- TIA’s exit from a falling wedge pattern indicates bullish momentum

- Social dominance and favorable liquidation trends supported TIA’s strong recovery potential.

THE Celestia (TIA) The token recently made an impressive move, breaking out of a falling wedge trend during the fourth half of the year. Such a breakout often suggests a bullish reversal, and the Celestia pattern also seemed to attract some attention.

At press time, TIA was trading at $4.54, down 1.31% over the past 24 hours. However, this slight drop could be temporary as other signals pointed to a potential shift towards bullish momentum.

TIA chart hints at upside potential

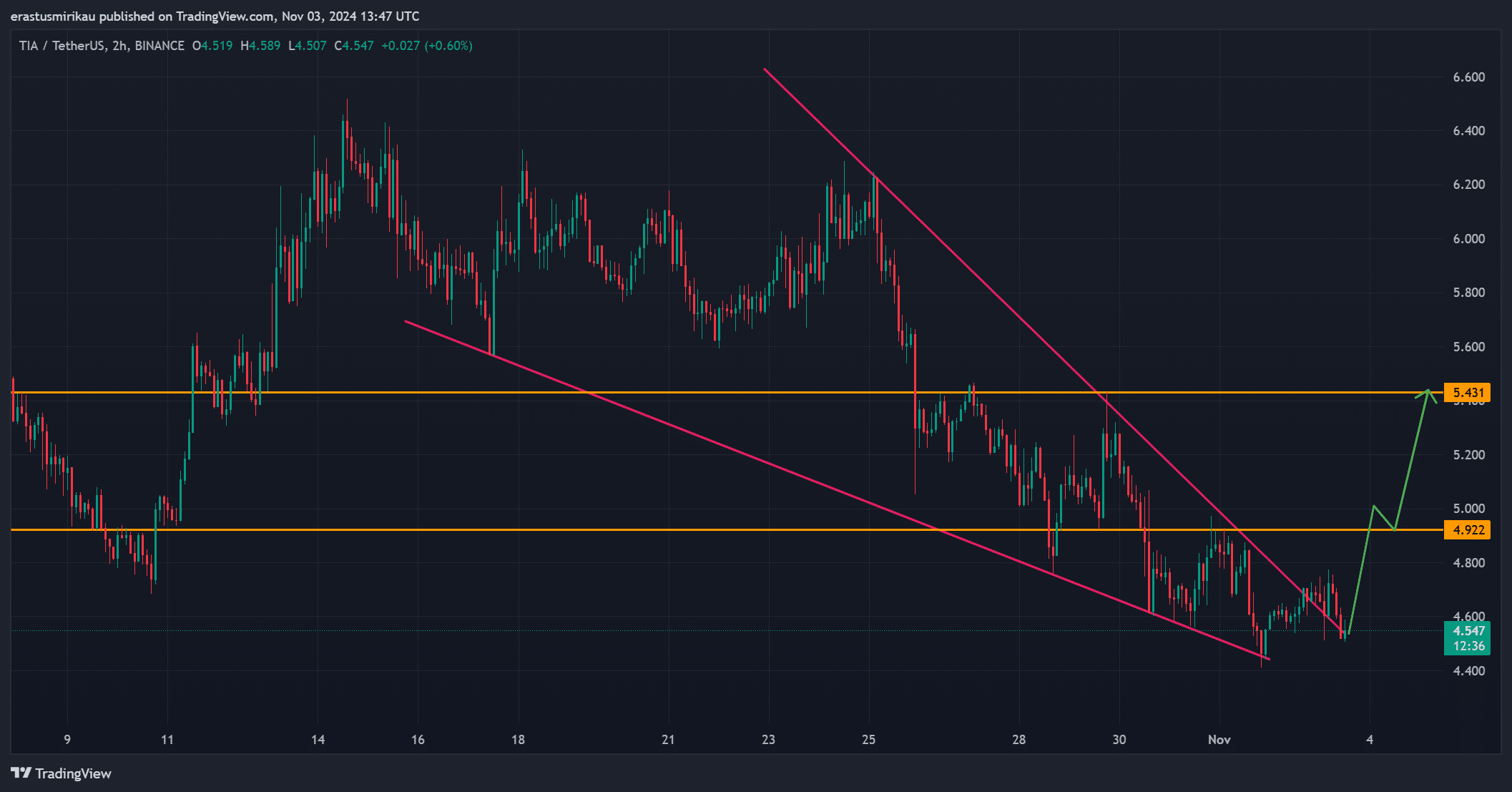

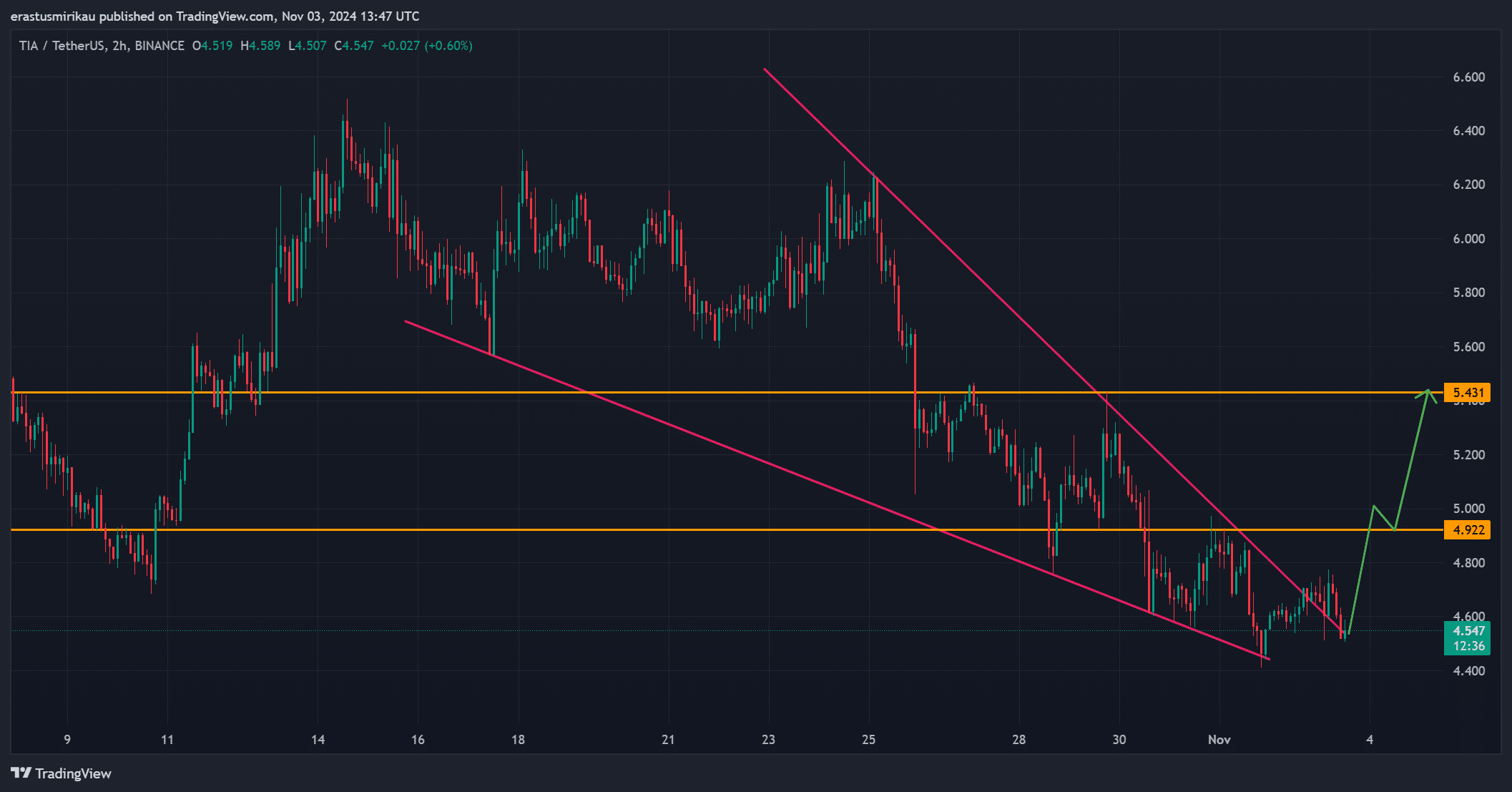

A breakout from a falling wedge can be a strong bullish indicator, and Celestia’s recent chart suggests exactly that. At press time, the token was facing crucial resistance around $4.92 – a level that had previously capped upward moves. Therefore, breaking above this first barrier could fuel additional buying pressure, with the next significant resistance area around $5.43.

Crossing this level could open the door for a significant rally, as it could spark greater investor interest. Therefore, traders are closely monitoring Celestia’s movements around these levels.

Source: TradingView

Growing social dominance provides momentum

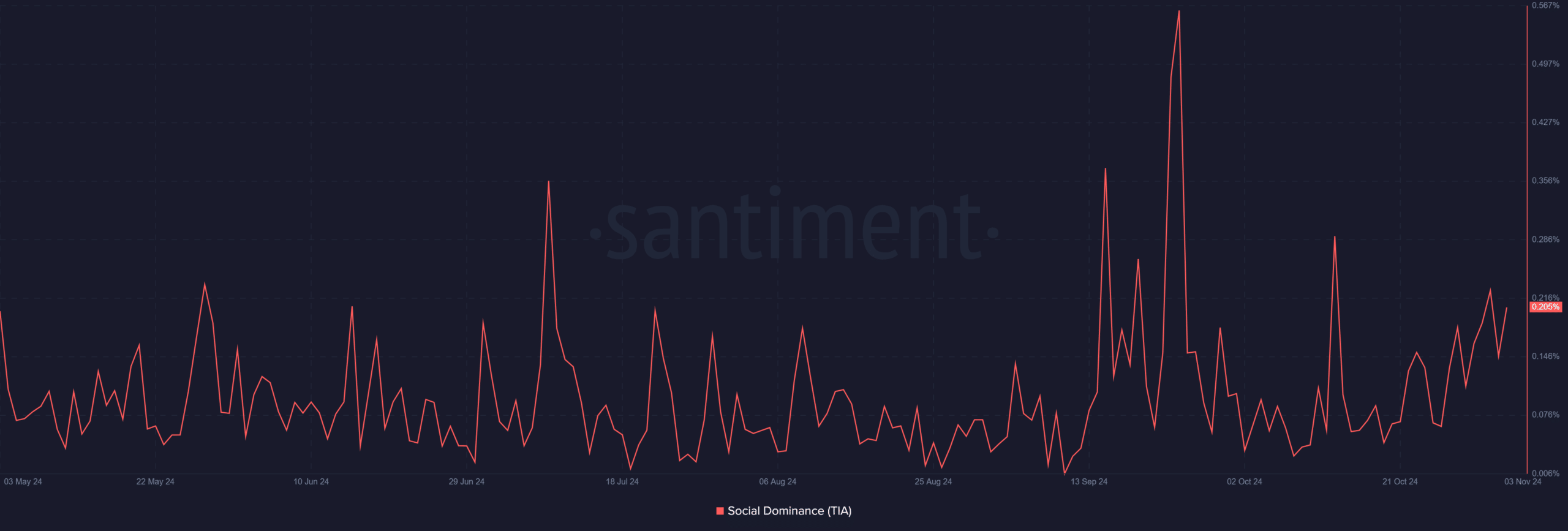

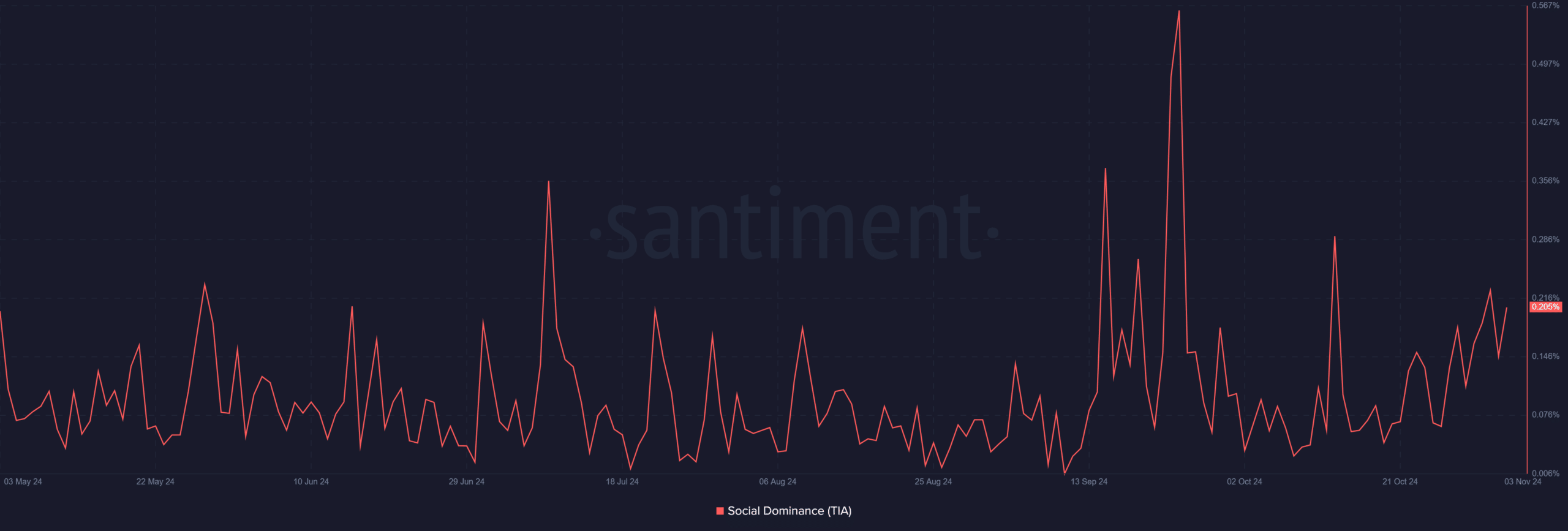

Additionally, social metrics revealed growing interest in TIA, which could further support its price action. Recent data indicates that TIA’s social dominance has reached 0.205%, highlighting the growing attention within the crypto community.

Such a spike in social activity often correlates with higher trading volume and investor enthusiasm.

Therefore, a rise in social sentiment could attract new buyers and strengthen the bullish momentum of the token. Therefore, the combination of technical breakout signals and increased community interest may well align with Celestia’s near-term outlook.

Source: Santiment

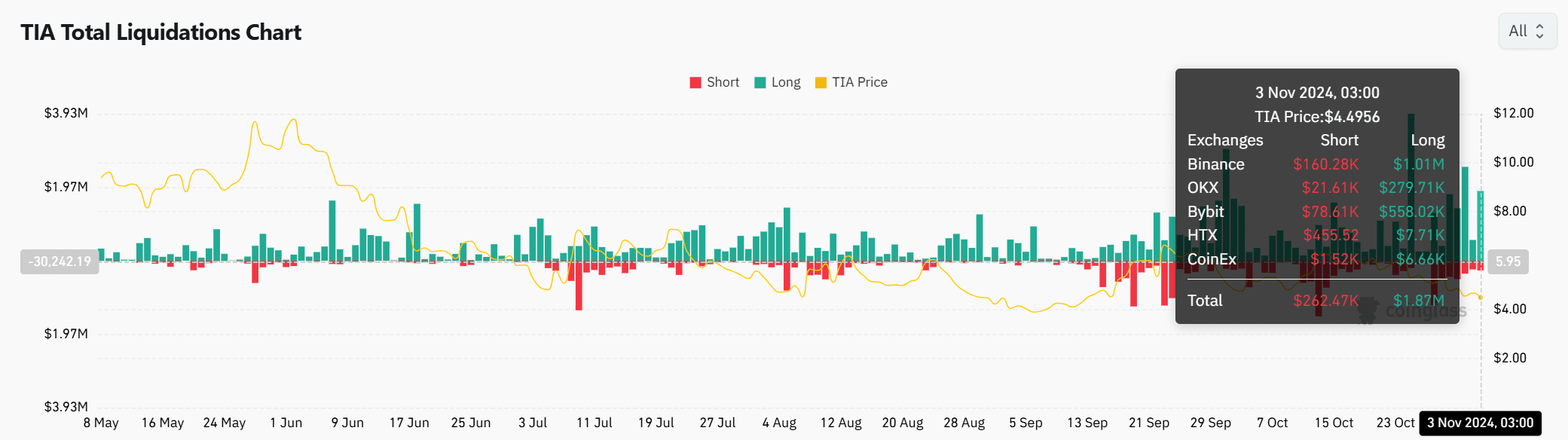

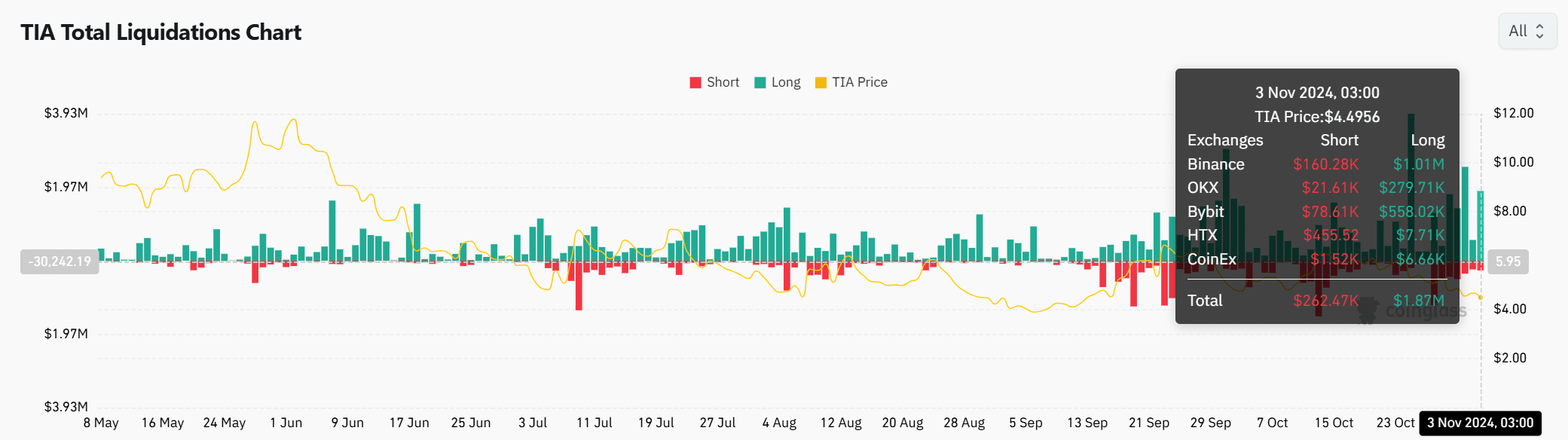

Liquidation Data Signals Bullish Sentiment

Additionally, liquidation trends revealed favorable conditions for TIA. At press time, long positions outnumbered short liquidations, with $1.87 million in long positions versus $262.47 thousand in short positions on exchanges including Binance, OKX, and Bybit. This imbalance meant more traders were positioning themselves for a potential move higher.

Additionally, the relatively lower level of short liquidations indicates that bearish sentiment may be easing. Therefore, with bullish positions dominating, the potential for upward pressure on TIA price appears to be stronger, especially if demand continues to increase.

Source: Coinglass

Can TIA overcome the $6.50 barrier?

With a strong breakout, growing social interest, and a favorable liquidation framework, TIA could be positioned for a significant move. However, the token needs to overcome the immediate resistance at $5.43 before targeting the $6.20 to $6.50 range.

If TIA manages to break above these levels, it could attract greater market attention, possibly paving the way for an extended rally. Therefore, the next few days will be crucial for TIA’s price trajectory as it attempts to capitalize on this recent momentum.

Is your wallet green? Check out the TIA Profit Calculator

Will TIA break through?

Given the technical breakout, increased social buzz, and favorable liquidation trends, TIA has shown promising signs of challenging its resistance levels. If it manages to decisively break above $5.43 and head towards $6.50, it could confirm an uptrend.

However, sustained buying pressure will be essential for TIA to secure a solid uptrend and longer-term rally.