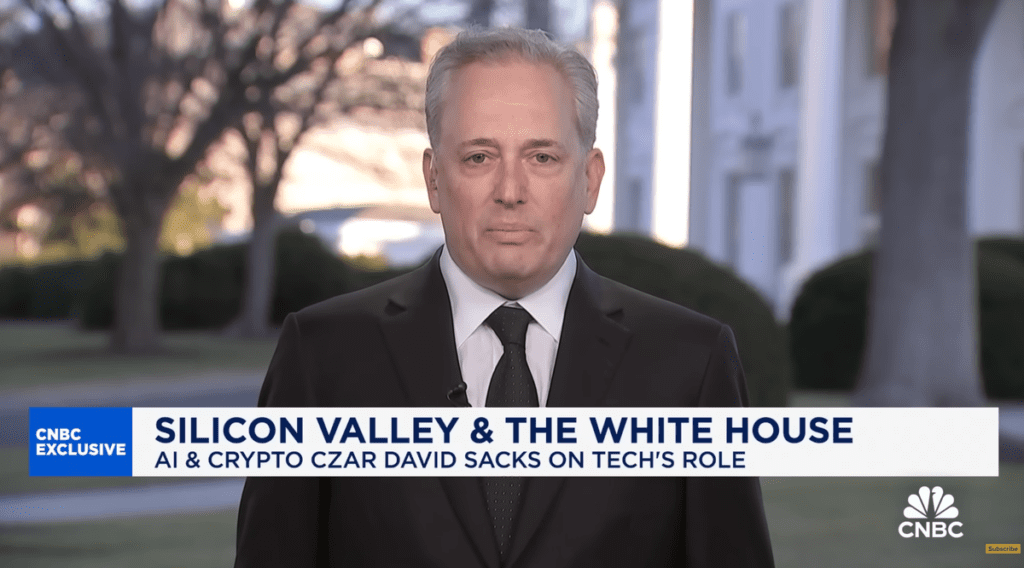

David Sacks, the newly named white house AI and the crypto-czar, set the stable legislation as the first major step towards the creation of a clear regulatory framework for digital assets in the United States

Speaking on CNBC Cloche fence over time Tuesday, Sacks stressed that legislators are committed to pushing the regulations of the stables across the congress in the next six months.

Sacks joined the main leaders of the Congress, notably Senator Tim Scott (RS.C.), the representative French Hill (R-Ark.), And Senator John Boozman (R-Ark.), During a conference of Press describing the approach of the administration towards crypto policy. The Stablecoin bill proposed by Senator Bill Hagerty (R-Tenn.)

Stablecoins as a strategic asset

Stablecoins, digital assets set for traditional currencies such as the US dollar, have gained ground worldwide, but US legislators wish to ensure that their adoption strengthens the role of the dollar in international finances.

Sacks and his team believe that a well -regulated market for stables could drop thousands of dollars in dollar demand and help reduce long -term interest rates by strengthening its domination in digital finance.

“This is an area that has already taken off, mainly offshore. We want to bring this innovation to the ground and allow the legislation to authorize the issuance of stablecoins in the United States. And I think that the power of stablecoins is That it could extend the domination of the dollar. Reduce long -term interest rates, “said Sacks.

The thrust of the legislation on stablescoin is aligned with broader ambitions within the administration to position the United States as a leader in cryptographic innovation. Sacks noted that beyond the stablecoins, his team assesses the feasibility of a Bitcoin national reserve – an idea defended by President Donald Trump during his campaign.

“We have not yet determined to do so, but this is one of the first things we are going to examine,” said Sacks about the prospects for a bitcoin reserve, noting that the president of the American sovereign fund Donald Trump has planned to be part of the cryptos his wallet.

Trump signs an executive decree for the creation of the sovereign fund

Trump orders the Treasury and Trade to write a sovereign fund plan in 90 days, covering funding, investments, structure and governance

Influence of Sacks to Washington

Since its name in December, Sacks quickly appeared as a central figure to shape the cryptography policy of the White House. Despite the lack of direct regulatory authority, its influence is reinforced by close links with the administration and the main players in the industry. His appointment follows a notable change in his political alignment; Formerly vocal critic of Trump, Sacks organized a fundraising of $ 12 million for the president’s campaign last year.

US Crypto-Ai Chief and its world vision adapted to technology

The choice of Trump’s Tsar Crypto, David Sacks, triggers a debate on his technological links and his regulatory position

Tuesday’s announcements mark the first major political event under the direction of Sacks. His declaration to the crypto ball that “war against crypto is over” underlines the intention of the administration to promote the growth of industry rather than imposing restrictive regulations. With the legislative and regulatory momentum, the next six months could prove to be essential in the definition of the future of digital assets in the United States.

In a related development, the Securities and Exchange Commission (SEC) reported a change of position on cryptographic regulations. Under the new management, the agency launched a crypto working group led by Commissioner Hester Peirce. In a declaration entitled The trip beginsPeirce described the objective of the dry to create a more transparent and predictable regulatory environment for digital assets.

Sec scale Application unit of scales cryptography

The dry reduces its unit of application of cryptography in reaffecting lawyers

Unlike previous administrations, which were often considered to be adversaries to cryptographic industry, the new DRI approach includes the solicitation of public contribution, clarifying what digital assets relate to securities laws and rationalize compliance measures for chip transmitters.