One of the largest banks in the city has cropped the withdrawal of the ETH USD price from Ethereum from its top of all time as a golden entry point. Standard Chartered Standard Digital Active Chef Geoffrey Kendrick told customers this week that the USD ETH remains structurally undervalued, set an end-of-year objective of $ 7,500 on the back of growing institutional demand and a wave of cash benefits.

Kendrick’s note stressed that traded stock market funds from Ethereum and business cash companies have accumulated 4.9% of the supply in circulation since June, a figure that it plans to reach 10% by the end of the year.

This regular absorption of tokens was the decisive factor in the ETH race at $ 4,953 on Sunday, overshadowing the record set in November 2021 before trace -11% in the following sessions.

ETF Crypto then treasure bills? What is the legitimate prediction of ETH USD prices from Standard Charterd?

What matters to standard charters is not correction but the structural offer. “ETH and ETH Treasury companies are cheap today,” wrote Kendrick, stressing that business treasury bills benefit from two advantages to exercise awards and make deviated return opportunities for investors ETF.

In his opinion, ETH treasury bills have more sense than Bitcoin vouchers, which offer options for limited performance to passive detention.

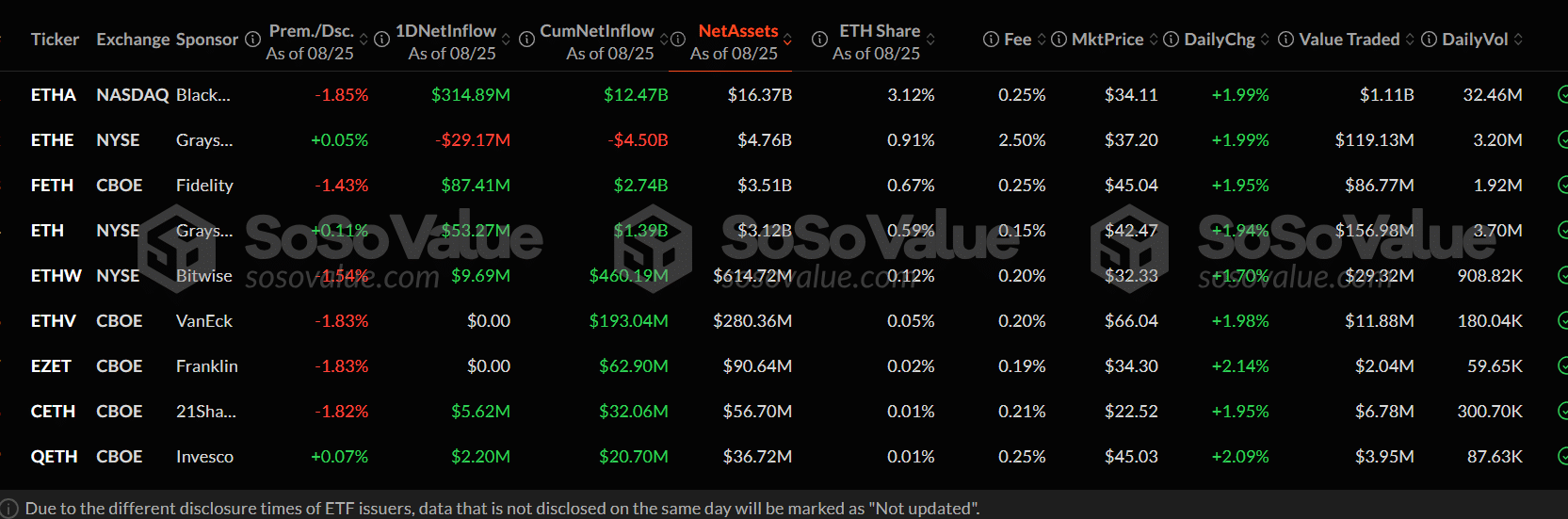

The flows confirm the thesis. Sosovalue data show that ETFE ETHEREUMs pulled $ 443.9 million only on Monday, more than double the $ 219 million that went to Bitcoin equivalents.

(Source – ETF dashboard, Sosovalue)

Through Thursday and Friday of last week, ETH funds attracted $ 628 million in fresh capital while products recorded on Bitcoin products have been recorded. On a basis of the year, ETH USD is up + 32.6%, almost double 17.3% bitcoin.

The divergence underlines how fast traditional finances reshape the cryptography market. From the FNB spots approved in January 2024, Wall Street has become the largest marginal buyer of digital assets, leading the price cycles previously dominated by retail speculation.

Now, the transmitters grow to widen the menu beyond Bitcoin and Ethereum

Discover: Best ICO ICO even to invest in 2025

Tarket Bit Link Price

Tuesday, Bitwise Asset Management filed an S-1 for an ETF Spot Chainlink, with Coinbase Pustody Trust named Guardian and Coinbase, Inc. as an execution agent.

The product will reflect Link’s cash prize but will exclude the clearing, despite the May of May’s directives specifying that the implementation rewards are not a transaction in securities.

Bitwise’s prudent structure suggests that transmitters favor the speed of regulatory approval on potential yield improvements.

This decision follows the application of Graycale to convert his avalanche confidence to an Avox Spot ETF, which is part of a growing race to secure the mid-cap lists linked to adoption accounts of the real world.

The IOC of Bit Matt Hougan has already described Chainlink as one of the “cleanest” games on the trend of tokenization, with infrastructures of Oracle Link for DEFI and institutional pilots.

Discover: 9+ best high -risk crypto and high reward to buy in 2025

What does this new tradfi mean for retail crypto traders?

Together, these developments highlight a decisive change: the Pipeline ETF is no longer limited to bitcoin and ether.

Instead, Tradfi deposits rails for exposure to wider Altcoin spectrum, with more and more dictated liquidity flows by institutional asset managers rather than telegram groups or celebrity mentions.

For retail merchants, the message is austere. The market is financialized at high speed. The Ethereum path at $ 7,500, if the Call of Standard Charterd is correct, will not be motivated by a media -based mememnation but by balance sheets and ETF entries.

And like new mono-token FNB for Chainlink, avalanche and others are online, the next rotation of Altcoin can be dictated not in Discord but in the trading offices of Wall Street.

The only question that remains is the speed with which retail trade can adapt to a market now led by Tradfi Capital, and if the volatility cycles of yesteryear will survive this structural change.

Discover: Top Solana Same Coins to Buy in 2025

The post-tradfi floods in the Crypto ETF while the standard ETH treasury bills at $ 7,500 appeared first on 99Bitcoins.