Nasdaq-listed Solana treasury company Upexi (UPXI) said its Solana Reserves increased by +4.4% to 2,106,989 SOL as of October 31, an increase of 88,750 SOL since its last update on September 10.

At Solana’s month-end price of $188.56, Upexi’s holdings were valued at approximately $397 million.

According to the press release, the company said it acquired the tokens for $325 million in total, at an average cost of $157.66 per SOL.

This places unrealized winnings at almost $72 million, reflecting prize winnings, staking rewards, and a discount on locked tokens.

After the broader market decline on Monday, Solana fell about 15% to around $160.94.

The value of Upexi’s holdings now stands at nearly $340 million, bringing paper profit down to around $15 million.

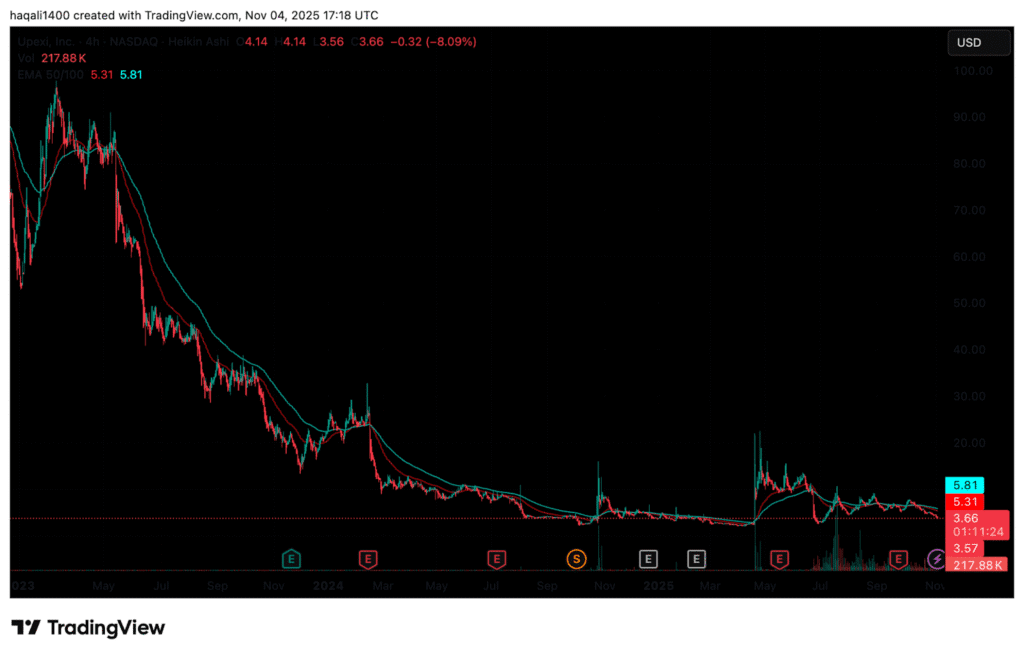

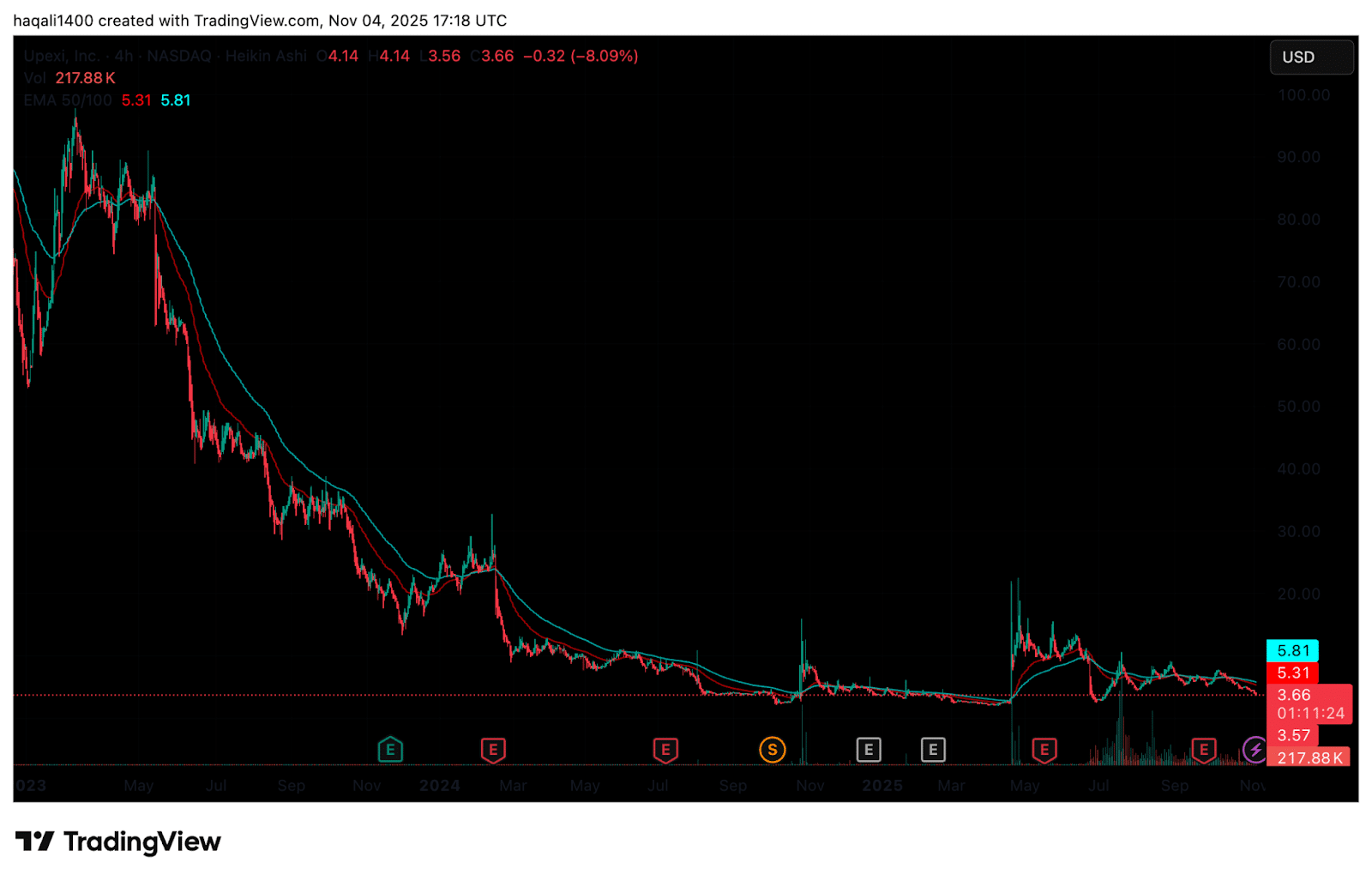

This update comes as digital asset treasury companies face sharp declines in stock prices from highs earlier this year. Upexi stock is down about -75% from its peak.

(Source: UPXI USDT, TradingView)

As a result, market capitalization to net asset value ratios have tightened, with Upexi’s modified net asset value now hovering around 0.7.

Upexi also reported an adjusted SOL per share of 0.0187 ($3.52), representing a gain of +47% in SOL and 82% in dollars since the company launched its cash flow effort in April through a $100 million private placement led by GSR.

EXPLORE: Top 20 cryptocurrencies to buy in 2025

Solana Price Prediction: Could SOL Price Drop by 30-40% if Support Breaks?

On Solana, new figures from DeFiLlama show around $10.30 billion locked across DeFi platforms.

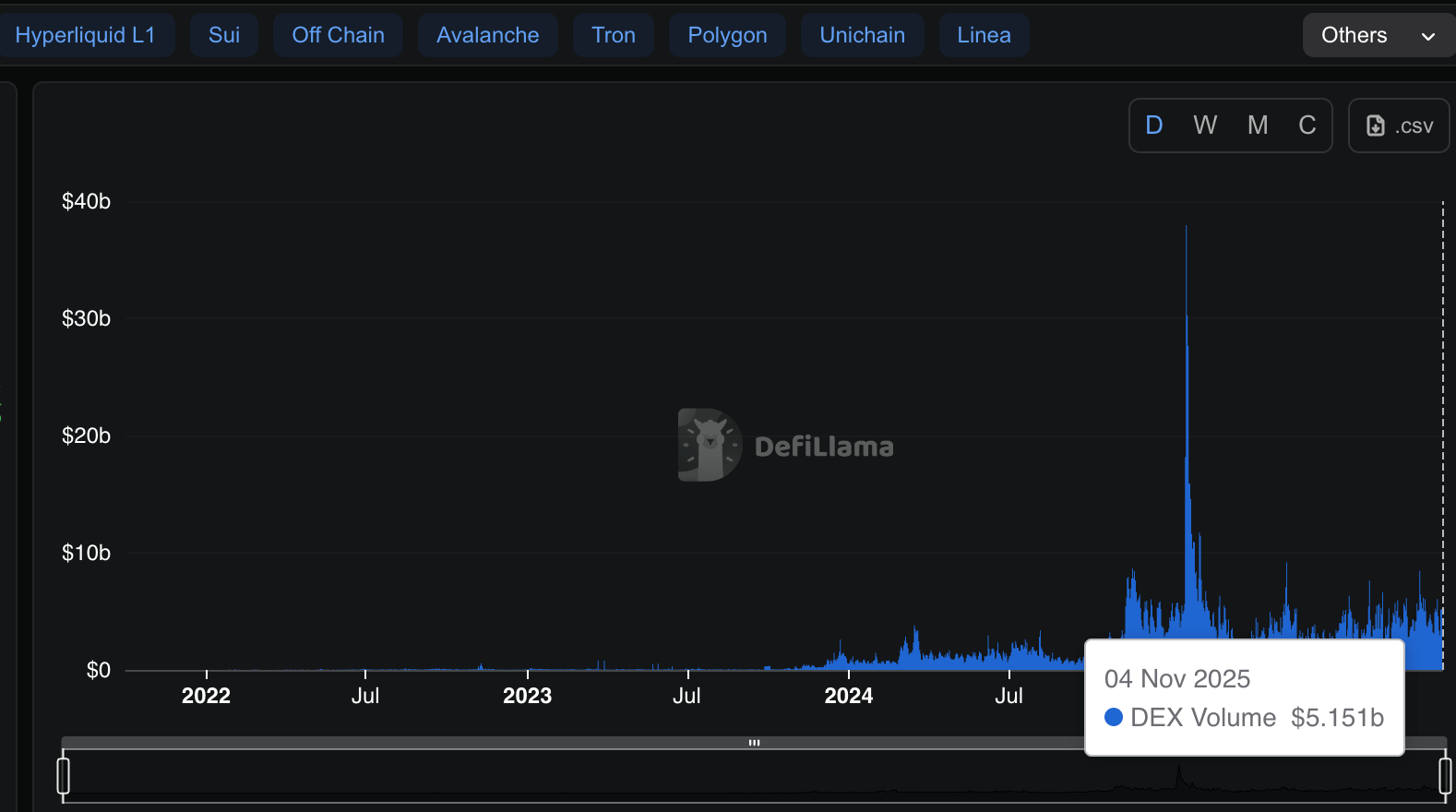

(Source: DéfiLlama)

Stablecoins on the network total a market value of around $14.26 billion, and USDC accounts for around 65% of that share.

Commercial activity is strong. Solana-based DEXs processed approximately $5.15 billion in volume over the past day.

However, price developments seem fragile. SOL is now retesting a long-lasting weekly trendline that has supported its rise since 2023.

The chart still shows a series of higher lows over the past year, but recent candles indicate a decline in strength as prices drift toward the $150-$160 area.

You can literally see a story about it $ SOL

Months of sharp lows and highs, now hanging just on the edge of the trend line that has held since 2023.

If it breaks, believe me, there is no magic, it’s a 30-40% slide straight to the next liquidity zone.

And yet people still try to buy the… pic.twitter.com/JkZoPxrvZH– Henry (@LordOfAlts) November 4, 2025

If this support gives way, the movement could turn quickly. The analyst warns that an outage could result in a 30-40% decline, which would translate into a liquidity pocket close to $100-$120.

A chart note indicates a decline closer to 36%, highlighting how exposed the market could become if buyers fail to defend.

SOL also repeatedly failed to break above resistance around $225, forming lower highs since mid-2025.

This trend shows that sellers are still in control. From here, the trendline is the key marker: hold it and bounce, or lose it and slide deeper. For now, the mood is one of caution.

EXPLORE: The 12+ Hottest Cryptocurrency Presales to Buy Now

Post TradFi Solana price prediction is BULLISH? Solana Treasuries Keep Stacking SOL appeared first on 99Bitcoins.