyperunit. Its BTC address (169qyzjykyw7HMWTJ58MVXRZDHMFHPZPD) and ETH address (0x616767179c5305A89F13348134C681061CF0BA9E) are now followed by walking because investors speculate during its next move.

After having moved $ 1.1 billion in BTC to a fresh portfolio, the whale has already bought $ 434.7 million from ETH, adding to its massive accumulation and reporting continuous confidence in the future of Ethereum. The majority of these assets are being set up, which reduces the liquid offer and highlights a long -term perspective rather than short -term speculation.

Now the question remains: will he buy the following $ 650 million today? If this is the case, the additional request could provide strong support in Ethereum, even if short -term prices have shown weakness. More importantly, this tendency to rotate capital is a clear sign that altcoins are preparing in turn. While investors turn from BTC to ETH and beyond, the basics of a wider Altcoin cycle seems to be formed, preparing the way for volatility and increased opportunities in the coming weeks.

Test the key request level

Ethereum (ETH) is negotiated around $ 4,369, showing signs of consolidation after weeks of net rallies and subsequent retractions. The graph underlines how the ETH has cooled in relation to its recent peaks of all time close to $ 4,900, but remains firmly above the averages of critical displacement which continue to guide its upward structure.

The 50 -day mobile average, currently close to $ 4,372, acts as immediate support and has been tested several times during recent sessions. Holding above this level is the key to maintaining short-term momentum. Meanwhile, the average of 100 days is around $ 3,962, and the average of 200 days is $ 3,257, strengthening the long -term upward trend, which suggests that even deeper withdrawals would probably be with a strong purchase interest.

However, Ethereum’s inability to repel $ 4,600 stimulates the trigger of the short -term momentum. Taking profits and broader uncertainty of the market slowed down the pace of gains, which makes the ETH vulnerable to more in -depth consolidation. A decisive break below $ 4,350 could open the door to $ 4,000 like the next main application area.

Ethereum remains in a healthy trend, but the market is clearly awaiting new catalysts. Whether it is the accumulation of wider whales or institutional flows, the ETH will need renewed purchase pressure to retest its summits greater than $ 4,800.

Dall-e star image, tradingview graphic

Editorial process Because the bitcoinist is centered on the supply of in -depth, precise and impartial content. We confirm strict supply standards, and each page undergoes a diligent review by our team of high -level technology experts and experienced editors. This process guarantees the integrity, relevance and value of our content for our readers.