OnreONCHAIN’s asset manager providing an institutional return to DEFI, launched today on points, a reward program designed to encourage significant participation in the Onyc ecosystem. Unlike the traditional liquidity exploitation, the points of ONRE reward a real effectiveness of capital by following the way in which Ony is actively deployed on the DEFI protocols, strengthening its usefulness as the first collateral active in Solana.

Onre points mark a passage from passive token agriculture to the active construction of the ecosystem. By rewarding the deployment of Onyc through the DEFI protocols, the program creates a direct link between user activity and the growth of the ecosystem.

“”Onre has been built on a simple principle: capital should work as effectively as possible,“Said Dan Roberts, co-founder and CEO of onre.”Onc is our foundation – a stable asset supported by reinsurance premiums and collateral interest. With the points onre, we reward users who put this capital to work so as to strengthen the entire ecosystem.“”

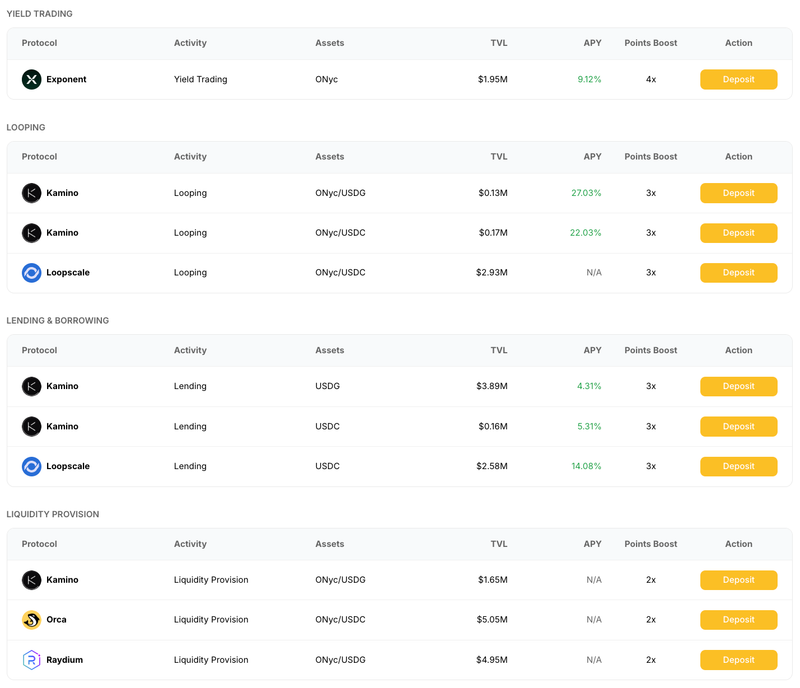

The points accumulate daily with strategic multipliers who reward the DEFI participation:

-

Basic holding (1x): 1 point per onc per day for asset holders, offering basic rewards while accessing real efficiency from reinsurance performance.

-

Liquidity provision (2x): Double reward to provide Onyc liquidity on the leading Solana Dex, in particular Kamino,, OrcaAnd Raydium. The LPS supports deeper markets and stricter differences, gaining both multipliers and trading costs.

-

Lendre and borrowed (3x): triple reward to provide Onc for warranty to loan protocols as Kamino And Mud. Advanced users Deployment of loop strategies receive multipliers who evolve with leverage, rewarding the effectiveness of capital thanks to recursive deposits that increase yields while maintaining exposure to Onyc.

-

Yield trading (4x): maximum rewards for the supply of liquidity and maintenance Yt-anec on Exhibitor. YT (yield tokens) gives LPS the possibility of speculating on the future yield of the underlying assets.

Bonus campaigns will add additional awards linked to social engagement, partnership launches and community participation, giving users more means to gain while driving a deeper utility for Onyc.

“”These are not short -term incentives,“Addition Ayyan Rahman, co-founder and CGO in onre.”We build a framework that follows and encourages the deployment of capital which truly strengthens Ony. The more the users put ony to work on deffi, the more the ecosystem becomes strong and the more their awards make up.“”

The transparent structure of the program allows users to optimize strategies while contributing to Onc’s growth. Onre points show how the strategic deployment of capital creates advantages to worsen, ensuring that participants who contribute most to the liquidity and usefulness of the ecosystem are rewarded in proportion.

Immediate availability

Onre points are live today in all supported strategies. Users can start winning immediately, with real -time monitoring in the Onre application displaying positions, points and onchain activity in one place. Participants can follow their progress and adjust strategies as new opportunities are emerging: https://app.onre.finance/.

The program underlines the commitment of onre to build a sustainable challenge infrastructure where real utility leads to the creation of long -term value, guaranteeing adoptors the first maximum profits of the expansion ecosystem of Onyc.

About onre

Onre is a main asset manager of ONCHAIN using active ingredients provided to subscribe to reinsurance, bringing stable yields and of institutional quality to DEFI. By connecting the global reinsurance market of 750B with Blockchain technology, Onre offers investors access to structured products designed to provide a coherent return between market cycles, opening a market that has always been out of reach. Its flagship product, Onyc, is a multi-collateral active ingredient and accessible to a dollar supported by reinsurance premiums, a $ 1.2 T market that the team has subscribed for more than a decade. Liquid, scalable and fully composable onyc, Onc offers resilient and non -correlated yields and is positioned to become the preferred collateral asset in all deffi.