It seems that 2025 promises to be a great year for the crypto … or at least for a particular room.

bitcoin a briefly exceeded $ 123,000 Monday morning, the first day of the “Week of Cryptography” of the Chamber, which (despite certain disappointments) saw the historical legislation to regulate the stablecoins adopted by the Congress, helping to stimulate the value of the entire cryptography market beyond the 4 dollars Mark Friday. Throughout the week, the largest cryptocurrency in the world has refreshed a little, with a handful of pieces even and altcoins starting to steal the show.

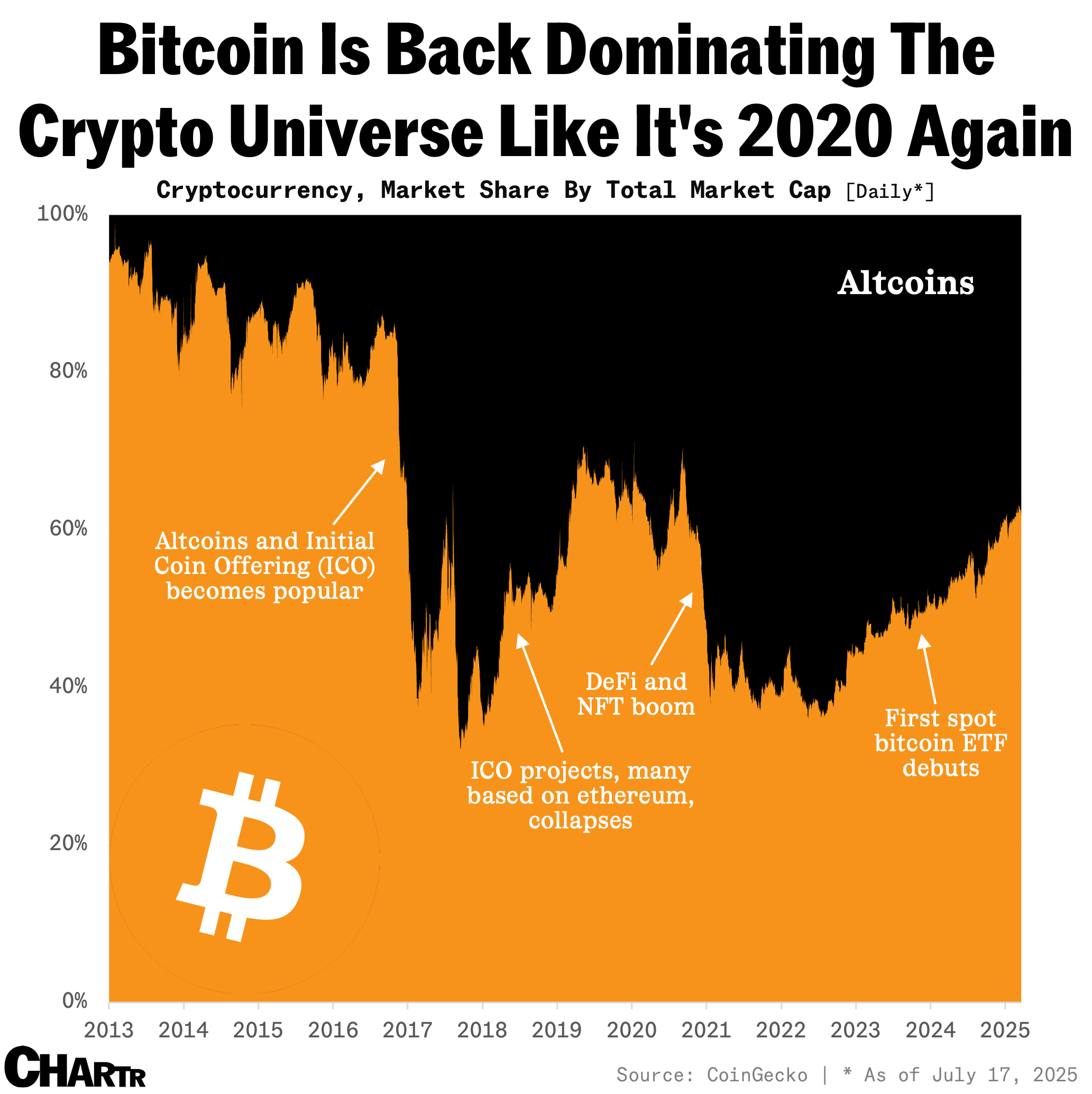

However, zooming beyond the recent Altcoin gains reveals that the cryptographic landscape is still very dominated by Bitcoin, which takes a huge 63% total value of the cryptography market.

Sherwood News

I can’t stop, will not stop

The last time Bitcoin experienced a similar level of domination, it was from 2018 to 2020 following the collapse of the boom of the initial offer in 2017 which made many Altcoin projects abandon. Companies love Tesla And Paypal Also saw Bitcoin accepting as a form of payment, lending an increasing feeling of legitimacy to the asset.

Just as the new demand came from the growing image of Bitcoin as a refuge, the supply was also pressed by many long-term investors banging (translation: hold) at their pieces, waiting for gains after a “half” event in mid-2010.

But many things have changed since then, and more commentators divert the eyes from Bitcoin traders at retail To explain the latest BTC wave.

Stable coin (R)

While the price of Bitcoin fluctuates less wildly and it begins to look a little more like titles of large names such as the magnificent 7, institutional investors have stacked. Bitcoin cash companies like Michael Saylor StrategyFor example, keep now $ 73 billion The Bitcoin value, while the Bitcoin Spot ETF brought some $ 50 billion Since 2024, by Deutsche Bank Analysis.

All in all, institutions are now controlling almost a third party of all bitcoins in circulation.

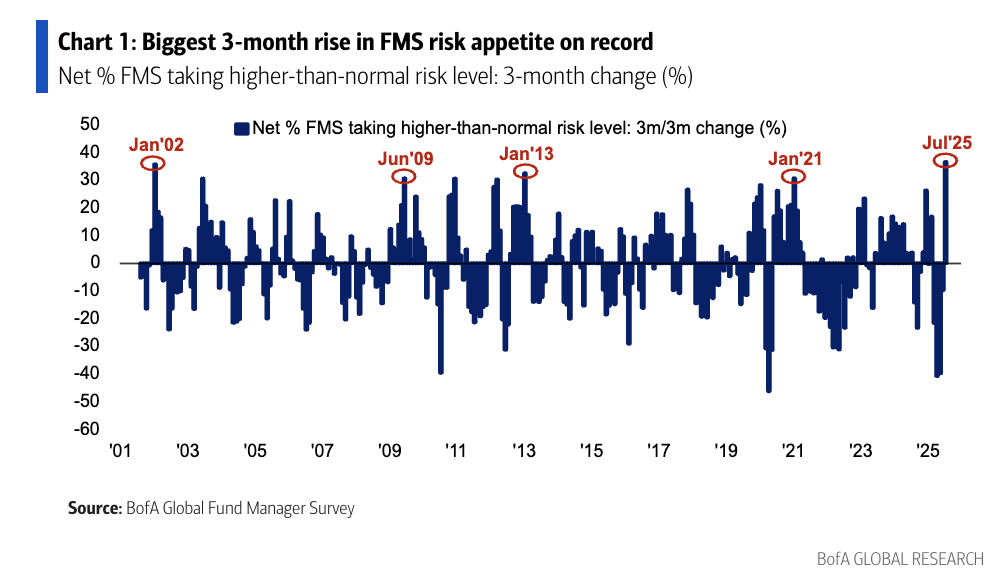

Indeed, while fund managers are evolving towards risky assets more widely, with the appétit at risk of three months of investors at its highest levels since 2001, Bitcoin seems to hit a little Sweet for today’s risk institutions – a high asset with beta which is nevertheless always perceived as a safety haven.

World Research of the Bank of America

Main character energy

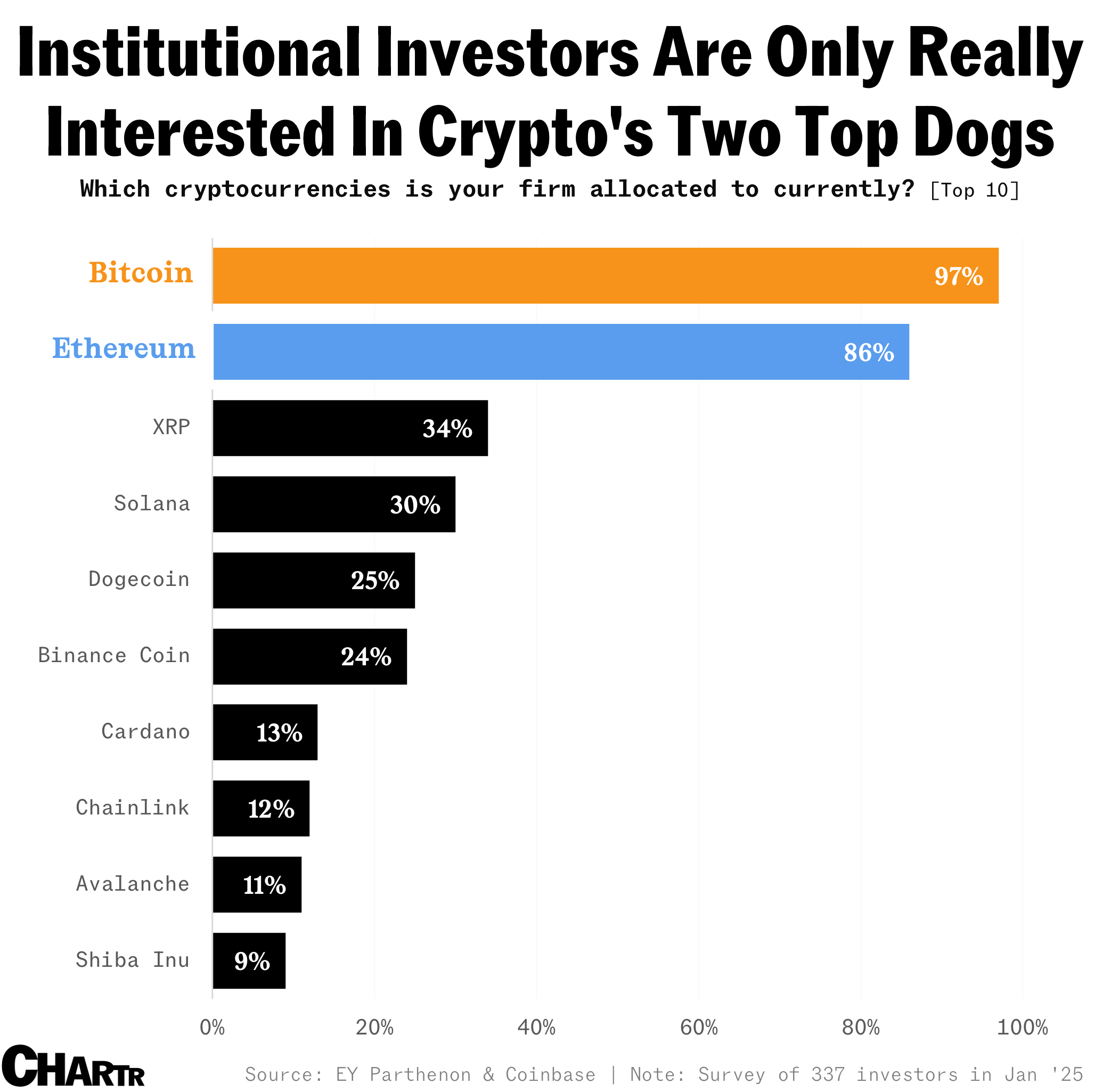

The rising tide does not raise all boats in the world of cryptography. A Coinbase-Eynon survey with institutional investors reveals that this new institutional request only filters bitcoin and EthereumWith an overwhelming majority of companies of those questioned interviewed holding the two largest cryptocurrencies (97% And 86%respectively). Even when they are Interested in other currencies, more than half of the respondents had only one or two rooms in addition to BTC and ETH.

Sherwood News

Ethereum, who took advantage of a few Institutional attention from entries and companies from the SPE of record points experimenting with a treasure based on ETF 20% In the past five days, may still need more – the asset is still on 25% Below its top of all time from 2021.

Magic Internet institutional money

Around 2010, when 10,000 BTCs were used to buy two pizzas, cryptocurrency was mainly considered as another means of investment for criticisms of the centralized financial system, which was dominated by banks, traditional currencies and large companies.

Now, 15 years old and a life of bitcoin earnings of a life later, it seems that institutions can begin to shape the domination of cryptography more than original hodlers.