Key notes

- The XRP price increases above $ 3 while traders anticipate the increase in the Ripple’s WOI Bank License demand.

- The derivative data shows 8.9 billion dollars of open interest, signaling renewed institutional speculation despite the liquidity of the weekend.

- The graphic indicators reveal that XRP entering a critical resistance area from $ 3.10 to $ 3.15, with a potential for a break of $ 5 in the fourth quarter. .

The XRP price exceeded $ 3 on Sunday October 5 and was held stable around its average of five days. Despite a modest increase of 2%, XRP seemed to be underperforming Bitcoin and Ethereum, which gathered more than 3% while BTC established new heights of all time. This divergence suggests that XRP could be started for a delayed rise momentum, because the liquidity of the record overvoltage of Bitcoin is poured into high capitalization altcoins.

A major story that stimulates the current XRP price rally is the current Ripple demand for an American office of the Banking License Controller (OCS). If it is approved, Ripple would join Kraken and encircling as one of the rare crypto-native entities with banking diplomas at the federal level, granting direct access to American financial infrastructure.

The intense speculation banking license request

The license would allow Ripple to contain deposits, settle transactions and provide natively childcare services, with XRP liquidity operations on the chain.

Discussions on social media platforms highlight the growing optimism around the proposed Ripple National Bank. A user has hypothesized that these opinions can take from 5 to 6 months, placing XRP in good standing for a positive market reaction to Christmas.

OCSSIBLE generally takes 5 to 6 months to revise if everything goes well, which would be approval around December. Merry Christmas to all of us!

– The foil (@thefoild) October 5, 2025

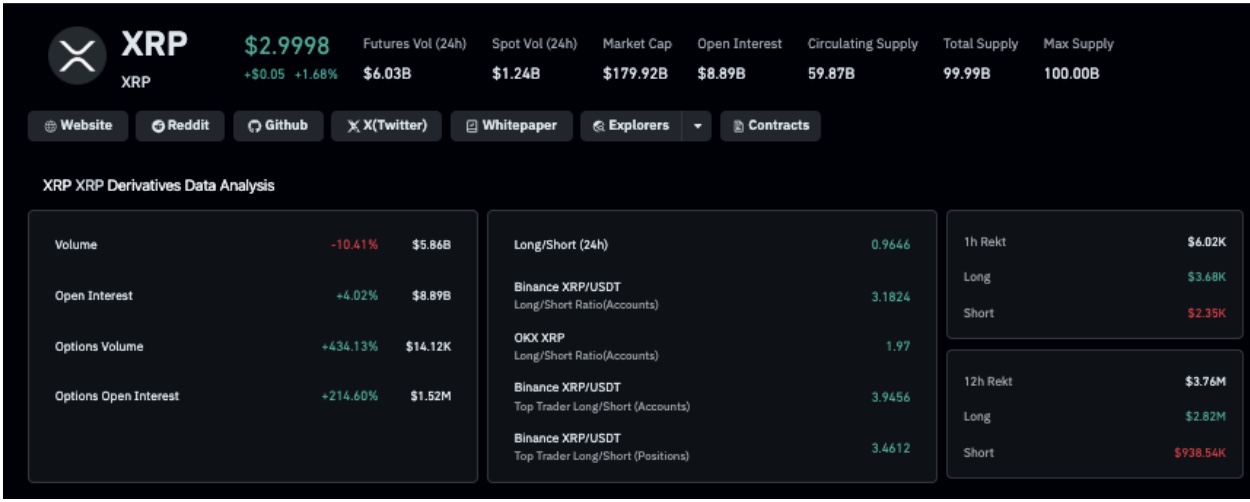

Although the official confirmation remains pending, the majority of XRP traders seem to position themselves for a positive performance in the coming week. Coinglass data show that XRP opened interests have jumped 4% in 24 hours to 8.9 billion dollars, even if cash trading volumes on weekends dived by $ 10.4%.

Ripple derivative market analysis (XRP), Sunday October 5, 2025 | Source: Coringlass

If the Ripple’s OCC application progresses favorably in the coming weeks, it could intensify the active tail winds of the imminent ETF Verdicts, and the increase in leverage positions could accelerate the price of XRP to the range of slippage at $ 5.

Ripple XRP price forecasts: Bulls Eye $ 5 if $ 3 The support holds

Technical indicators on the daily XRP / USD graph confirm the upper nuances despite the volume of moderate weekend. The price is currently negotiated nearly $ 2.99, comfortably above the Bollinger median point 20 days to $ 2.93 and supported by the SAR parabolic base line at $ 2.74.

Ripple technical price analysis (XRP) | Source: tradingView

The Delta volume has become positive at + 2.7 million, after a week of negative divergence, further reaffirming the renewed domination of the buyer.

Bollinger’s upper strip is nearly $ 3.13, representing the next key resistance area. A decisive daily fence greater than $ 3.15 could confirm an escape from the two -week consolidation channel, potentially targeting the level of $ 5 if the ETF XRP obtain an approval verdict in the coming weeks.

However, non-compliance with the $ 2.93 support area could invite a short-term correction to $ 2.74, where the parabolic SAR provides strong structural support.

following

Non-liability clause: Coinspeaker undertakes to provide impartial and transparent reports. This article aims to provide precise and timely information, but should not be considered as financial or investment advice. Since market conditions can change quickly, we encourage you to check the information for yourself and consult a professional before making decisions according to this content.

Ibrahim Ajibade is a seasoned research analyst with training by supporting various web3 and financial organizations. He obtained his undergraduate diploma in economics and is currently studying for a master’s degree in blockchain and distributed major book technologies at the University of Malta.

Ibrahim Ajibade on LinkedIn