Reports revealed that 16 portfolios had recovered 431,018 ether between September 25 to 27, spending about $ 1.73 billion to do so. Purchases came by names like Kraken, Galaxy Digital, Bitgo, Falconx and OKX.

Related reading

This accumulation scale has drawn attention to who buys the dive, and why the big players seem willing to add an exposure while the prices border.

Exchange sales fall to a hollow of 9 years

According to Glassnode data, the amount of ethn maintained on trade has increased from around 31 million to around 14.8 million ETH – a decrease of 52% compared to the levels of 2016.

Many of these documents are probably in the development contracts, cold portfolios or institutional guard, and the recent launch of the first ETHEREUM implementation has contributed to further withdrawing the exchanges.

The lower exchange sales mean fewer coins ready to be sold instantly on the scholarships, which can make the price clearer when large orders have passed the market.

ETH hovers nearly $ 4,000 as volatility increases

Based on trading view, ETH is negotiated about $ 4,011, down approximately 0.33% in the last 24 hours and more than 10% in last week.

The token briefly slipped less than $ 3,980 earlier in the session before going up, and it remains below a recent fence of $ 4,034.

This two -week decline returned ETH to a key support area of $ 4,000, and short -term fluctuations have become more pronounced as holders rest.

$ 3,700 becomes a sand line

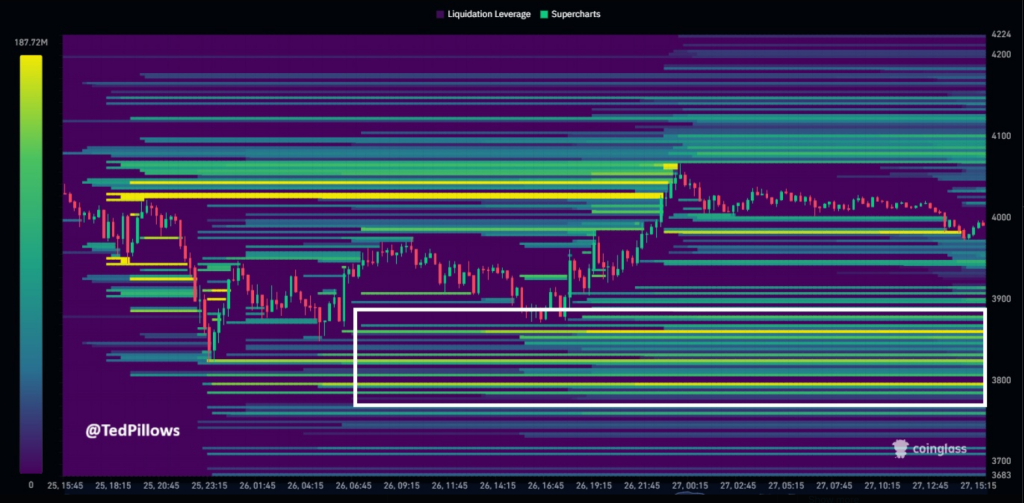

Crypto Ted Oilers analyst warned that the $ 3,700 zone at $ 3,800 could face high pressure. The reports note that if the ETH falls below $ 3,700, many margin positions could be annihilated and sparkle the forced sale which lowers prices.

$ ETh Liquidity Heatmap shows long decent liquidations around the level of $ 3,700 to $ 3,800.

This level could be revisited again before Ethereum shows any recovery. pic.twitter.com/sqtbfrujaa

– Ted (@tedpillows) September 27, 2025

With fewer documents on exchanges and exposure to the concentrated margin, short -term perspectives are more fragile, while the longer -term demand indicators seem solid.

ETF outputs show that institutional mood can return

Cut in the United States has recorded nearly $ 800 million on outings this week, their biggest acquisitions to date. However, about $ 26 billion is in ETHEREUM ETF, or 5.37% of the total supply.

Whales continue to accumulate $ ETh!

16 portfolios received 431,018 $ ETh($ 1.73 billion) #Kraken,, #Galaxidigital,, #Bitgo,, #Falconx And #Okx In the last 3 days. pic.twitter.com/oexzkiermr

– Lookonchain (@lookonchain) September 27, 2025

Related reading

These figures underline the speed with which institutional feeling can change: large entrances can disappear just as quickly, and ETF flows now add a new important layer to price dynamics.

Lookonchain Data also highlighted a prior accumulation of around $ 204 million in ETH, showing similar models of great players who intensify during the hollows.

Retail merchants seem more cautious for the moment. But the sequence of large purchases of guards of institutional quality suggests that some buyers consider the dips as chances of purchase while others choose to wait on the sidelines.

Felash star image, tradingView graphic

(Tagstotranslate) Altcoins

Source link