Join our Telegram Channel to stay up to date on the coverage of information on the breakup

FUNSTRAT CIO TOM LEE says that the Leaders of the Crypto Bitcoin (BTC) and Ethereum (ETH) market are about to print “monster” gains if the federal reserve announces a largely awaited interest rate drop this week.

“I think they could move a monster in the next three months”, Lee saidWho is also president of the company of Eth Treasury Bitmine Immersion Technologies, in an interview with CNBC.

Related The prediction is based on the conviction that cryptos like BTC and ETH are sensitive to monetary policy and better placed to benefit from a drop in rate, which generally leads to An increased appetite for risky assets such as cryptos.

Lee compared the current situation to September 1998 and 2024, when the Fed reduced rates after a “prolonged break”.

“The Fed can really reject confidence by saying that we are back in a relaxation cycle,” he said, adding that a drop in rate will be a “real improvement in liquidity”.

Ethereum has a “growth protocol”, says Lee

Lee said that although Bitcoin and Ethereum are sensitive to liquidity on the market, Altcoin should also benefit from the recent decision of AI and Wall Street developers to transmit in a chain in what he called a “pussy-cat moment of stablecoin for crypto”.

“So, Ethereum, I think that the exchanges are almost in 1971 Wall Street, which was when the dollar came out of the gold stallion” and there was “a lot of innovation,” added Lee.

“Ethereum is essentially a growth protocol,” he said. “The convergence of Wall Street moving on the blockchain and AI and the agentics-Ai creating an economy in token create a supercycle for Ethereum.”

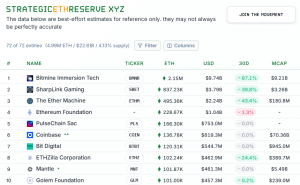

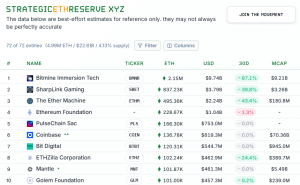

This is also why the Bitmin was so aggressive in the accumulation of Ethereum Ethreum’s Ethreum token, he added. The company is currently the largest holder of corporate Ethereum in the world, with approximately 2.15 million ETH worth around 9.21 billion dollars, data Programs on emissions.

Top ten ETH cash companies (Source: Reserve strategy))

Bitmine used the same debt financing game book used by Michael Saylor’s strategy to buy Bitcoin, and currently holds 1.78% of the total ETH offer.

Analysts recently expressed concerns concerning the decrease in the company, but he jumped 17% last week and is now down 3% in the last month, according to Google Finance.

Traders anticipate the drop in Fed interest rates while Trump pushes more

Lee’s predictions occur while traders are becoming more and more confident that the Fed will announce the first drop in interest rates for the year this week.

The Fed begins a two -day political meeting today, the decision scheduled for September 17. The markets expect a drop of 25 basic points, which would reduce interest rates between 4% and 4.25%.

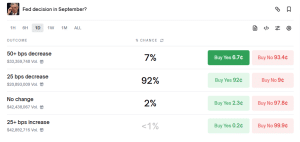

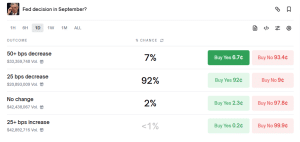

Traders on the Polymarket decentralized prediction platform place the chances of a reduction advertisement of 25 BPS this week at 92%. There are even some who see 7% like that a larger 50 SBPS reduction is announced.

Counts of lower interest rates (source: Polymarket))

These chances are taken up by the CME Fedwatch tool, which shows that analysts see 96.1% chance that prices are reduced at the next Fed meeting. These analysts also see a 3.9% chance that the Fed reduce the rates of 50 BPS.

It was then that US President Donald Trump continues to put pressure on the president of Fed, Jerome Powell, for large interest rate drops.

In August, Trump argued that interest rates should be reduced by 3 percentage points. He added that interest rate reductions of this magnitude would allow the United States to “a dollar billion per year”.

🇺🇸 Trump said inflation is very low and that Fed should reduce the rates by 3 points. pic.twitter.com/fljnhjphsf

– ash crypto (@ashcryptoral) July 15, 2025

The crypto market has exchanged in the past 24 hours before the Fed decision, but maintains a capitalization of more than 4 dollars, according to data from Coinmarketcap.

BTC achieved a minor gain of 24 hours while the ETH slipped with a fraction of one percent. Both are in the green on the weekly time in the longer term.

Related items:

Best wallet – diversify your crypto wallet

- Easy to use cryptographic wallet, easy to use

- Get early access to ICO to toys to come

- Multi-chaînes, multi-walk, non-guardians

- Now on the App Store, Google Play

- Pape to win the native token $ the best

- 250,000+ monthly active users

Join our Telegram Channel to stay up to date on the coverage of information on the breakup