Key dishes to remember

- Trump felt manipulated after discovering that his post was influenced by a lobbyist linked to Ripple Labs.

- Ballard Partners, despite the incident, won 130 new customers with a turnover of $ 14 million in the first quarter of 2025.

Share this article

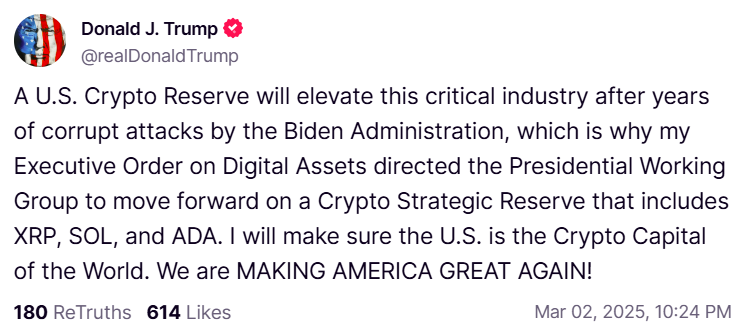

In March, Trump shocked the cryptographic community after having publicly approved XRP, Solana and Cardano for a proposal for an American cryptography reserve – now a new report suggests that he did not get the full story.

Politico revealed Thursday that the post, intended to report Trump’s support to a “cryptographic strategic reserve”, was orchestrated by a Ballard Partners employee, a company linked to Ripple Labs, the company behind XRP.

The lobbyist, who attended a donor event in Mar-A-Lago this weekend when the declaration was published, would have urged Trump to publish a pre-written message without fully disclosing his link with Ripple.

Trump, who thought he made a broad declaration to the support of the American Crypto Innovation, was “furious” and felt manipulated after Ripple learned that Ripple was a Ballard Partners client.

The next day, Trump would have told assistants that Brian Ballard, the founder of the company and a long -standing fundraising, was no longer “welcome in anything”.

The staff of the White House was invited to freeze Ballard, and certain Crypto companies have since raised silent concerns concerning the appearance of an influence of the banche.

Ballard denied any reprehensible act and argued that neither he nor his team had misleaded the president. He rejected the accusations, highlighting the continuous success of the company in the sectors and claiming that Ballard Partners continues to provide “effective results and plea” for customers.

Trump has signed an order creating a bitcoin reserve and a stock of digital assets funded by Sined Crypto

A few days after the historic position, President Trump signed an executive decree forming a strategic bitcoin reserve and a stock of digital assets, both financed using cryptographic assets seized by means of a procedure for confiscation of federal criminal and civil assets.

Unlike the Bitcoin reserve, the government does not provide actively acquiring altcoins – only those obtained by the confiscation will be held. The Treasury Department will oversee the management of digital asset stocks and is authorized to sell assets if necessary.

It is not clear if XRP will be added to the stock, because it depends on whether federal agencies signal their assets to the secretary of the Treasury by the recent date of disclosure. The decree does not impose the public publication of the reports submitted.

In March, David Sacks, the White House Czar crypto, said that the mention by Trump from XRP, Solana and Cardano was based on their status of five best cryptographic assets by market capitalization at the time.

Share this article