The crypto market ended the year with a combined valuation of $3.26 trillion. The year 2024 saw a change in dynamics in Bitcoin, Ethereum and other assets, influenced by the approval of Bitcoin spot ETFs, the US elections and evolving crypto regulations.

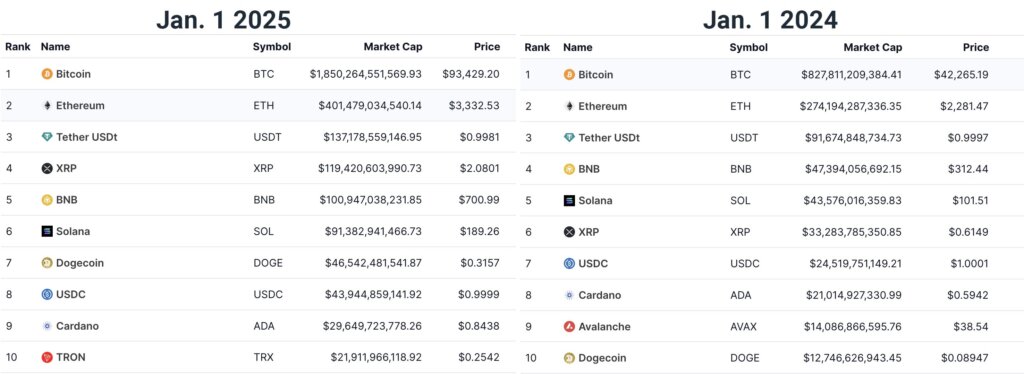

The top 10 coins and tokens as of January 1, 2025 include the majority of those present a year ago. Avalanche dropped out and was replaced by TRON, while others like BNB and XRP swapped places. The second biggest loser was Dogecoin, which fell three places from seventh to tenth.

Crypto markets at the start of 2025

Bitcoin surpassed $100,000 for the first time in December, attracting attention after the November elections in the United States, which led to a dramatic price rise. This rally pushed Bitcoin’s peak above $108,000 before a retracement took it closer to $93,000 by the end of the year.

Ethereum retained its place as the second-largest asset and traded at nearly $3,300 in late December, with a market capitalization of around $400 billion.

Bitcoin’s dominance was approaching 57%, while Ethereum’s share fell to around 12%. Tether retained its position as the world’s leading stablecoin, with a record market capitalization of $137 billion. XRP was hovering around $2.13, reflecting speculation about institutional adoption, and BNB was hovering around $706.

Solana was trading around $190 and Dogecoin closed at nearly $0.31 after a year of meager social media support and market fluctuations tied to Elon Musk’s new government role. USDC was in eighth place with a market capitalization of $43 billion, three times lower than Tether, while Cardano was in ninth and tenth positions at $0.84 and Tron at almost $0.25.

Many observers view 2024 as a pivotal year for digital assets, with Bitcoin’s rise above the six-figure mark attracting the attention of retailers and institutions. The period also saw brief corrections, including a return to the $40,000 range for Bitcoin and similarly restricted moves for several top tokens. As markets continue to react to election results, monetary policies and Trump’s inauguration in January, traders are monitoring liquidity, derivatives activity and protocol upgrades to gauge potential upside.

The year ended with traders eyeing new highs after Bitcoin fluctuated between $100,000 and $92,000. Ethereum has remained the leading smart contract platform by market capitalization, and the demand for stablecoins has highlighted the continued reliance on liquidity pairs. Altcoins like XRP, BNB, Solana, Dogecoin, Cardano and Tron each held or gained their place in the top 10.

Price predictions for 2025 suggest a Bitcoin peak of $180,000 has $200,000, according to institutional analysts. All eyes are now on January 20, when Trump takes office, to see whether a strategic Bitcoin reserve will be passed and whether the SEC’s new leadership will spur a monumental altcoin season.