Digitalx LimitedAn Australian digital investment manager, made the headlines with a new Bitcoin acquisition (BTC)reporting renewed institutional trust in the market. The Crypto Fund manager classified asx widened his Bitcoin treasure by a huge 74.7 BTC, marking an important addition to its already existing assets.

Digitalx buys 74.7 BTC

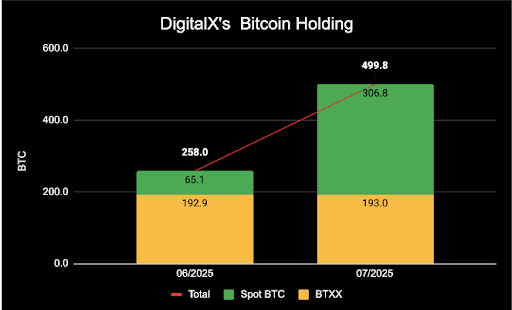

In a recent x social media job On July 23, Digitalx confirmed the addition of 74.7 BTC to its treasure. The acquisition, completed at an average price of $ 117,293 per BTC, reflects the continuous commitment of the company to its strategy led by Bitcoin. This last purchase increased the total Bitcoin Holdings of the Crypto fund manager at 499.8 BTC, worth around $ 91.3 million.

Related reading

In particular, the company too announcement And extended the details of this large -scale bitcoin purchase in an official declaration on Investorhub. On its total 499.8 BTC Holdings, 306.8 BTC are held directly by Digitalx, while the 193 remaining pieces are kept indirectly through 881,000 units in its ETF Bitcoin classified asx, BTXX.

The recent addition of 74.7 Bitcoin follows an earlier acquisition of 57.5 BTC disclosed by the company on July 18, 2025. These consecutive purchases demonstrate a continuous reallocation of the digital digital assets towards Bitcoin. The total treasure of the company, excluding cash, now exceeds $ 104.4 million.

As part of its long -term crypto strategy, the adjustment of the targeted Digitalx portfolio is strengthening its role as an institutional quality Bitcoin investment vehicle on the Australian securities exchange. The Crypto Fund Manager highlights its latest acquisition as a key step in its continuous effort to establish bitcoin as its heart Treasury reserve active.

The development of shareholders accuses as the value of the Bitcoin treasure increases

According to its official declaration, the Digitalx strategy goes beyond the simple growth of its BTC reserve. It also aims to improve the value of shareholders thanks to coherent and transparent reports. The Crypto Fund Manager now follows its Bitcoin holders by action Satoshis (Sats)The smallest BTC unit.

Related reading

Since the last update, the BTC by digitalx action amounts to 33.88 SAT, marking a 58% increase in its Bitcoin Treasury Value since June 30, 2025. This figure reflects the impact of recent acquisitions and provides a somewhat measurable reference for investors evaluating exposure to the company’s considerable portfolio.

Prioritizing Bitcoin accumulation And optimizing its cash structure, Digitalx continues to position itself as a prominent cryptocurrency company – one which considers the value of shareholders as being directly linked to the strength and growth of its BTC participations. The company also doubles its long-term vision to take advantage of flagship cryptocurrency as a strategic financial basis.

Leigh Travers, former CEO and current non -executive president of Digitalx, reaffirmed The company’s commitment to its digital asset objectives, declaring that it aims to regularly develop its BTC portfolio throughout the year and in the future.

Pixabay star image, tradingView.com graphic