Bitcoin has entered price discovery and we are witnessing the start of a new bull market in crypto trading.

It is understandable that after a 55% rise in the price of Bitcoin over the past month, the crypto asset has attracted worldwide attention.

In this article, we will look at different trading strategies to analyze and find potential entries in an uptrending environment.

Mayne (in the video above) is a great resource for learning how to analyze price action!

Below, we’ll explore two simple strategies for going long or buying spot when the price continues to rise. One uses moving averages and the other uses Fibonacci retracement.

DISCOVER: The best Altcoins to buy

Use technical analysis finding entries when trading in a bull market

Let’s start with moving averages.

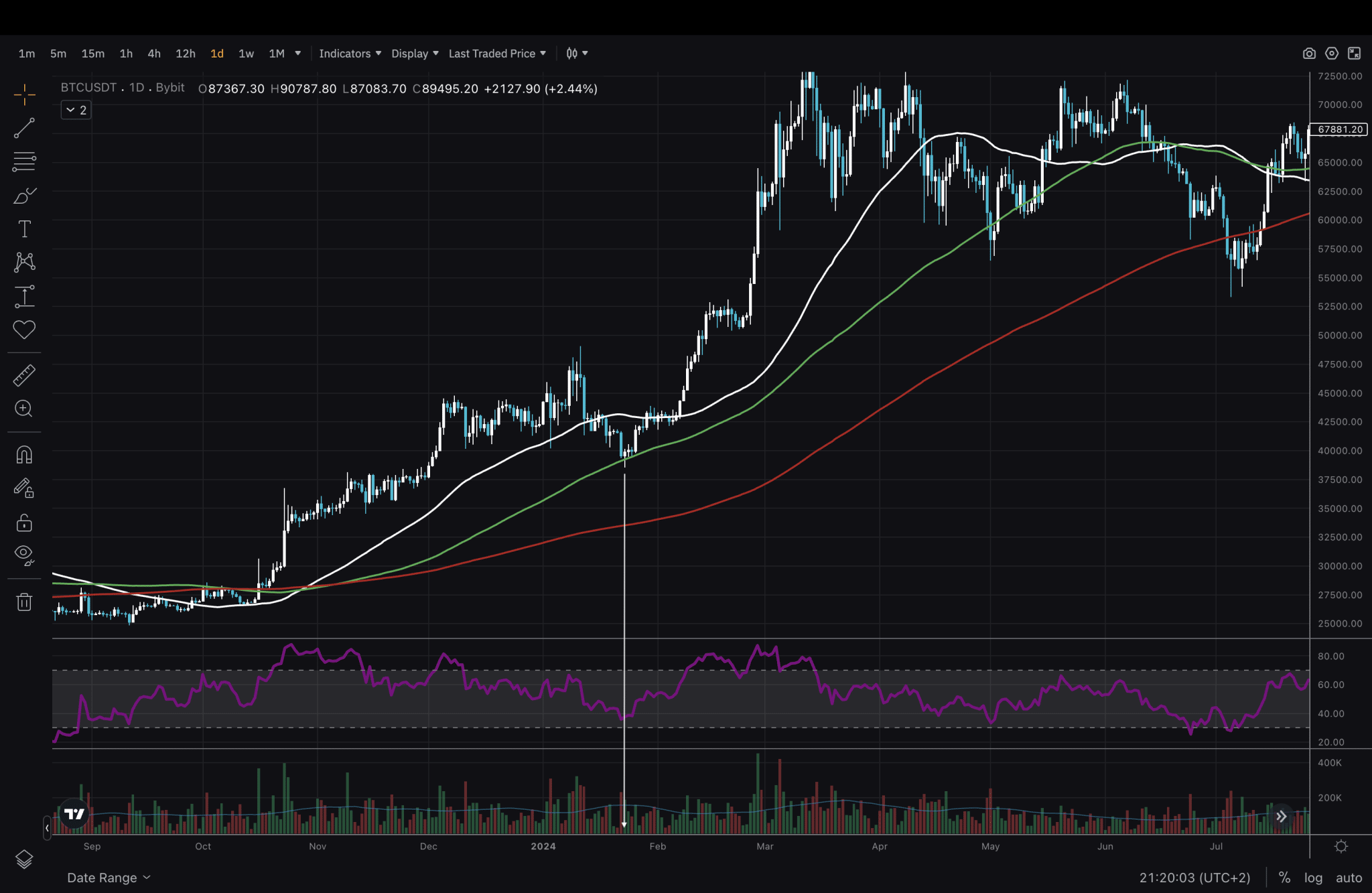

(BTC/USDT) 1D Chart

In the graph above we have MA200 (red), MA100 (green) and MA50 (white). Rising in early 2024, traders had the opportunity to go long Bitcoin when the price returned to 100 MA in the second half of January.

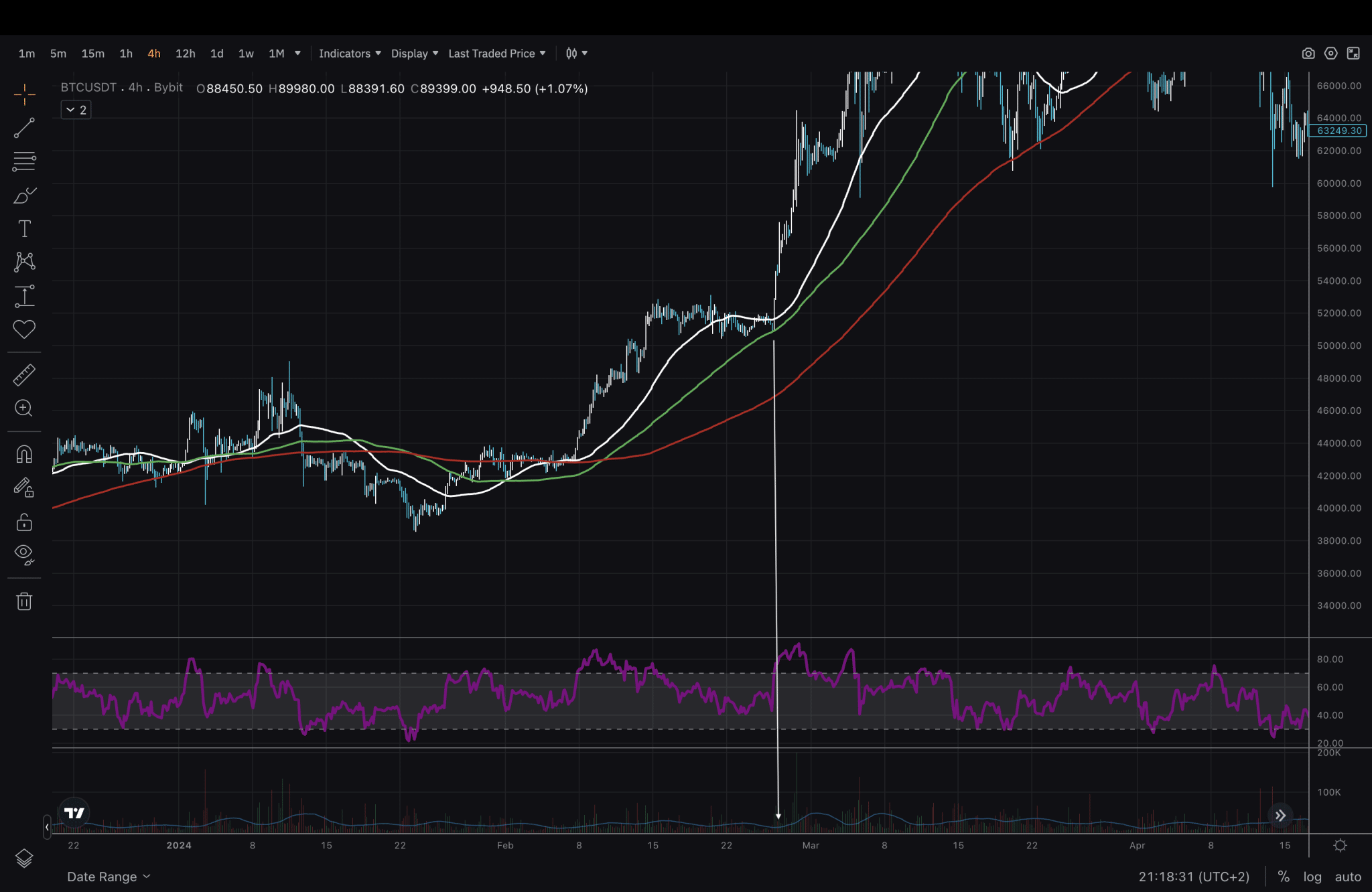

(BTC/USDT) 4H Chart

(BTC/USDT) 4H Chart

On the analysis of the 4H period, there was an additional entry opportunity – end of March. It’s a simple way to get on the bull market train.

Let’s move on to using Fib retracements

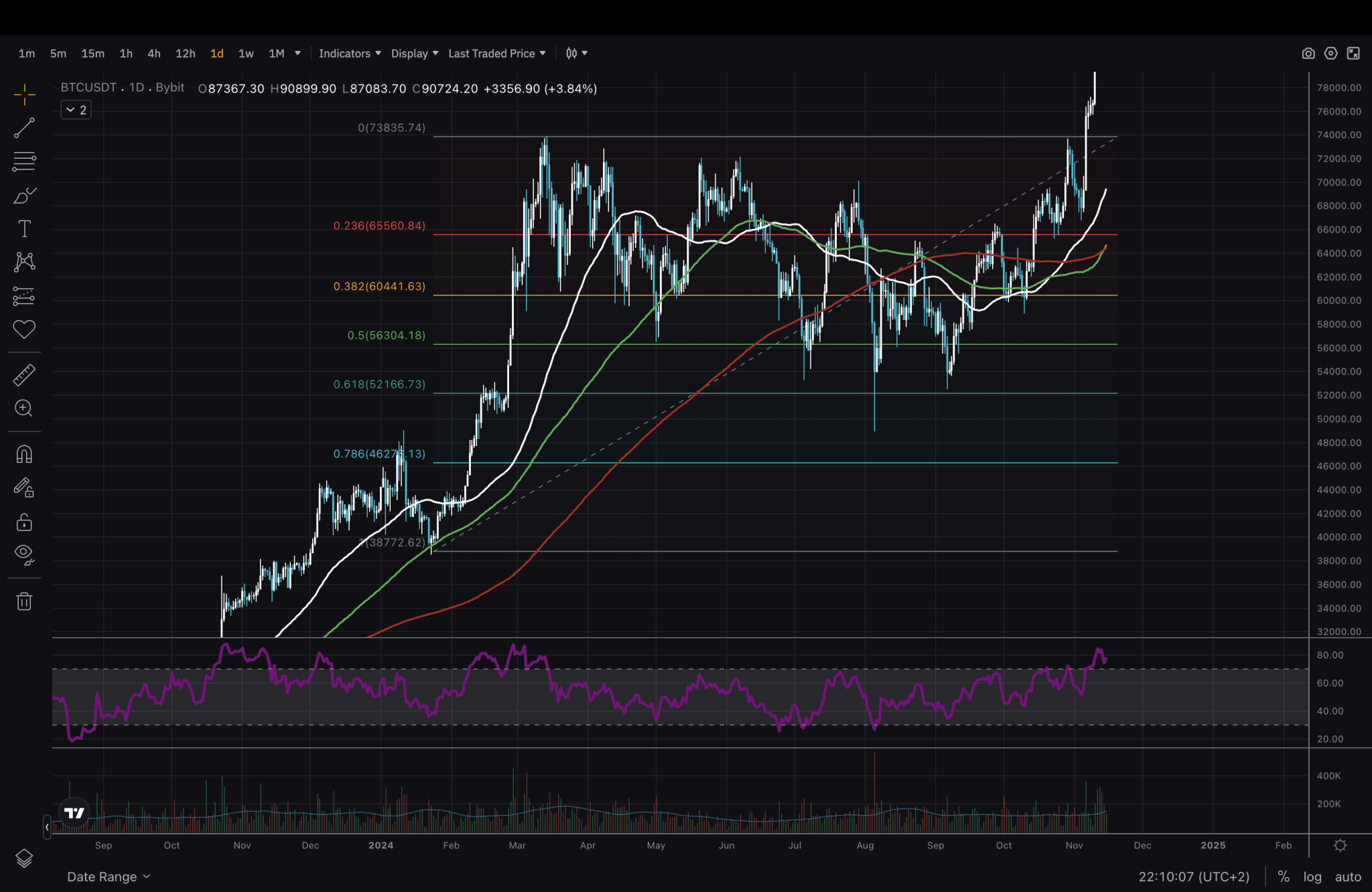

(BTC/USDT) 1D Chart

For this example, we use the 1D period again. After selecting the Fib Retracement tool, we click first at the start of the movement and then at the top of the movement. The levels we are looking at are 0.382, 0.5 and 0.618. As seen here, the price fell below the 0.618 level, but we did not have a daily close below it. So, 0.618 can be a great place to set a limit order.

Remember that trading is risky and you should never risk too much capital, as I myself did several times and it did not end well…

As some seasoned traders say: “Patience is the key!” »

EXPLORE: How to buy Bitcoin with PayPal

Warning: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose your entire capital.

The article Trading in a Bull Market: Bitcoin Price Rises and How to Find Entries appeared first on .