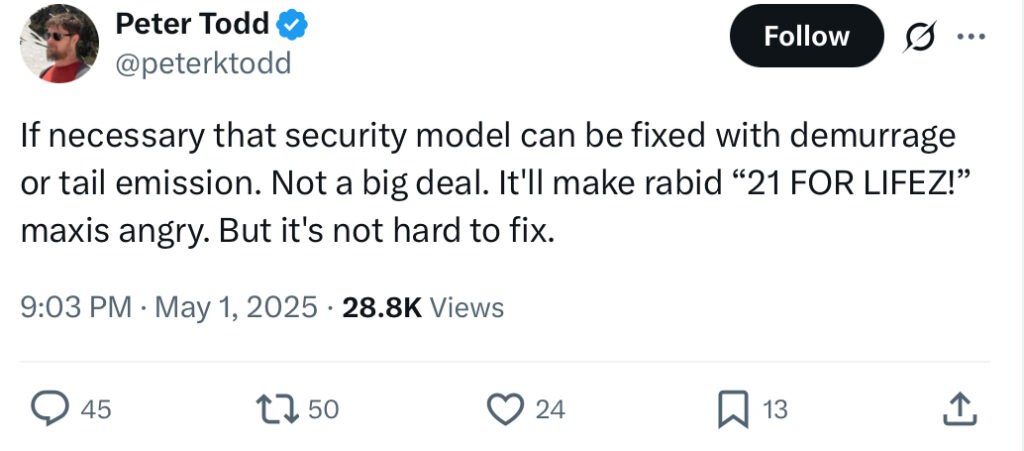

One of the influential Bitcoin developers, Peter Todd (who would also be Satoshi in the HBO documentary), said that Bitcoin may not have a hard cap in the future and swell by 1% per year.

Have you laughed aloud? Many on the internet have alleged that “21 million BTC” is the best story of Bitcoin.

The bitcoin fixed offer of 21 million parts was its decisive characteristic, positioning it as “digital gold” in a world of inflation of fiduciary currency. What happens if it disappears?

The origins of Bitcoin hard cap

Who is Peter Todd? In the new Doc HBO “Money Electric”, Peter Todd, a Bitcoin Clécoin developer, is identified as Satoshi Nakamoto, the creator of Bitcoin.

Todd, illustrated above, is exactly what you could expect in Satoshi. To quote a bizarre song: “White & Nerdy”.

Although the Bitcoin supply limit has become at the heart of its value proposal, it is not explicitly written in its source code. This gradual slowdown is designed to reduce the new program over time, the final play which should arrive in 2140.

Peter Todd proposed to completely rethink the sacred cap, introducing a small constant inflation rate to keep minors encouraged at the end of block rewards. It is a controversial idea, but one is gaining ground among those who are worried about future security risks.

:max_bytes(150000):strip_icc()/BlockReward-5c0ad88946e0fb0001af7198.png)

The change in the ceiling of 21 million bitcoin is not as simple as returning a switch. It would take a formal proposal to improve Bitcoin, a review of in -depth peers and a large consensus of the ecosystem, in particular the 22,000 active nodes which maintain the network in progress.

Without almost unanimous agreement, this decision could trigger a hard fork, fracturing the chain as it did in 2017 with the creation of Bitcoin Cash.

Community reaction

Trying to lift the Bitcoin supply cap, it’s like trying to rewrite the Scriptures – and the faithful do not have it. Analysts argue that its hard limit is the lamp pin for its legitimacy.

“Changing it could undermine confidence in the system,” said Virginia Canter. “Rarity is history.”

And the story was not kind to internal fights. The drama of the size of the blocks which divided the community between 2015 and 2017 is a case study in the speed with which technical debates can become ideological wars.

In the long term, however, a different problem is looming: once the 21 million BTCs are extracted, minors will continue the costs alone. This raises a more important question-will that be enough to keep people satisfied?

What is the next step for Bitcoin?

For the moment, the falsification of the 21 million bitcoin of 21 million ceilings remains speculative.

Sweat technical and political obstacles and potential fallout in the market make it unlikely in the short term. But the conversation underlines how Bitcoin is still evolving and nothing is certain even with BTC.

Explore: the XRP price jumps 11% after the progression of dry crypto unit tease xrp etf

Join the 99Bitcoins News Discord here for the latest market updates

Key dishes to remember

-

The bitcoin fixed offer of 21 million parts was its decisive characteristic, positioning it as “digital gold”.

-

Trying to lift the Bitcoin supply cap, it’s like trying to rewrite the Scriptures – and the faithful do not have it.

The Bitcoin Developer of Post Top Peter Todd Questions 21m Cap: Do you always want to hold? appeared first on 99Bitcoins.