Share this article

Toronto, Canada, January 16, 2025, Chainwire

Torram, a Web2.5 infrastructure company, announced the successful closing of its $710,000 pre-seed funding round in early December 2024. The company is focused on developing decentralized finance (DeFi) infrastructure of institutional level directly on Bitcoin, positioning itself as a key catalyst for innovation in an evolving financial ecosystem.

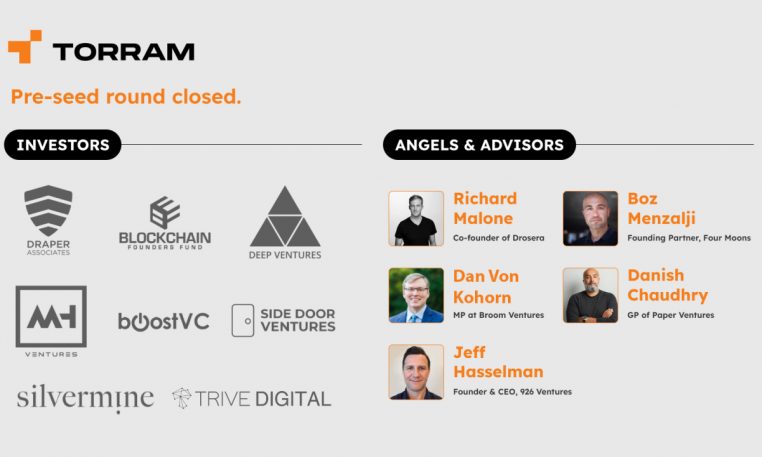

The funding round included participation from leading investors such as Draper Associates, Blockchain Founders Fund, Boost VC, Side Door Ventures, Deep Ventures, MH Ventures, Silvermine Capital, and Trive Digital.

“This oversubscribed funding round demonstrates the growing demand for infrastructure that meets institutional needs,” said Vakeesan MahalingamCFA, CEO of Torram. “We are building what others have not dared to do: transparent and reliable systems on Bitcoin that will redefine the trillion-dollar financial landscape.”

Building institutional DeFi on Bitcoin

Every day, billions of dollars flow between institutions through invisible financial infrastructure. Torram’s mission is to replicate this seamless reliability within DeFi. By developing advanced enablement technology, Torram enables businesses to build robust Bitcoin-native applications while enabling institutions to leverage Bitcoin as a secure settlement layer for financial transactions.

“Our goal is simple,” says Mahalingam. “We are building infrastructure that powers institutional DeFi, using the security of Bitcoin, the innovation of DeFi, and bank-grade reliability.”

Torram’s native Bitcoin toolkit will include:

- Decentralized Oracle Network: Secure real-time data feeds for institutional use, enabling high-stakes operations. Imagine financial data stored on the Bitcoin blockchain using Bitcoin as a settlement layer for fixed income transactions.

- Network of decentralized indexers: Complete indexing of the Bitcoin ecosystem, allowing developers to query blockchain data and build applications. Similar to a search engine for data stored on Bitcoin; organized and easily accessible. With Torram’s indexers, developers can easily find the data they need.

- Decentralized APIs: Standardized tools for seamless data integration, connecting traditional finance (TradFi) to decentralized networks.

Ecosystem Traction and Market Opportunities

Torram reports strong interest in its technology, with more than 40 projects awaiting integration. This highlights the growing demand for reliable infrastructure as Bitcoin continues to expand its role in global finance.

Bitcoin’s market capitalization surpassed $2 trillion in December 2024, reflecting its growing importance. As institutional interest in blockchain technology reaches new heights, the need for scalable solutions tailored to financial institutions has never been greater.

“Torram’s technology bridges the gap between Bitcoin’s potential and institutional requirements,” Mahalingam said. “We are working in spades and shovels to build on Bitcoin. By 2027, paying with native Bitcoin stablecoins will be as easy as sending an email – and our infrastructure will make it possible.

About Torram

Torram is a Web2.5 infrastructure company dedicated to building Bitcoin-native technology that powers institutional-grade decentralized finance (DeFi) and real-world asset tokenization directly on the Bitcoin base layer. This critical infrastructure on Bitcoin will enable financial institutions and developers to create robust applications that will power the future of finance.

X(Twitter): @torram_xyz

Website: torram.xyz

Disclaimer:

This press release contains forward-looking statements. Actual results may differ materially due to various factors. This is not an offer to sell or a solicitation to buy any securities. The information does not constitute legal, financial or investment advice. Readers should conduct their own research and consult professional advisors before making any investment decisions or entering into any agreements. Torram does not guarantee any specific results or return on investment. Torram and its investors are not responsible for any actions taken based on this communication. To see our full disclaimer, visit here.

Contact

CEO and co-founder

Vakeesan Mahalingam

Torram Laboratories

(email protected)

Share this article