Posted on March 13, 2025 at 2:42 p.m..

A strong argument can be advanced that stablecoins are the only real application of the crypto. Led by the emission of USDT giants (market capitalization: $ 143.34 billion) and USDC ($ 57.85 billion), the $ 235 billion sector is the blockchain -based economy.

Stablecoins are useful in several ways. During bullish times, traders follow their flows in exchanges, as these assets are the dry powder necessary to start buying. They have also proven to be a critical rescue in stormy weather for investors who want the security of the US dollar but remain ready to be purchased.

But in this crisis in the cryptography market, traders are turning more and more to another digital active ingredient which not only has its value but pays a small yield.

Tokenized treasure bills, a sub-assembly of the growing active asset market (RWA) which pack the debt of the US government in blockchain tokens, have long been the small engine that could. A year ago, in March 2024, the RWA industry won a billion dollars of assets under management (AUM).

“I just occurred, $ 1 billion in US treasures of $ 1 billion on public blockchains”, ” tweeted The Tom Wan industry analyst of entropy advisers.

Although this number may seem large to occasional observers, it is a ribbon of the US treasure market of 28 billions of dollars.

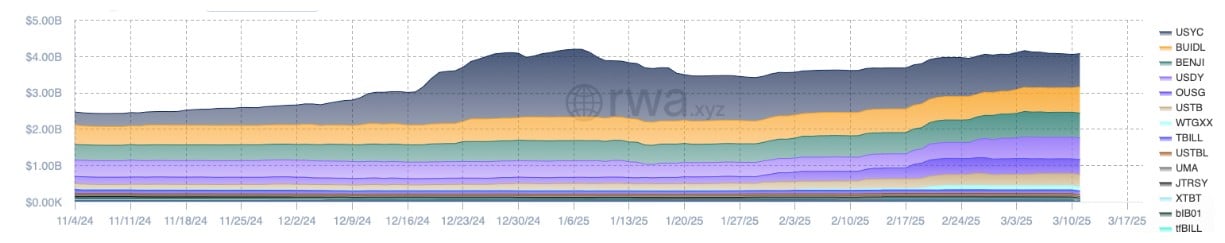

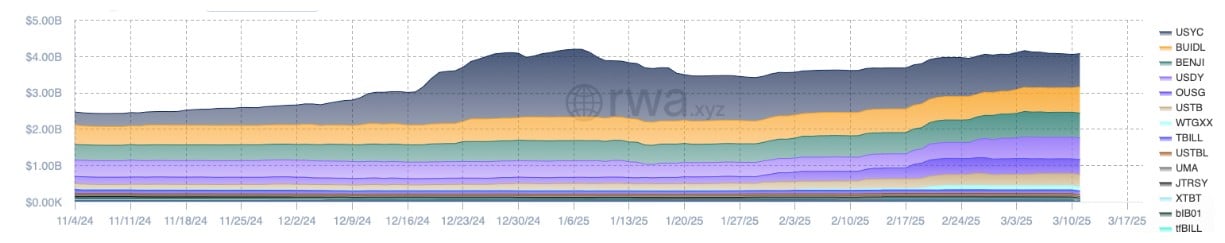

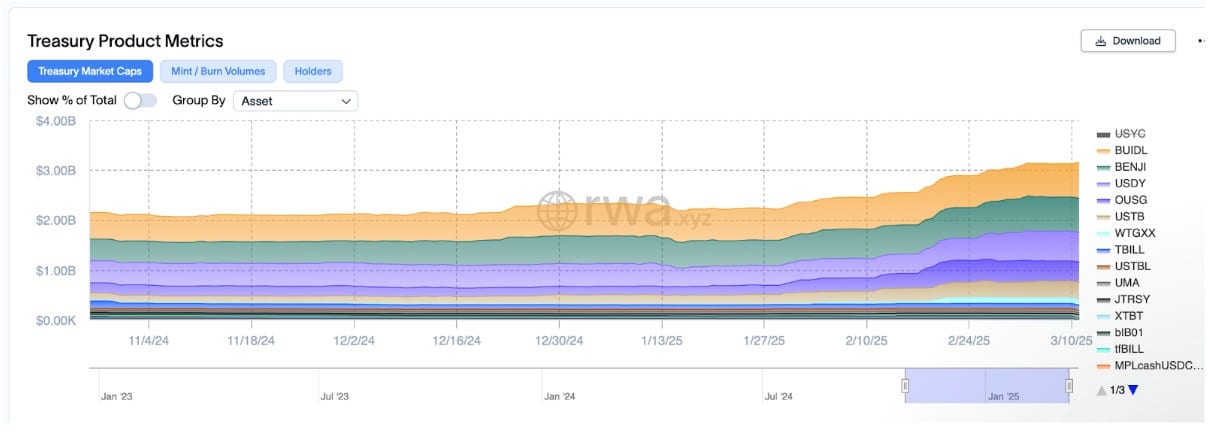

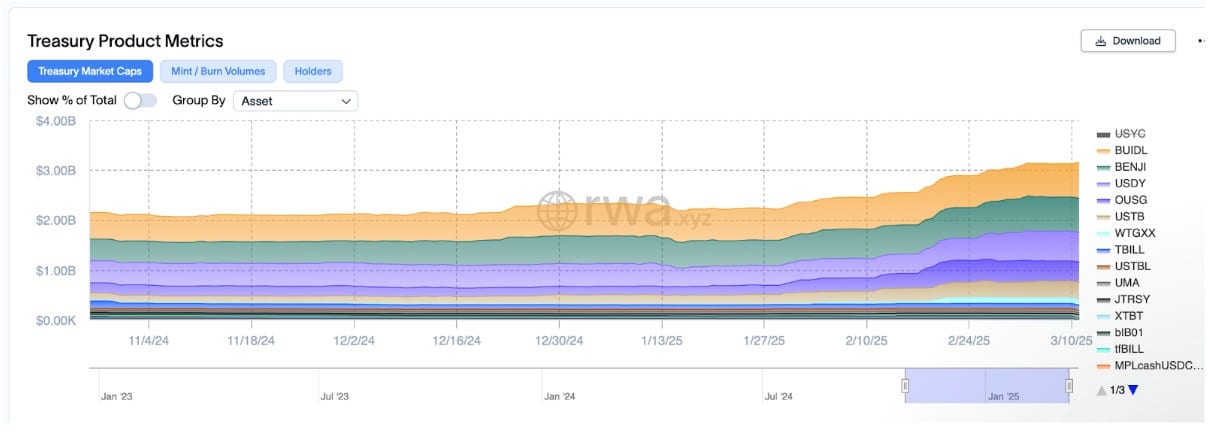

A year later, the tokenized treasure market quadrupled to approach $ 4 billion.

It is always a bite of bread compared to the total market, but it represents a growth of 300%. More striking is that, although there are a lot of discussions on the growth of stablecoins in this tenuous macro environment while traders flee the cryptographic assets that flow, the tokenized treasure goods increased almost 20x as quickly as their brothers and sisters of Stablecoin.

Stablecoins do not make any interest in their holders, leaving the issuers like Tether and Circle invest the guarantees in short -term treasury bills and billions of risk -free profiles. The product has also been in a regulatory gray area as legislators in Washington, DC continues to progress in legislation. It has always been a question of when merchants are starting to demand their share of their return.

It finally seems to happen.

Boom of token treasure bills after the elections

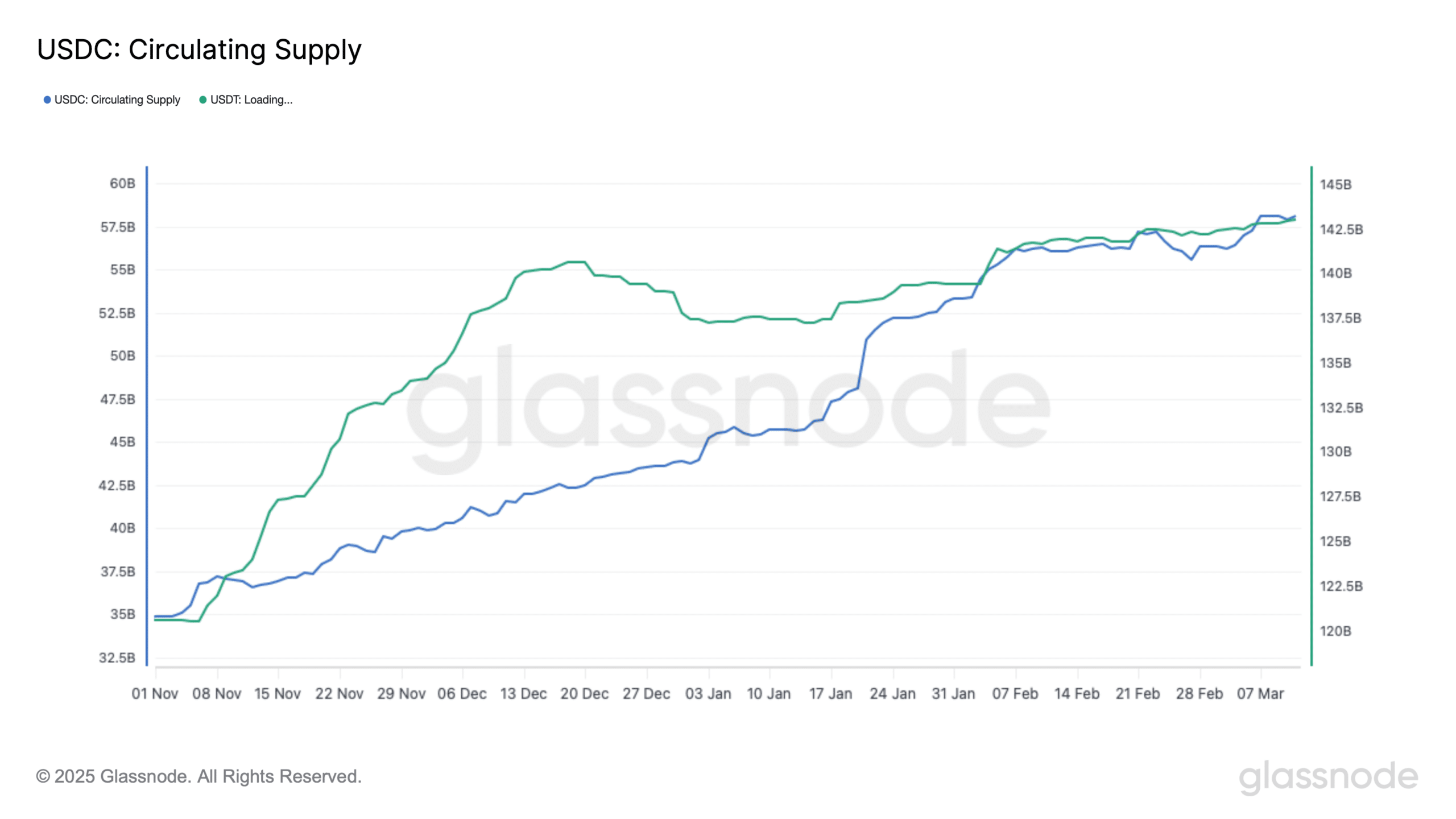

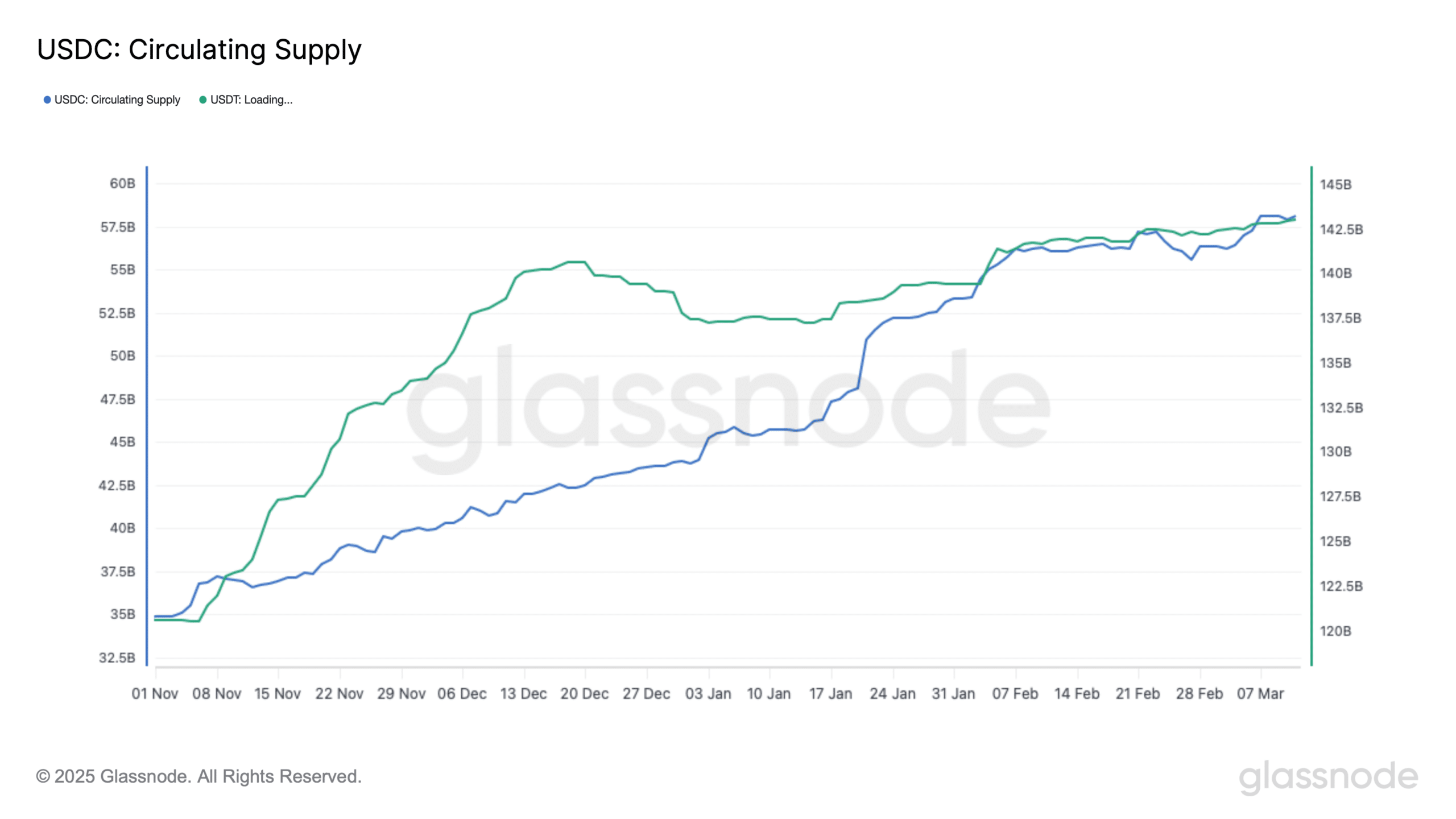

Stablecoins have seen a great increase in growth after Donald Trump was re -elected to the presidency on November 5. On this date, the Stablescoin market was worth 183.82 billion dollars. Since then, he added $ 50.95 billion, USDT and USDC, each adding more than $ 20 billion while the traders were looking to capitalize on Trump’s pro-Crypto momentum which propelled the price of Bitcoin to a summit of $ 108,000 in January. This represents an increase of 27.71% of stablecoins.

However, tokenized treasury bills experienced growth of 68.3% during the same period, or growth faster of 2.46x to increase from 2.4 billion to $ 4.1 billion.

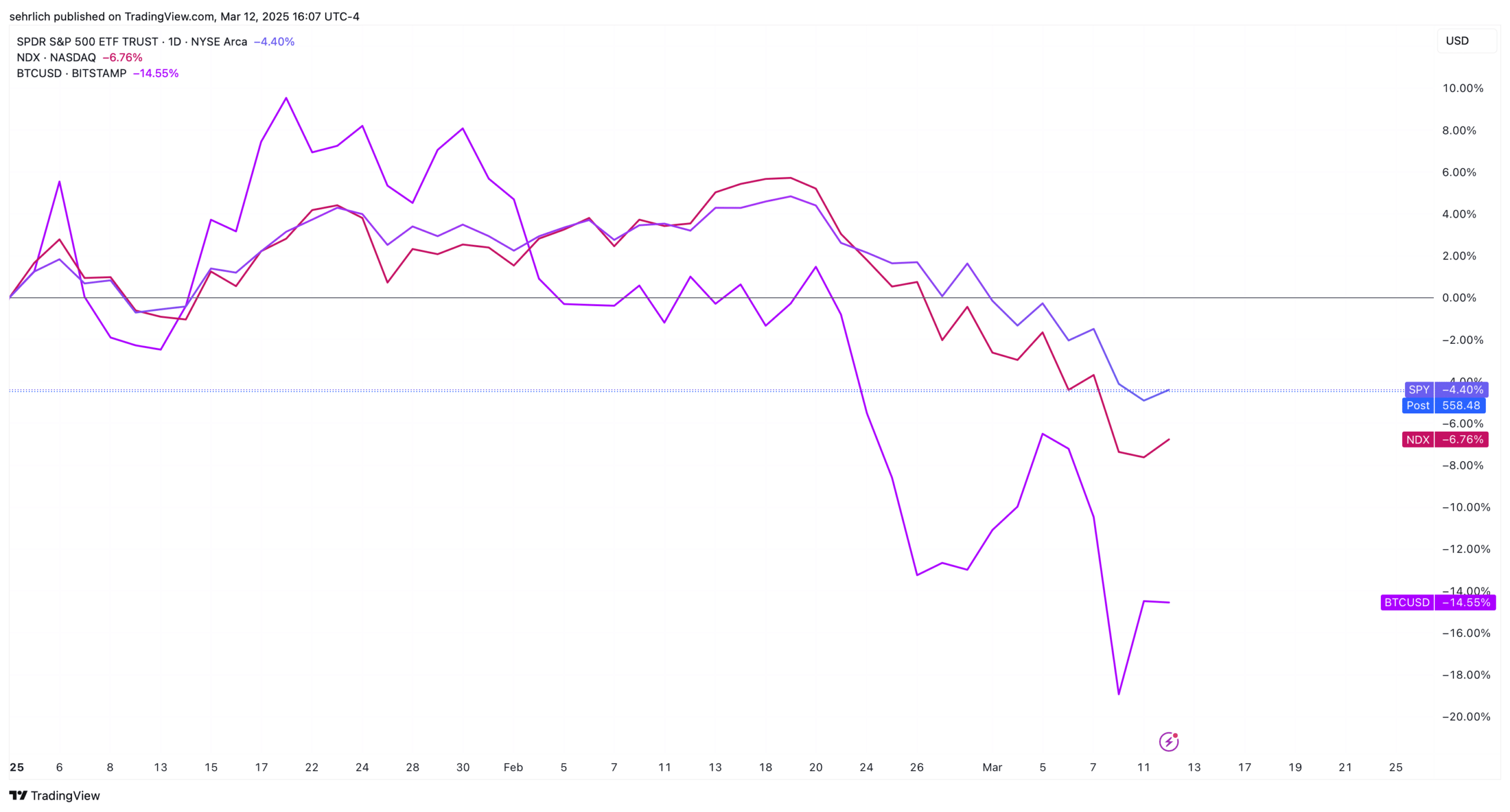

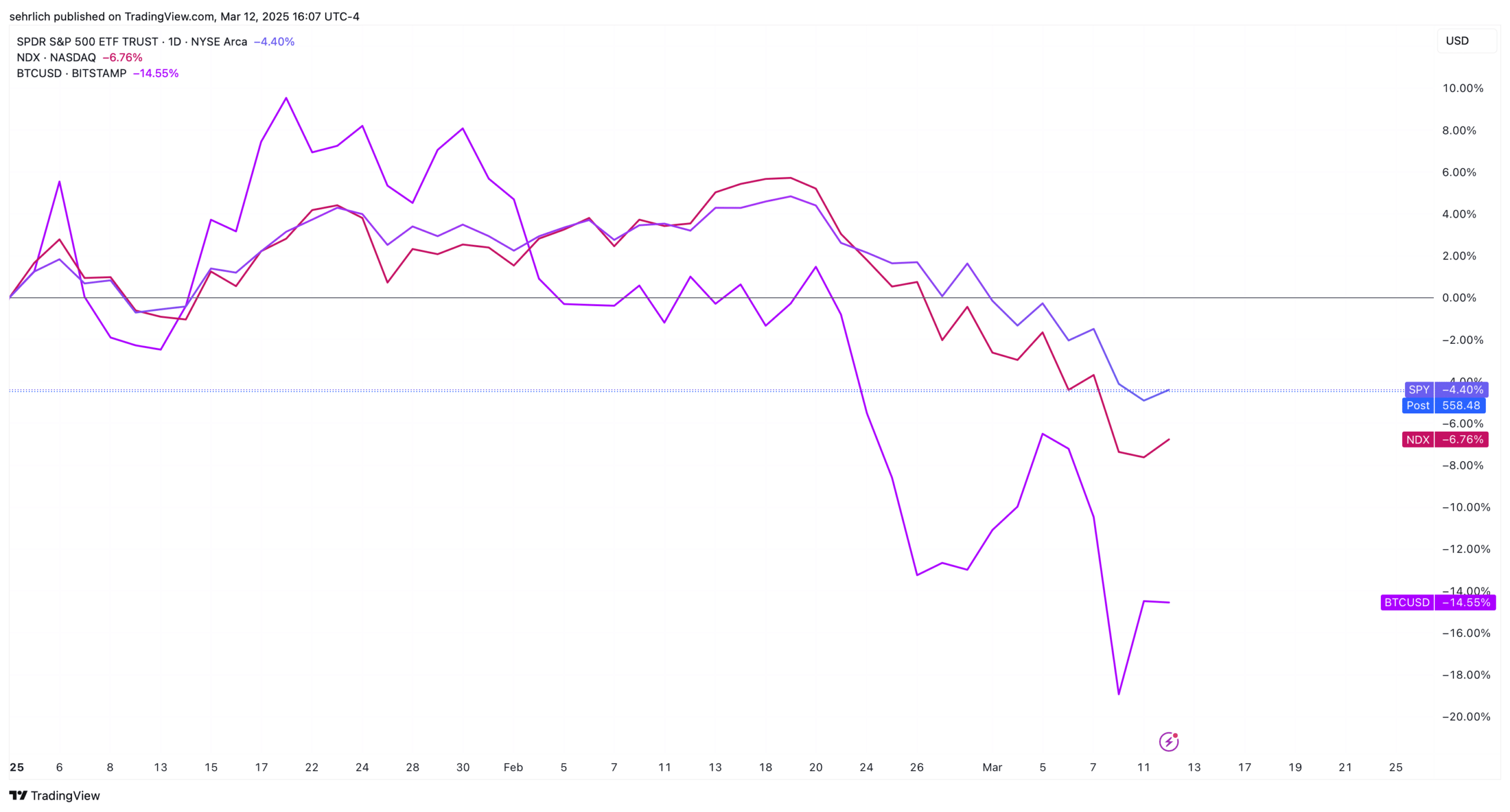

The trend is even more striking by looking at the last few weeks. Analysts generally consider that the market, or an index, is in a correction when it drops at least 10% compared to a recent summit. The S&P 500 and the Nasdaq 100, heavy with technology, started their trends down on February 19 and entered the correction territory in the last day. Bitcoin is down almost 30% compared to its summit at the end of January.

During the period from February 19 to March 11, the Stablescoin market increased from $ 233.81 billion to its current $ 234.77 billion, or 0.4%. In comparison, tokenized treasury bills went from $ 3.8 billion to $ 4.11 billion. This represents growth of 8.16% in just over two weeks.

Each penny counts

Several experts indicate to UNCHAINED that a major reason for this growth in Tokenized Treasury bills is that traders are under pressure in this economy to stretch each gain. Tokenized treasury bills pay an average of 4.27% per year to their holders. This may seem like a rounding error in the crypto, but in this uncertain environment, it suddenly becomes material, especially for sophisticated traders.

“We must expect those who display stable guarantees such as the main users of tokenized treasures in order to win the performance on the guarantees they publish,” said a USDC spokesperson from the USDC Circle, who recently bought Hashnote, treasury treasury issuer at 912 million dollars. A merchant who wanted to remain anonymous puts things more succinctly: “Why use something that does not give you any return when you can earn an additional supplement?” It’s just to put your collateral order to work. »»

Falconx, a leading brokerage, accepted monetary market funds in tokenized like Blackrock’s Buidl and USTB of Superstate as guaranteed for almost a year. Recently, the company also started accepting Jito Jito Solana (Jitosol) as guaranteed for certain trades.

“I expect the industry to continue in this direction, allowing investors to maximize the effectiveness of assets,” said Matthew Sheffield, main vice-president of Falconx trading.

What is in your token?

There may be more at stake here. Despite their name, the Stablecoins have historically suffered periods of instability. The attachment was prey to So much fear, uncertainty and doubt (Fud) that there is a nickname for people who claim that the transmitter does not have the guarantee to support its massive product, a “truther”. However, Tether never failed to respect a redemption.

The USDC was marketed as the USDT FUD antidote, but even he struck the snags. In March 2023 USDC exceeded its price of $ 1.00 Up to $ 0.87 when it was revealed that the company has placed $ 3.3 billion in guaranteed guarantees in Silicon Valley Bank in difficulty. The federal government finally intervened and guaranteed all SVB deposits above the limit of the FDIC of $ 250,000, but investors were marked.

During these perilous days, investors learned some lessons. It can be difficult to know the exact composition of the guarantee of a stablecoin. Second, if you want to convert the tokens to the underlying warranty outside of normal banking hours, you may be lucky.

According to Sandy Kaul, the main vice-president of the director of assets Franklin Templeton and head of his division of digital assets, treasury vouchers are the answer.

“Yes, Stablecoins can move around the ecosystem, but they cannot be removed from the chain and return to Fiat during the periods when there are no banking hours,” she said. Tokenized treasury bills, she said, offer “more certainty about going from a regulation in a regulated entity”. In the event of market calamity, Kaul said: “There is a chance that the shock can exceed. If I can get out of this stablecoin in an American treasure, at least I know that the American treasure is a regulated vehicle (and) will not change value of day overnight. »»

A tokenized future?

It seems clear that the industry has crossed the Rubicon and the Tokenized Treasury Bonnes will be there to stay. But the rate of growth will depend on a few factors.

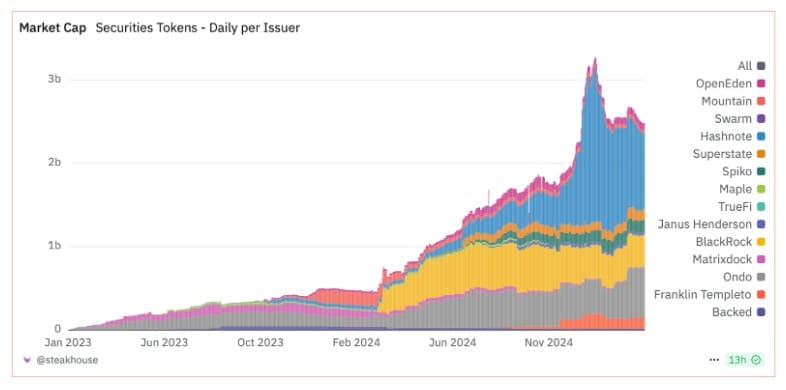

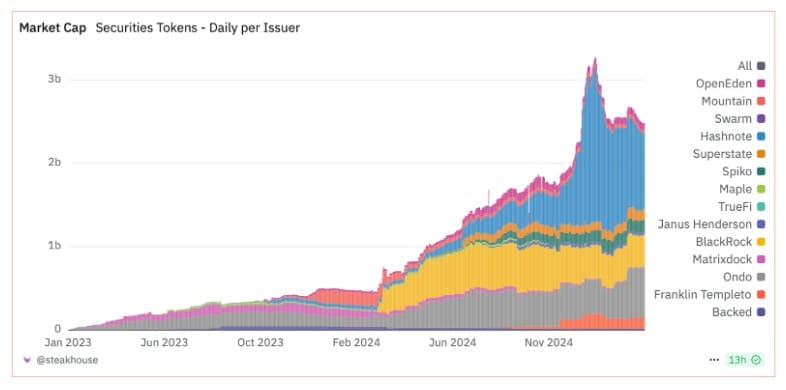

An important reason for the massive overvoltage of these products in recent months was a October decision by DeribitThe largest supplier of cryptography derivatives to the world, to accept the USYC of Hashnote as guaranteed for margin transactions on the platform. The timing was extremely very fortunate because it caught the wave of Bitcoin at the end of 2024 early. On October 9, the day of the ad, Bitcoin was worth $ 60,370. By the inauguration of Trump, he had jumped 76% to exceed $ 106,000.

Many of these traders have benefited from the basic trade, which is essentially a way to earn free money by buying a bitcoin spot and then selling a higher price contract. It is an extremely profitable strategy during bullish periods.

“Base trade is obviously one of the most popular professions at the moment, and it is because Tradfi has essentially found an opportunity to return from the above market which exceeds 15 to 25 normal (basic points) that a monetary market manager fights mainly to perform too much,” explains the anonymous merchant. “You can currently gain 8% on species and transport exchanges roughly, so when you see it being used in leverage, you will earn a return on your warranty.”

The magnitude of this wave is obvious in the graph below, where Usyc has gone from almost nothing to more than a billion dollars in alms.

But it would be an error to assign all the growth of treasury bills to the USYC. Excluding this token, the rest of the tokenized treasure market has increased by 17% since February 19. Since the day of the election, the tokenized treasure market excluding USYC has jumped 51.68% from 2.08 billion to $ 3.155 billion.

This particular trade can fall into short -term disgrace given the market correction, but it should resume popularity once a new bullish cycle is hit.

In the meantime, tokenized treasury bills could also continue to gain the favor of traders who want to stay ready to jump on market opportunities. “It is like any trader in shares that goes from actions on the money markets,” said Steve Sosnick, chief strategist at Wall Street Colossus Interactive Brokers. “It’s the same basic motivation.”